Where Biden and Sanders stand on retirement

Throughout the campaign so far, former Vice President Joe Biden and Sen. Bernie Sanders have had some intense clashes over Social Security. It’s largely been subsumed by other things as retirement issues have taken a bit of a backseat in the presidential campaign.

That might be about to change as the campaign moves beyond Super Tuesday with Biden and Sanders locked in a head-to-head matchup. The contest is also moving toward states like Florida (voting on March 17) where questions from retirees — and those thinking about their older years — could move center stage.

In fact, the Sanders campaign announced a new ad on Wednesday morning to air in upcoming states that goes directly after Biden on the issues.

Throughout the campaign, Biden has repeatedly said he would not cut Social Security benefits if he wins the White House.

Either way, the next president will confront a range of challenges to the retirement system: the Social Security Trust Fund could begin to run short of money (and face benefit cuts) in the coming years and the private retirement system has left one in three Americans with less than $5,000 saved for retirement.

Each of the remaining campaigns have released a plan, in varying levels of detail, about everything from funding Social Security to changing how 401(k)s work.

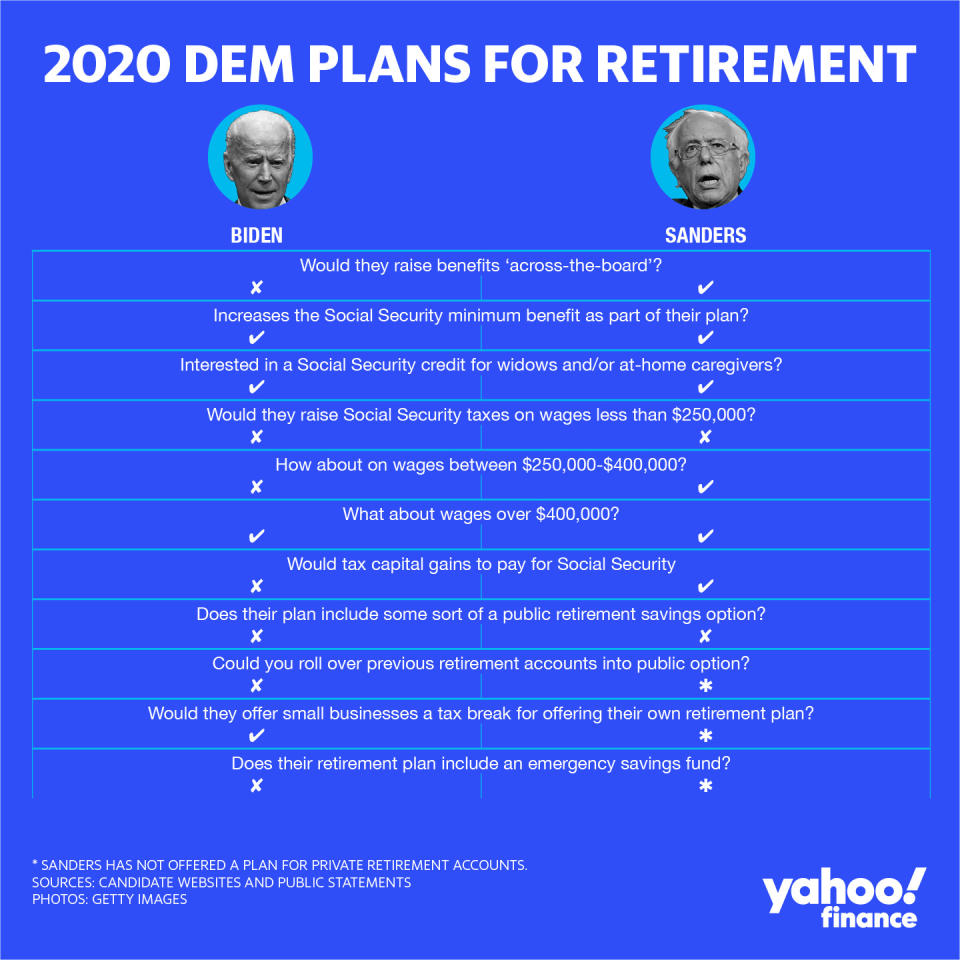

Here’s a complete rundown of what these two candidates say they’ll do to shore up the system in the coming years.

On Social Security, a question of how much to raise benefits

The average Social Security benefit for 2020 is about $1,503 a month. The debate within the Democratic field has been almost exclusively around how much — not whether — to increase those payouts.

Sanders has the most ambitious plan. He wrote a bill that would increase benefits across the board, including by $1,300 a year for low-income seniors.

