Were Hedge Funds Right About Discover Financial Services (DFS)?

At Insider Monkey, we pore over the filings of nearly 887 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we've gathered as a result gives us access to a wealth of collective knowledge based on these firms' portfolio holdings as of December 31st. In this article, we will use that wealth of knowledge to determine whether or not Discover Financial Services (NYSE:DFS) makes for a good investment right now.

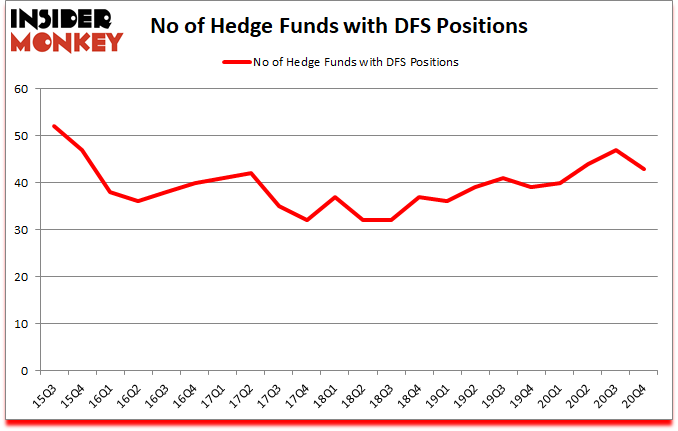

Discover Financial Services (NYSE:DFS) was in 43 hedge funds' portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 52. DFS has seen a decrease in support from the world's most elite money managers recently. There were 47 hedge funds in our database with DFS holdings at the end of September. Our calculations also showed that DFS isn't among the 30 most popular stocks among hedge funds (click for Q4 rankings).

To most market participants, hedge funds are seen as unimportant, old investment tools of yesteryear. While there are greater than 8000 funds with their doors open today, We look at the moguls of this group, approximately 850 funds. These investment experts preside over bulk of the hedge fund industry's total asset base, and by watching their top investments, Insider Monkey has come up with several investment strategies that have historically outstripped the S&P 500 index. Insider Monkey's flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter's portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Ricky Sandler of Eminence Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let's analyze the key hedge fund action regarding Discover Financial Services (NYSE:DFS).

Do Hedge Funds Think DFS Is A Good Stock To Buy Now?

At Q4's end, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the third quarter of 2020. By comparison, 39 hedge funds held shares or bullish call options in DFS a year ago. With hedgies' capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

More specifically, Eminence Capital was the largest shareholder of Discover Financial Services (NYSE:DFS), with a stake worth $168.6 million reported as of the end of December. Trailing Eminence Capital was Alua Capital Management, which amassed a stake valued at $112.8 million. East Side Capital (RR Partners), KG Funds Management, and Columbus Hill Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position East Side Capital (RR Partners) allocated the biggest weight to Discover Financial Services (NYSE:DFS), around 10.79% of its 13F portfolio. Alua Capital Management is also relatively very bullish on the stock, setting aside 7.89 percent of its 13F equity portfolio to DFS.

Judging by the fact that Discover Financial Services (NYSE:DFS) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there exists a select few hedge funds who sold off their positions entirely in the fourth quarter. Interestingly, Eashwar Krishnan's Tybourne Capital Management dropped the largest investment of all the hedgies tracked by Insider Monkey, totaling about $290.7 million in stock, and Snehal Amin's Windacre Partnership was right behind this move, as the fund dropped about $278.5 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 4 funds in the fourth quarter.

Let's check out hedge fund activity in other stocks similar to Discover Financial Services (NYSE:DFS). These stocks are Southwest Airlines Co. (NYSE:LUV), Corning Incorporated (NYSE:GLW), Splunk Inc (NASDAQ:SPLK), NatWest Group plc (NYSE:NWG), Nutrien Ltd. (NYSE:NTR), Willis Towers Watson Public Limited Company (NASDAQ:WLTW), and Mettler-Toledo International Inc. (NYSE:MTD). All of these stocks' market caps resemble DFS's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position LUV,55,757534,4 GLW,39,334973,3 SPLK,47,1036156,3 NWG,3,759,1 NTR,25,754698,-1 WLTW,58,3245691,7 MTD,29,850200,-1 Average,36.6,997144,2.3 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.6 hedge funds with bullish positions and the average amount invested in these stocks was $997 million. That figure was $730 million in DFS's case. Willis Towers Watson Public Limited Company (NASDAQ:WLTW) is the most popular stock in this table. On the other hand NatWest Group plc (NYSE:NWG) is the least popular one with only 3 bullish hedge fund positions. Discover Financial Services (NYSE:DFS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DFS is 62.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on DFS as the stock returned 26.5% since the end of Q4 (through 4/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Get real-time email alerts: Follow Discover Financial Services (NYSE:DFS)

Disclosure: None. This article was originally published at Insider Monkey.

Follow Insider Monkey on Twitter

Related Content