Walmart's (NYSE:WMT) Dividend Hike Falls Short of the Expectations

This article first appeared on Simply Wall St News.

After ranging throughout 2021, Walmart Inc. (NYSE: WMT) is looking to regain its footing, closing the full-year report on a positive note hiking the dividend in the process.

While the broad market looks on shaky legs, the staples sector is gaining interest.

Click here to check our latest outlook for Walmart.

Earnings Results

Non-GAAP EPS: US$1.53 (beat by US$0.03)

Revenue: US$152.87b (beat by US$2.67b)

Revenue growth: +0.5% Y/Y

Other highlights

Q4 same-store and online sales: +5.6%

Sam's club sales: +16.5% Y/Y

Q4 web and in-store traffic: +3.1%

FY buybacks: US$9.8b

CFO Brett Biggs noted the increased e-commerce penetration, but also the fact that supply chain costs went US$400m above the expectations. However, he expects those costs to subside over time.

Meanwhile, the company announced a 2% dividend hike, so now it will be paying US$0.56/share quarterly dividend, with a forward yield of 1.68%.

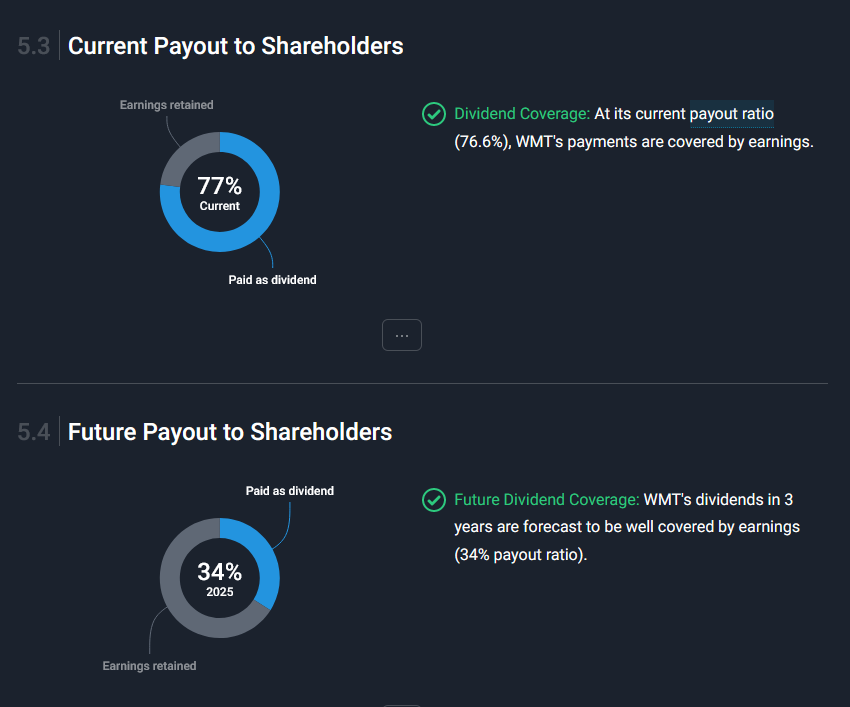

Yet, looking at the FY23 EPS with a target of US$6.8, with a dividend of US$2.24, this gives us a relatively low payout ratio of 33%. If we add to the fact that the company used only 50% of its allotted buyback plan in the last year, we believe the dividend hike could have been more significant.

The Dividend Analysis

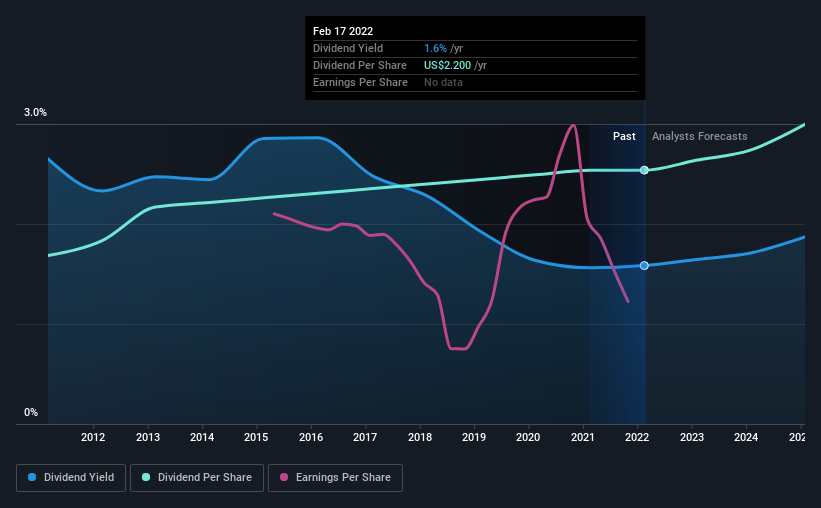

A 1.6% yield is nothing to get excited about, but investors probably think the long payment history suggests Walmart has some staying power. The company also conducted a buyback equivalent to around 2.3% of its market capitalization during the year. When buying stocks for their dividends, you should always run through the checks below to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

In the last year, Walmart paid out 77% of its profit as dividends. Paying out a majority of its earnings limits the amount that can be reinvested in the business, but it isn't surprising for mature companies.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend. In the last year, Walmart's cash payout ratio was 36%, which suggests dividends were well covered by cash generated by the business. It's positive to see that both profits and cash flow cover Walmart's dividend since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Consider getting our latest analysis on Walmart's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income is the potential for a company to struggle financially and cut its dividend. Walmart has been paying dividends for a long time, but we only examine the past 10 years of payments for this analysis. The dividend has been stable during this period, implying the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was US$1.5 in 2012, compared to US$2.2 last year. Dividends per share have grown at approximately 4.2% per year over this time.

Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) grew, as this is essential to maintaining the dividend's purchasing power over the long term. It's not great to see that Walmart's have fallen at approximately 9.0% over the past five years. Declining earnings per share over several years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long-term value of a company's dividend.

Conclusion

While the latest dividend hike might look underwhelming for some, it follows a similar trend in the last few years. However, looking at the projected earnings and dividend coverage - we believe it could have been better.

Overall, Walmart's payouts ratios are very good, and the dividend has been consistent, but it certainly isn't great to see the earnings per share shrinking. After these latest developments, we aren't that excited about Walmart from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, investors can consider other things when analyzing stock performance. For example, we've picked out 3 warning signs for Walmart that investors should know about before committing capital to this stock.

We have also put together a list of global stocks with a market capitalization above $1bn and yielding more 3%.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.