Walmart: Comparable Sales Growth Remains Solid

Walmart Inc. (NYSE:WMT) reported earnings results last month that showed growth in same-store sales compared to the prior year. Most impressive about this was it comes on the heels of excellent comparable numbers in same period of 2020.

The companys ability to see an improvement in sales following such an advance in the previous year is an extremely encouraging sign that Walmart is not only maintaining its momentum, but extending it.

Lets look closer at the company's most recent quarter to see why this ongoing growth is such a positive development.

Earnings highlights

Walmart reported third-quarter financial results on Nov. 16. Revenue grew 4.3% to $140.5 billion, coming in $6.3 billion ahead of Wall Street analysts' estimates. Adjusted earnings per share of $1.45 compared favorably to $1.34 in the prior year and was 6 cents better than expected.

U.S. net sales grew more than 9% to $96.6 billion. Comparable sales improved 9.2% with transactions up 5.7% and average ticket higher by 3.3%. Revenue from the e-commerce channel was up 8%.

Each product category within the segment improved against the prior period. Health and wellness sales were up a mid-teens percentage due to higher prescriptions. Covid-10 vaccines were also a tailwind to results.

Grocery was up high single-digits. Food sales improved by $3.6 billion, the best showing of growth for this category in a year and a half. Fresh food was the highlight, but all areas of the category outperformed the third quarter of last year.

General merchandise improved by mid-single digits as the back-to-school business benefited from the reopening of schools. Demand for apparel, automotive and seasonal items also stood out.

Walmart International fell 20.1% to $23.6 billion, though this was due to divestitures. The core business improved 17% due to performances in China, Mexico and Flipkart. E-commerce totaled 19% of total revenue for this business.

Sams Club had a 19.7% gain in net sales to $19 billion. Comparable sales rose almost 20% due to robust transactions and ticket increases. Membership income was up 11.3% as the segment reached a new member record. Most areas of the business reported growth, but fresh food, beverages and consumable products led the way.

Leadership also provided updated guidance. The company expects U.S. comparable sales of 6% when excluding fuel. Adjusted earnings per share is projected to be in a range of $6.20 to $6.35.

Takeaways

Walmarts comparable sales were up on nearly every metric. What really stands out is how these results came on top of last years performance. One a two-year stacked basis, U.S. sales grew 15.6% while international was higher by more than 10% and Sams Club was up almost 31%.

Consumers made fewer trips to the companys stores last year due almost entirely to the pandemic. For example, in the U.S., the number of transactions dropped by more than 14% in the third quarter of 2020. However, consumers made up for the less frequent trips with much larger baskets as the average ticket was up 24% last year with shoppers stocking up on items.

Transactions grew almost 6% in the most recent quarter, so the total number of visits isnt yet back to pre-pandemic levels. That said, comparable tickets improved another 3.3% this time around, giving Walmart a two-year stacked ticket growth rate of 27.3%.

Walmart is starting to see some uptick in the number of visitors to locations and these shoppers are actually spending more than they did per ticket this year as opposed to last year. This is evidence that Walmart wasnt the beneficiary of a just one-time pandemic-fueled boom to business. This past quarter is evidence that the company continues to resonate with customers, which is arguably a bullish sign.

Another positive sign is the importance of e-commerce. The contribution from this channel added less than 10 basis points to comparable sales growth, but this adds to the 660-basis point contribution from e-commerce that the company saw last year. In fact, the two-year stack rate is 87% for the e-commerce channel.

Walmart Connect is another way the company is attempting to reach consumers. For a fee of less than $100 annually, customers can receive unlimited free delivery and other deals. Sales for this program are up 240% over the last two years.

The company is also increasing customer access to pick up and same-day delivery options. The third quarter saw pickup expanded to nearly 4,300 U.S. locations, up from 3,600 in the prior year, with same-day delivery available from more than 3,300 stores, compared to 2,900 last year.

In short, Walmart, through e-commerce, pickup and delivery, is attempting to reach more customers in different ways to drive sales growth. This had led to the strength seen in a number of comparable metrics.

Finally, leadership has set the bar at 6% same-store sales growth, which would result in a two-year stacked growth rate of almost 15% for U.S. stores.

Valuation analysis

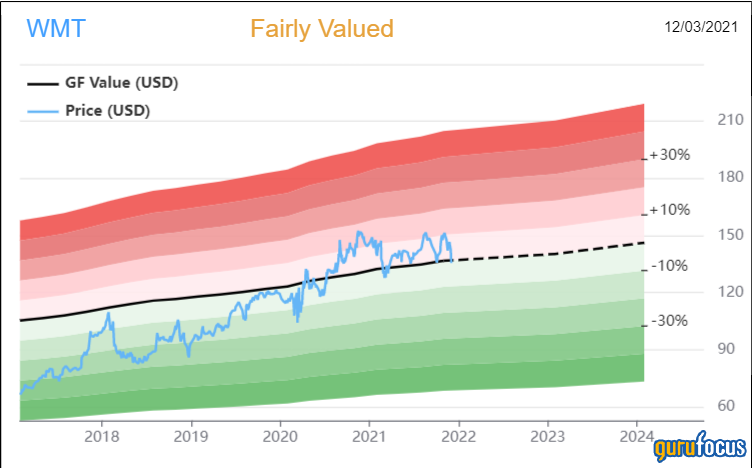

Walmart currently trades at 21.8 times the midpoint of guidance for the fiscal year. The stock has an average price-earnings ratio of 19.9 and 17.1 over the last five- and 10-year periods of time, so shares are not trading at a discount relative to the historical average.

The GF Value chart also shows the stock is at fair value.

With a current price of $137 and a GF Value of $136.86, the price-to-GF Value ratio for Walmart is 1.0. Shares are rated as fairly valued by GuruFocus.

Final thoughts

Walmart blew away the estimates for revenue by more than $6 billion, the largest top-line beat in at least five years for the company. This was due to strength in nearly every part of the business and on most comparable metrics. That the company was able to produce these growth rates when the prior years results were among the best ever seen on a year-over-year basis shows that Walmarts business model is performing very healthy

At 48 consecutive years, Walmart has a long history of dividend growth, which helps to offset the stocks yield of just 1.6%.

That said, the market is aware of these factors and shares arent trading with any discounted valuation. For investors looking for margin of safety, Walmart might be a pass for now.

While shares arent cheap, they arent all that expensive either, especially for the results that the company is producing. Those who find the core business growth attractive, in addition to the income aspect of the name, might find this enough of a reason to add Walmart to their portfolio.

This article first appeared on GuruFocus.