United Parcel Service Offers Excellent Value

The last time I discussed United Parcel Service (NYSE:UPS) it was because of the companys nearly 50% dividend increase. Since then, shares of the company are down nearly 13% while the S&P 500 Index is lower by only 6%.

UPS recently released a solid quarterly earnings report that reaffirmed much of my bullish thesis on the stock and indicated that the company was performing well despite headwinds from an increase in costs.

Thanks to the selloff over the last two months, UPS is now trading with a forward price-earnings ratio that is below the long-term average. Just as important, shares look undervalued using the GF Value chart. Lets dive deeper into the company to see why UPS is one of my favorite value plays at the moment.

Earnings recap

UPS reported its first-quarter 2022 earnings results on April 26. Revenue grew 6.4% to $24.4 billion, beating Wall Street analysts estimates by $580 million. Adjusted earnings per share of $3.05 compared favorably to $2.77 in the prior year and was 17 cents above expectations.

Each segment showed growth from the prior period, led by an 8% increase in revenue for the U.S. Domestic business to $15.1 billon. Average daily volume did fall by 3%, but business-to-business volume was up 3.6% due to gains across all segments. Revenue per piece improved 9.5% and the adjusted operating margin expanded 90 basis points to 11.3% due to productivity gains.

International was up by 5.8% to $4.9 billion. Revenue per piece was up 10.5%, though a 6.7% decrease in volume caused the adjusted operating profit to fall 70 basis points to 23%.

Revenue for Supply Chain Solutions grew 2% to $4.4 billion. Much of this strength is related to a $517 million, or 25%, increase in revenue from Forwarding, which is UPS freight shipping business. The adjusted operating margin improved 180 basis points to 11%, a new record for the segment.

Finally, UPS reaffirmed much of its outlook for the full fiscal year, with revenue expected to be approximately $102 billion, which would be a 5% improvement from 2021.

Selling points

Top-line growth is solid at UPS and looks even more impressive when adding additional context to the prior year. UPS had revenue growth of 27% in the first quarter of 2021, one of the companys best year-over-year performances ever. Earnings per share growth also remained strong in the most recent quarter, even after more than doubling last year.

The tailwinds that the company experienced from the increase in shipping that Covid-19 sparked havent dissipated. Guidance for the year confirms this as revenue is expected to grow more than 20% from 2020, which was one of the best years in recent memory for UPS.

Headwinds

There were some weaker areas of the quarter. The most important was a decrease in average daily volume in the U.S. and International segments. Much of the decline in the U.S. was due to fewer packages delivered by ground transportation. International was lower in all areas, led by a domestic average daily volume decrease of 10.1%. Export volume was lower by 2.9%. However, this comes on the heels of a 23.1% improvement in average daily volume for International last year, including a nearly 78% increase in business-to-business.

UPS did see some diminished volume demand following record activity related to Covid-19, but the company saw a small decline, not a complete retreat on this front. On a two-year stack rate, average daily volume has gained 16.4%.

Expenses were higher by 4.9% to $21.1 billion. Almost all of the increase is related to higher fuel costs, which coincided with a surge in energy prices, and purchased transportation. An increase in compensation and benefits for workers was a much smaller headwind.

Valuation

Even with the tailwinds that the company saw in the first quarter and the reiterating of prior guidance, UPS shares declined the day of the earnings release and are down more than 6% since late April.

According to Yahoo Finance, analysts project that the company will earn $12.81 per share this year. Shares of UPS are presently trading at $178, or just under 14 times forward earnings estimates. According to Value Line, UPS has traded with an average price-earnings ratio of 17.5 over the last decade, implying a 26% margin of safety if the stock were to return to its historical average valuation.

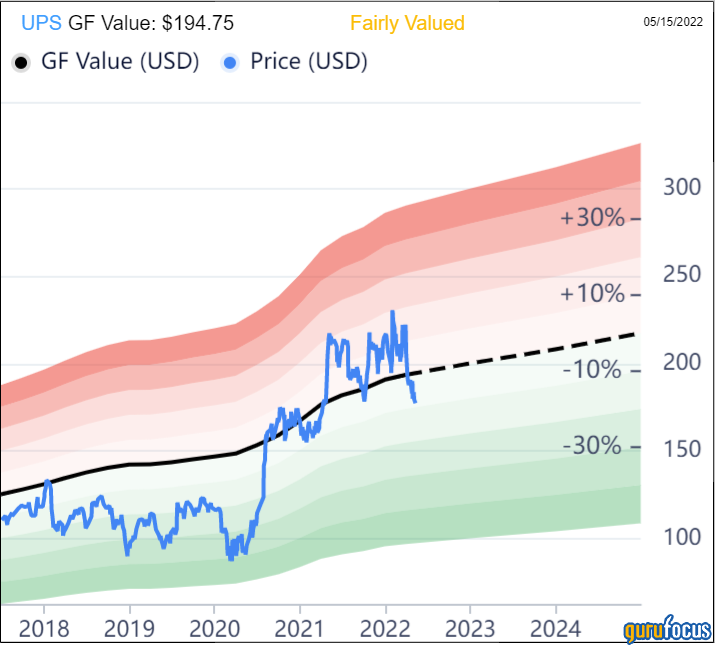

The GF Value chart is slightly less bullish, but still shows the potential for share price gains.

With a GF Value of $194.75, UPS has a price-to-GF-Value ratio of 0.91. GuruFocus rates the stock as fairly valued, but reaching the GF Value level would result in a 9.4% gain. Factor in the dividend yield, which is at 3.4% at the moment, and total returns could reach into the low double-digit range.

Final thoughts

Price action has not been kind to shares of UPS over the past two months. The good news is that the companys most recent quarterly report showed positives nearly across the board. Volume was lower, but higher revenue per piece has more than offset this weakness. Revenue and adjusted earnings per share were up even as both metrics faced one of the toughest year-over-year comparable periods in the companys history.

UPS has also seen just a small pullback in the heightened demand that stemmed from Covid-19-related improvements. This should be seen as a positive as customers and business still find the companys services highly appealing.

From a valuation standpoint, the decline in share price has attractively positioned the stock in my opinion. UPS is well below its long-term average valuation and GF Value. When combined with the stocks dividend yield, this shows that total returns could be at least in the double-digit range by my calculations.

This article first appeared on GuruFocus.