Why are so many baseball players giving up millions by foregoing free agency?

Throughout the decades of the 1990s and 2000s, it seemed like Major League Baseball was in an un-winnable arms race when it came to paying its players. The Los Angeles Dodgers, for example, made pitcher Kevin Brown the sport’s first nine-figure player with a seven-year, $105 million salary in 1998, and followed that by signing fellow pitchers Darren Dreifort and Jason Schmidt for a combined $102 million. But all three struggled with injuries or mediocrity, and while the Dodgers won more games than they lost, they never appeared in a World Series with any of the three on their roster.

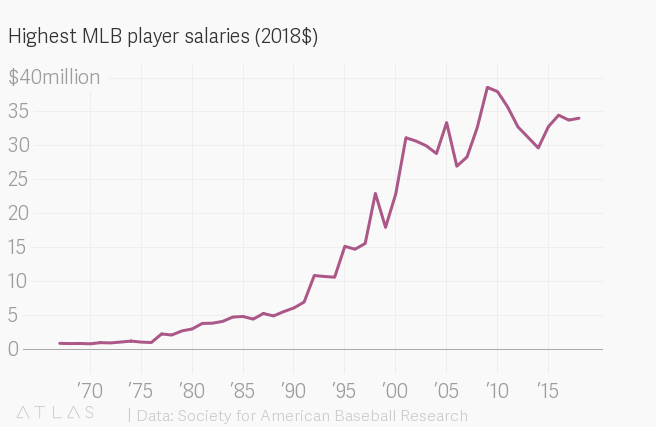

Clubs armed with statisticians noticed that paying top dollar for top talent wasn’t worth it. Since the Dodgers pay-heyday, when top salaries grew as much as 20% some years, pay for top players hasn’t gone up so much.

Unlike other entertainment industries, like basketball, football, or even pop music, where top talent is paid more than ever, the upside potential for free-agency in baseball is not what it used to be. After adjusting for inflation, even the highest player’s salary today don’t match what the Yankees paid Alex Rodriguez or Jason Giambi more than a decade ago. So it is no surprise top players are no longer as interested in becoming free agents when their contracts expire, and are instead signing extensions with their current teams, since even the best possible upside to free agency is not what it used to be.

When a player enters the major leagues, they commit to the team that drafted them for six years, according to the collective bargaining agreement negotiated between MLB and the player’s union. For the first three years they are paid close to the industry minimum, around $500,000. After that they enter arbitration, where the player and team each float a salary and come to an agreement. If they can’t reach an agreement, a third-party arbiter picks one of the two salaries, and that’s what the player is paid. After six years in the major leagues, the player is a free agent and can go to whatever team offers him the most.

But lately, instead of entering arbitration or free agency, many players are opting to extend their contracts for a set salary. Some are even signing extensions in the first three years, locking in contracts lasting up to nine years. According to calculations by Ben Lindbergh of The Ringer, these extensions are nothing new, and there were more extensions signed most years before 2016.

But what is new, and has led many observers to sense there are more extensions (even if there aren’t) is that in 2018 more high high-profile superstars, like Astros pitcher Justin Verlander and Angels outfielder Mike Trout, eschewed free agency and extended instead. Indeed, even though the number of extensions in 2018 was not high, by historical standards, the number of dollars on the contracts is up, especially among players who have more than six years of service and qualify for free agency.

Often, players who sign extensions may be paid less than if they went into arbitration or free agency. But they also give up lots of risk. If they get injured before either of these events they may get nothing, and when there are millions of dollars on the line—Trout, for example, signed a $427 million extension—it is a big gamble. Meanwhile, as teams have become more savvy about how they evaluate and spend on talent, the upside of free agency may not be what it used to be.

Lindbergh argues the clubs have too much power, but extensions may actually reflect a fair exchange. The teams are absorbing the risk a player gets injured; since they still have to pay him, it can be an expensive risk to bear. Team can diversify their risk by contracting with many players and locking in lower salaries in exchange for taking on this risk. If players go into arbitration or free agency, they bear the risk of injury on their own.

We’ve become desensitized to enormous salaries paid to superstar athletes and entertainers. But that does not mean players aren’t sensitive to risk, and sometimes a good hedge is worth a few (or 10) million dollars of upside.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz: