Waiting on your California inflation relief payment? Avoid scammers with these tips

Qualifying Californian taxpayers expecting one-time payments of up to $1,050 should keep their eyes peeled for scammers.

California Attorney General Rob Bonta issued a warning Monday to both direct deposit and debit card recipients still waiting on their inflation relief dollars: “Do not be fooled.”

“Unfortunately,” Bonta said in a press release from the Office of the Attorney General “there are some bad actors hoping to take advantage as Californians patiently wait for their direct deposit or prepaid debit card to arrive.”

The last few qualifying direct deposit recipients should have received their check around Nov. 22. Meaning, the scam warning is especially important for debit card recipients still waiting on their prepaid visa cards in the mail.

Here’s what to expect and when, plus precautions to take to protect yourself from getting scammed.

Tips to avoid being scammed

More than 19 million Californians received their inflation relief dollars, with more still waiting on their check to hit by Jan. 14.

To avoid falling victim to scammers, first be sure to check how much you’re expecting from California’s inflation relief effort. While you wait for your money, don’t take any action or pay money to get your payment because the tax board already already has the information needed to send your check.

“Do not provide anyone else with your personal information,” the Office of the Attorney General wrote in a November release “such as your bank account information, social security number or credit card information.”

Here are a couple more tips, provided by the Office of the Attorney General, to remember while you wait for your one-time payment of up to $1,050:

Your payment schedule cannot be sped up — Anyone who claims they can get you your money quicker is a scammer.

Ignore text messages, emails or calls — Do not share personal information with anyone who is contacting you this way, even if they claim to be with the government.

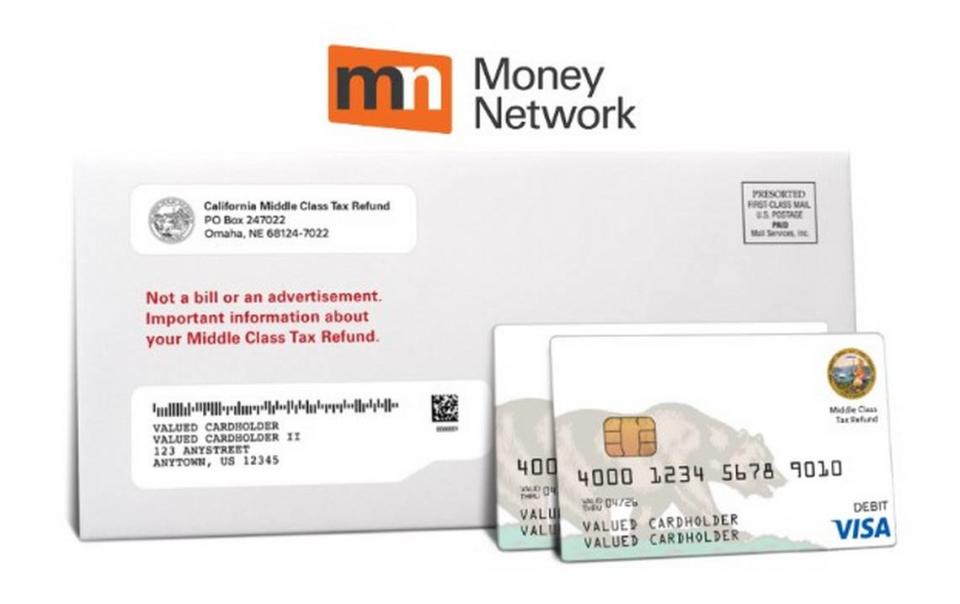

Debit card recipients: Know what to look for — You’ll receive your prepaid debit card in an envelope that states “Not a bill or an advertisement. Important information about your Middle Class Tax Refund.”

If you’re expecting a prepaid debit card, be on the lookout for an envelope that looks like this:

Once inside the slip, “Visa” should be printed on the front of the prepaid card and issuing bank “My Bank Direct” should be scripted on the back.

Information inside the white envelope should also explain that it’s your Middle Class Tax Refund debit card. If everything checks out, you’re ready to start swiping plastic.

Here’s how to activate your California inflation relief debit card once it arrives

Report a scam

Report a scam by calling the Franchise Tax Board at 800-852-5711 7 a.m. to 5 p.m. Monday through Friday.

Scams can also be reported online through the tax board’s Fraud Referral Report.

Will I receive a debit card?

In a little over a month, according to the Franchise Tax Board, more than 3.5 million debit cards have been issued to qualifying Californian taxpayers.

You should expect a debit card, according to the tax board website, if one of the following are true for you:

Filed a paper return

Had a balance due

Received your 2021 Golden State Stimulus payment by check

Received your tax refund by check regardless of filing method

Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

When will my debit card be mailed?

Debit card recipients should allow up to two weeks from the issue date to receive their payment in the mail.

Debit cards should have been mailed out by Nov. 19 to previous Golden State Stimulus recipients whose last name starts with A-M. Here’s the mailing time frame, according to the tax board’s website, for the other previous Golden State Stimulus check recipients with last names N-Z:

Last names N-V will be mailed between Nov. 20 and Dec. 3

Last names W-Z will be mailed between Dec. 4 and Dec. 10

NON-GOLDEN STATE STIMULUS RECIPIENTS

Last names A-K will be mailed between Dec. 5 and Dec. 17

Last names L-Z will be mailed out between Dec. Dec. 19 and Dec. 31

Eligible Californian taxpayers who changed their banking information since filing their 2020 tax returns should expect a debit card to be mailed out between Dec. 17 and Jan. 14.

What do you want to know about life in Sacramento? Ask our California Utility Team your top-of-mind questions in the module below or email utilityteam@sacbee.com.