United States Hospital Emergency Department Market Report 2022-2030: Opportunities in the Increasing Use of Telehealth for Emergency Departments

U.S. Hospital Emergency Department Market

Dublin, March 30, 2022 (GLOBE NEWSWIRE) -- The "U.S. Hospital Emergency Department Market Size, Share & Trends Analysis Report by Insurance Type (Medicare & Medicaid, Private), by Condition (Gastrointestinal, Cardiac, Infectious, Traumatic), and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

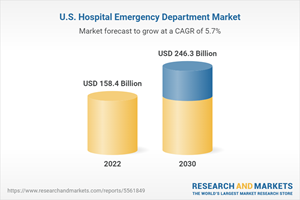

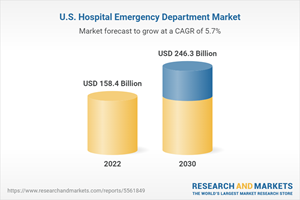

The U.S. hospital emergency department market size is expected to reach USD 246.3 billion by 2030, registering a CAGR of 5.7%

Rising prevalence of diseases requiring immediate care such as cardiac arrest is expected to drive the growth of this market. Hospital Emergency Departments (EDs) are preferred by such individuals in need of emergency care due to the 24-hour availability of care over other medical centers. There has been an increase in the number of patients with acute psychiatric crises visiting hospital EDsin the last few years.

According to National Hospital Ambulatory Medical Care Survey, in 2018, there were around 1.15 million ED visits due to problems related to psychological and mental disorders. Furthermore, a total of 2.4 million ED visits occurred due to diseases of the nervous system. Neurologic emergencies include conditions such as stroke, migraine, Alzheimer's disease, and others. Stroke is a major contributor to ED visits, with around 795,000 individuals suffering a stroke annually. This is likely to increase the number of ER visits in the coming years.

To meet the high demand for EDs and create awareness, hospitals are adopting new technologies and conducting various business activities. For instance, in May 2019, Montefiore Medical Center installed communication systems in the emergency room, which facilitates prehospital communication between ED staff and first responders. Similarly, in July 2019, Clarion Hospital collaborated with Allegheny Health Network to bring Advanced Telestroke Services to its ED to treat patients suffering from stroke symptoms.

Moreover, there is a trend of adopting new treatment options, such as Artificial Intelligence (AI), and telehealth for emergency care of acute illnesses and injuries. For instance, in October 2020, Northwestern Memorial Hospital partnered with Caption Health to acquire Caption AI, the AI technology for ultrasound, for use in EDs. Such measures are expected to increase demand for emergency care due to growing awareness about the availability of accurate and quick treatment options and increasing adoption of new technologies.

The onset of the COVID-19 pandemic resulted in revenue loss for emergency departments in the United States, due to the substantial reductions in the number of ED visits. The decline in visits was largely due to people delaying treatment to avoid infection, a decrease in surgery volume, and social distancing restrictions.

U.S. Hospital Emergency Department Market Report Highlights

The private and others segment dominated the market in 2021 and is expected to register the highest CAGR from 2022 to 2030. An increasing number of people choosing private insurance is the primary factor driving the growth of the segment. For instance, according to National Hospital Ambulatory Medical Care Survey, for around 40,003 ED visits, the source of payment was private insurance in 2018

The infectious condition segment accounted for the maximum market share in 2021. This growth can be attributed to an increasing number of ER visits during flu season. For instance, according to CDC National Hospital Ambulatory Medical Care Survey, in 2018, fever and cough accounted for a total of 5,837,000 and 4,955,000 emergency visits, respectively, in the U.S. Increasing hospitalizations due to infectious diseases is expected to favor segment growth

In August 2019, Clarion Healthcare System, Inc. received a grant of USD 1 million from the Redevelopment Assistance Capital Projects program, which would be used for renovating the existing emergency room to expand the waiting room and add three exam rooms

Market Dynamics

Market Driver Analysis

High number of emergency department visits

Availability of insurance

Growing initiatives by hospitals

Market Restraint Analysis

Overcrowded emergency departments with a prolonged waiting period

Rising preference for convenient care

Industry Challenges

Possible harm to patients due to lack of medical history

Duplicate testing costs and unnecessary testing costs

Staffing issues

Industry Opportunities

Increasing use of telehealth for emergency departments

Penetration & Growth Prospect Mapping

Business Environment Analysis Tools

Pestel Analysis

Porter's Five Forces Analysis

Impact of COVID-19: Qualitative Analysis

Regulatory Framework & Reimbursement Scenario

Competitive Analysis

Parkland Health & Hospital System

Lakeland Regional Health

St. Joseph's Health

Natchitoches Regional Medical Center

Schoolcraft Memorial Hospital

Clarion Hospital

USA Health

Baptist Health South Florida

Montefiore Medical Center

LAC+USC Medical Center

For more information about this report visit https://www.researchandmarkets.com/r/sagxd3

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900