Undervalued Aviva Looks Very Interesting

When Amanda Blanc became the CEO of Aviva PLC (LSE:AV.) in July 2020, she inherited a large life insurer with an inconsistent track record, which had made the FTSE 100 stock unpopular with investors. The stock is still cheap, but its prospects, thanks to Blanc, are far better now. Surprisingly, the company trades at a discount to rivals at just over 7 times its forward earnings.

The recent first-quarter 2022 trading update showed a good set of numbers. A Solvency II capital position of almost 192% at the quarter end raises hopes of more cash returns to investors because Aviva considers any capital over the benchmark level of 180% to be excess.

In a statement, Blanc said, "U.K. & Ireland Life sales are up 2%, and net flows into our Wealth business remained strong at 2.7 billion pounds ($3.36 billion), despite market volatility."

"We have also continued our momentum in General Insurance where we had our best first quarter sales in a decade, as more people were attracted to the strength of the Aviva brand and the quality of our products," she said. "Total General Insurance sales were up 5% to over 2 billion pounds, driven by strong sales in commercial lines in both the UK and Canada."

The trading update confirmed shareholder approval was received for a return of 3.75 billion pounds of capital via a B share scheme. This brings the total capital return to shareholders of 4.75 billion pounds to be completed by the end of May.

Analyst estimates, which should take into account the share consolidation from the buyback, for dividends are 32 pence and 33 pence for this year and next, which represents a dividend yield of about 8% at the current share price.

As with most financial institutions, rising interest rates are also good for the company. Aviva has become a more efficient and more focused business too. Selling eight international businesses in recent years, it is now focused on its main markets of the U.K., Ireland and Canada. Operating costs came down another 3% in the first quarter. According to the company, this means it is likely going to save 400 million pounds net of inflation by 2024, compared with 2018. Cutting costs can make products more competitively priced, which is important as the insurance industry needs to balance rising claims inflation against recent regulatory reforms. Aviva looks like it can remain competitive enough to drive policy growth.

Earlier in the year, Aviva had assumed 4% to 6% inflation in motor and home claims, which has now been increased by 2 to 2.5 percentage points. The overall combined operating ratio ticked up to 96.4% during the first quarter from 90.6% - a slightly negative outcome that was partly due to weather-related losses and more drivers back on the roads following the unwinding of lockdowns. Premiums during the quarter increased, but Aviva said it is also looking for cost reductions elsewhere to help prevent prices from rising too much.

In March, Aviva completed the 385 million pounds acquisition of wealth management company Succession, which will give the group a large-scale financial advice unit. This plays into Blancs strategy to win more share of potential business from existing customers by trying to provide policyholders, pension scheme members and investors with a greater product range.

This will not be easy as switching providers in financial services is increasingly easy and the retirement, wealth and savings markets in which Aviva operates are already quite mature. That said, the company is looking to is tap into structural growth trends such as employee pension scheme auto-enrollments.

The macro environment is also going to be a tailwind for Aviva. The insurer has a large back book of annuities, which pay rates to its holders. When these policies mature, the capital the company holds against them for regulatory purposes can be reinvested at higher interest rates, boosting interest margins.

With activist investor Cevian Capital breathing down her back, Blanc plans to return more than 5.4 billion pounds over the next three years. This would be a similar amount generated between 2019 and last year, although from a shrunk asset base given recent divestments. Cevian Capital has called for a higher dividend payout.

According to media reports, Niko Pakalen, a partner at Cevian, said in March the company needed to translate Avivas improved profitability, growing cash flow generation and resilient balance sheet into high, growing and predictable dividends Aviva has the capacity for a 50 pence per share total cash return to shareholders for 2024, higher than the 33 pence ordinary dividend indicated for 2023.

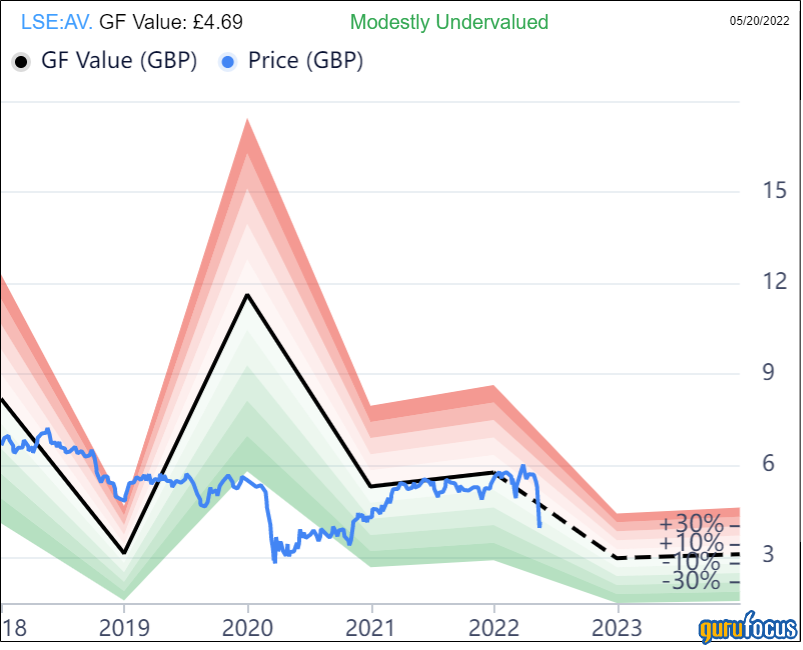

Blanc seems to be on the right course as the shares are currently rated modestly undervalued by the GF Value Line.

As such, Aviva is well worth a closer look.

This article first appeared on GuruFocus.