Biden has shied away from across-the-board hikes but he would implement targeted benefit increases. Biden has also voiced support for increases in survivor benefits. The former VP also suggests targeted benefit increases for the the oldest Americans and a minimum benefit for workers who spent at least 30 years paying into the system.

Paying for benefits

Social Security is already in a somewhat precarious financial state, so bigger benefit checks will, of course, make that math problem worse.

With no action, Social Security will run low on cash in about 15 years, according to the 2019 Trustees report. As such, the candidates have proposed a range of ways to increase revenue, largely by raising the Social Security cap on wages.

For 2020, all wages above $137,700 a year are exempt from Social Security taxes. Nearly every candidate would change that to some extent.

Biden would create what he calls a “donut hole” on wages from the current cap to $400,000. That means wages up to $137,700 would be taxed; then the wages between $137,700 and $400,000 would be exempt; and then wages above $400,000 would again be taxed.

Sanders has a similar idea but with a smaller gap: He’d exempt wages between the current cap and $250,000.

The Social Security payroll tax rate on wages is currently 6.2% for the employer and 6.2% for the employee.

Capital gains are currently exempt from Social Security taxes but Sanders is mulling taxes there to help close any potential shortfall . His plan for Social Security would "apply the payroll tax on all income over $250,000" (including “investment gain”) as a means to expand Social Security.

Biden has ruled out looking at capital gains to shore up the system.

The various plans all put Social Security on firmer fiscal ground, but they all would extend solvency for only a limited time.

Before he suspended his campaign, Pete Buttigieg’s plan, as an example, would have extended solvency for about 15 years from where it is currently. Moody’s Analytics chief economist Mark Zandi analyzed the plan and noted to Buttigieg’s campaign that “based on your reforms, the solvency of Social Security will be extended to 2051.”

Some Democrats on Capitol Hill support a plan that extends solvency much further. The Social Security 2100 Plan has proposed what presidential candidates avoid like the plague: new taxes on the middle class.

The bill — championed by Rep. John Larson (D-CT) — would increase benefits and gradually phase in an increase in the rate paid by workers across-the-board. “The problem with just scrapping the cap or taxing just the wealthy is that it doesn't make the program sustainably solvent beyond 75 years,” said Larson in a recent interview with Yahoo Finance.

Public retirement plans

It’s not just Social Security on presidential candidates’ radar.

Public option retirement accounts were an idea floated by many campaigns as a means to supplement employer 401(k) plans, except the government is involved and, in some cases, may kick in additional benefits.

Neither Biden nor Sanders have come out in support of the idea.

Before he suspended his campaign, Bloomberg released a public-option retirement savings plan, where both employer and employee contributions were automatic. A reduction in tax breaks for high-income earners would also follow, paying for a new government match for low-income workers.

Biden’s Plan For Older Americans eschews government-managed private accounts and instead would shore up workplace accounts through tax breaks for middle- and low- income workers withdrawing 401(k) or IRA funds in retirement.

Sanders has not put out plans for private retirement accounts — his focus has stayed on Social Security.

It also come at a time when faith in public programs is already dwindling. About 24% of Americans believe that it’s "not at all likely" that Social Security will be available by the time they retire.

In addition, “not everyone has the ability to save income — there’s also wage inequality,” said Chad Parks, CEO at Ubiquity Retirement + Savings. “We can’t get blood from a stone.”

Underlying problems

“It won’t hurt to provide additional incentives, but at the end of the day, it won’t move the needle enough,” said Henry Hoang, founder at Bright Wealth Advisors, LLC. “At the end of the day, people struggle with the cost of living – there are more problems to solve.”

Ande Frazier, CEO of myWorth, an online financial firm, shares Hoang’s sentiment.

While she believes the focus on the retirement crisis is commendable, a real solution will consist of addressing underlying problems.

One challenge, she says, remains the lack of financial literacy in the U.S. It’s not enough to have more retirement options if Americans don’t fully understand how the current ones work, she said.

“We should have financial literacy taught at every school in the country,” Frazier said. “People in rural areas still have trouble balancing a checkbook, understanding interest rates and even knowing how to collect Social Security benefits when a spouse has passed.”

A 2019 survey by the Financial Educators Council mirrors her concern. It found that Americans’ inability to answer basic financial literacy questions costs Americans $1,279 on average, more than a $40 jump from the year prior. This could be higher than what some Americans get in their monthly Social Security checks.

Ben Werschkul is a producer for Yahoo Finance in Washington, DC. Dhara Singh covers retirement and housing for Yahoo Finance. You can follow them on twitter at @benwerschkul and @dsinghx.

Read more:

How Mike Bloomberg’s new retirement plans stack up vs. other Democrats

How Bernie Sanders – and Trump – are making Social Security a big issue for 2020

How to supercharge your retirement savings in 2020

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.