What To Watch For In ETFs In 2022

Key Takeaways

Heading into 2022, CFRA expects some of the emerging ETF industry trends to accelerate, while the largest overall provider seeks to recapture its leadership.

Actively managed equity ETFs could represent 10% of the asset category's net inflows in 2021.

BlackRock (BLK) could shift the momentum and gather more net inflows in 2022 than Vanguard.

Thematic ETF demand swung from cloud computing and cybersecurity to electric vehicles and infrastructure in 2021. Investors have over 200 thematic ETFs to consider for 2022 as they look to identify the next long-term trend.

Fundamental Context

With $800 billion of net inflows (and counting), 2021 will be hard to top. The U.S.-listed ETF market matched the 2020 record of $504 billion in July and kept gaining steam. It remains to be seen how close to doubling the cash haul the industry will get to, especially as investors tax-loss harvest and rebalance for the year ahead.

In addition, the first bitcoin-price-related ETF, the ProShares Bitcoin Strategy ETF (BITO), organically gathered $1 billion faster than any other ETF when it launched in October. BITO came to market eight years after the first bitcoin ETF request was considered.

Meanwhile, nearly two dozen mutual funds converted into ETFs in 2021, providing investors with a more tax-efficient and fully transparent product. CFRA considers this money to be net ETF inflows, but we know other ETF data providers such as FactSet do not.

At the end of November, CFRA had star ETF ratings on 2,166 equity and fixed income ETFs, based on a combination of analysis including what is inside the portfolio using proprietary risk and reward metrics, fund costs and performance relative to other ETFs. But since we are big believers that ETF investors should not only look backward, but forward, following are three topics we are focused on for 2022.

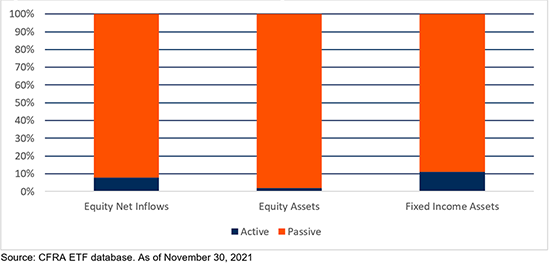

(1) Can actively managed equity ETFs gather more than 10% of flows in 2022? Aided by conversions of mutual funds into ETFs like the Dimensional U.S. Equity ETF (DFUS) and organic flows, new money into actively managed equity ETFs represented 7.8% of the asset category in the first 11 months of 2021, despite representing 2.3% of the overall assets. Meanwhile, fixed income ETFs were 11% of the category's assets, and gathered 16% of the net inflows thus far in 2021.

Deep-pocketed, well-established asset managers including Charles Schwab, Fidelity, Goldman Sachs, J.P. Morgan and Nuveen expanded their active equity ETF lineup in 2021, with products like the Fidelity Magellan ETF (FMAG), the Goldman Sachs Future Planet Equity ETF (GSFP) and the JPMorgan ActiveBuilders Emerging Markets Equity ETF (JEMA). Meanwhile, Capital Group—the firm behind the vastly popular American Funds mutual funds—is set to launch its first suite of active ETFs in the first quarter of 2022.

We think these firms collectively will have success in gathering assets in 2022 as they further educate existing clients and those that shifted to the ETF structure on the merits of their offerings.

Furthermore, we expect loyal shareholders of the ARK family of funds will have renewed optimism that 2022 will be a recovery from the challenges of 2021, when funds like the ARK Innovation ETF (ARKK) lost 15% in value. We think 2022 will be an even more successful year for actively managed ETF asset gathering than 2021 has been.

How Are U.S.-Listed ETF Assets Managed?

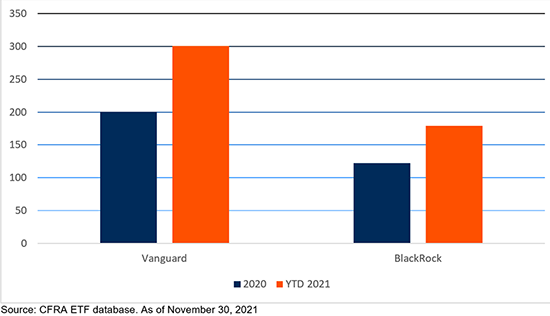

(2) Will iShares recapture the ETF flows lead from Vanguard? With $180 billion of net inflows in the first 11 months of 2021, the ETF division of BlackRock (BLK) pulled in 1.5 times the cash haul achieved for all of 2020 to extend its industry leading asset base to $2.4 trillion.

The firm's low-cost core series continued to gain traction with the iShares Core S&P 500 ETF (IVV), the iShares Core Total USD Bond Market ETF (IUSB) and the iShares Core MSCI Emerging Markets ETF (IEMG) among the firm's 51 products, which pulled in more than $1 billion in 2021.

However, $2.0 trillion ETF provider Vanguard gathered just over $300 billion of new money year-to-date in 2021, 1.5 times its 2020 net inflows, similar to BlackRock and aided by having six funds among the top-10 most purchased. Vanguard's relative success also stemmed in part from not receiving meaningful redemptions.

BlackRock ETFs had 14 of the industry's 20 highest redemptions year-to-date through November, and these funds collectively had $50 billion of net outflows. In contrast, Vanguard had no ETF among the top-20 in redemptions.

CFRA expects that as institutional investors further embrace ETFs in 2022, the strong liquidity of some of BlackRock's largest funds will have added appeal to help it be positioned to recapture its flows leadership. Meanwhile, the fund's smart beta suite is positioned to gain further ground.

Top 2 Managers Of U.S.-Listed ETFs ($B)

3) Will thematic ETF investors continue to pivot? Year-to-date through Dec. 1, thematic ETFs gathered $46 billion, according to Global X, equal to approximately 6% of the industry's net inflows. This ETF segment consists of ETFs that have a long-term growth focus, are unconstrained by geographies and sectors, and are tied to relatable concepts that impact daily lives.

Despite the demand in 2021, thematic ETF assets rose by only $31 billon in the 11-month period to $135 billion. Some of the technology-focused products, such as cloud computing and cybersecurity—which gained traction in 2020 as COVID-19 forced many Americans to work from home—had lower asset levels in 2021 as sentiment has shifted away from the work-from-home theme.

However, funds focused on electric vehicles and physical infrastructure—like the Global X U.S. Infrastructure Development ETF (PAVE) and the iShares Self-Driving EV and Tech ETF (IDRV)—gained traction ahead of the federal government's trillion-dollar spending plan currently being implemented.

While our crystal ball for identifying the thematic trends that will resonate with investors in 2022 is a little foggy, we have confidence that investors will rotate to some of the more than 200 thematic ETFs offered by more than a dozen asset managers, covering diverse long-term trends, such as blockchain, cannabis, cleantech, health care innovation, mobile payments and resource scarcity.

We think thematic ETFs, some of which are actively managed, will also approach 10% of equity net inflows in 2022.

Conclusion

Investors’ growing comfort with ETFs in 2021 positions the industry for continued success in 2022. However, with more than 2,000 products available and many competing with one another for investor attention, we expect asset managers to continue to focus on investor education to highlight what makes their ETF unique.

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2021 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.

Recommended Stories