Companies Vie for Share of Action Camera Market

- By David Goodloe

It seems that whenever something notorious occurs, an amateur video pops up that confirms or refutes popular opinion about what happened.

Many such videos are made with cell phones, but it would seem that in such an atmosphere professional-grade cameras would be in great demand.

For the last two years GoPro (GPRO), the California-based manufacturer of action cameras, has been selling video cameras capable of filming in 16:9 aspect ratio, the most common ratio for TVs and computer monitors. The ratio is also used inversely in mobile phone screens.

Warning! GuruFocus has detected 4 Warning Signs with GPRO. Click here to check it out.

The intrinsic value of GPRO

GoPro has been the undisputed action camera market leader, but its shares endured a decline in 2015 as demand fell off. In hope of reviving itself, GoPro introduced its drone and the latest version of its action camera, the company's first major launches in more than a year.

In the Global Consumer Electronics industry, GoPro has a return on equity (ROE) of -29.34% that is lower than 91% of the companies in the industry and a return on assets (ROA) of -20.59% that is lower than 93% of the companies in that industry.

In spite of GoPro's dominance of the market, several companies - most of whom are not in the Global Consumer Electronics industry - have been vying for pieces of the action camera market lately: Nikon (TSE:7731), Sony (SNE), Garmin (GRMN), HP Inc. (HPQ), Panasonic (TSE:6752) and Kodak (KODK).

Many may have been encouraged by GoPro's recent decision to stop selling its newest camera on Amazon.com (AMZN). Although the move is expected to be temporary - GoPro says it will resume selling on Amazon once a price dispute has been resolved - the announcement caused GoPro's stock to drop nearly 4%.

The DCF Calculator gives GoPro a fair value of $-16.8.

GoPro continues to get most of the market attention, but how have its would-be competitors been faring since their intentions to go head to head with GoPro were made known?

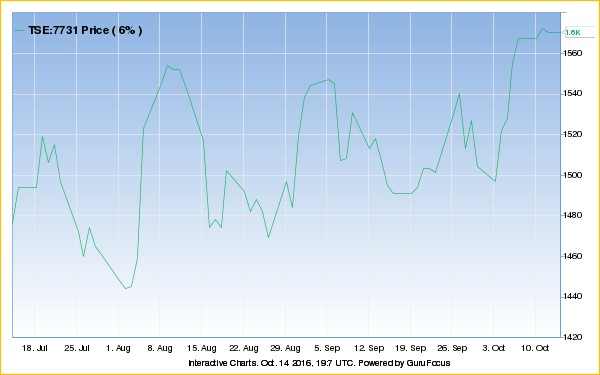

Tokyo-based consumer electronics company Nikon recently unveiled its own line of action cameras.

Since Oct. 3, Nikon's shares are up nearly 5%.

Nikon has ROE of 5.36% that is higher than 53% of the companies in the Global Leisure industry and ROA of 3.03% that is higher than 56% of the companies in that industry. The DCF Calculator gives Nikon a fair value of 795.24 Japanese yen ($7.66).

Sony, like GoPro a member of the Global Consumer Electronics industry, is introducing its own action camera as well as a PlayStation virtual reality camera for use with its PS4.

Its ROE of 3.41% is lower than 58% of the companies in the industry, and its ROA of 0.52% is lower than 66% of the companies in that industry. The DCF Calculator gives Sony a fair value of $5.33.

Garmin, of the Global Scientific & Technical Instruments industry, entered the action camera market earlier this year, then trimmed the price of the product to be more competitive with GoPro.

Garmin has ROE of 15.23% that is higher than 82% of the companies in its industry and ROA of 11.26% that is higher than 90% of the companies in that industry.

The DCF Calculator gives Garmin a fair value of $28.25.

HP, a California-based information technology company, has a trademark license agreement with Life Clips Inc. (LCLP) allowing it to use the HP brand on its cameras.

HP has ROE of 40.39% that is higher than 98% of the companies in the Global Computer Systems industry and ROA of 5.69% that is higher than 69% of the companies in that industry. The DCF Calculator gives HP a fair value of $26.86 with a 46% margin of safety.

Japanese electronics company Panasonic entered the action camera market with its lightweight HX-A1M earlier this year. Since June 28, Panasonic's share price has gone up 21%.

Panasonic has ROE of 1.82% that is lower than 64% of the companies in the Global Consumer Electronics industry and ROA of 0.58% that is lower than 65% of the companies in that industry. The DCF Calculator gives Panasonic a fair value of 892.52 yen.

New York-based Kodak's Pixpro 4KVR360 won't be available in stores until next year, but it received a positive response when it was unveiled in September. While the story may be different when the camera is available for purchase, Kodak's share price has dropped nearly 3% since the product was introduced.

Kodak has ROE of -15.52% that is lower than 87% of the companies in the Global Consumer Electronics industry and ROA of -0.42% that is lower than 71% of the companies in that industry.

Disclosure: I do not own any stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with GPRO. Click here to check it out.

The intrinsic value of GPRO