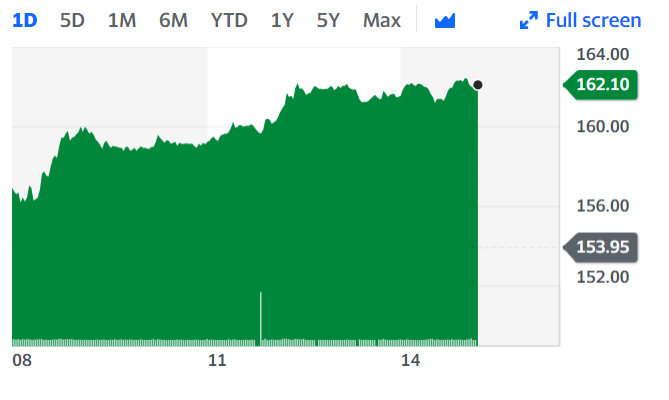

Taylor Wimpey and Berkeley Group lead FTSE gains as UK housing demand remains resilient

London’s FTSE (FTSE) was driven higher on Tuesday by strong housing demand for Taylor Wimpey (TW.L) and Berkeley Group (BKG.L).

The former stock was up 5.4% at around 3:30pm in London and Berkeley Group was also higher by 3.4%.

UK house builders were surging on strong data from Nationwide that showed house price growth accelerated at its fastest pace in more than five years, even as lockdown restrictions hampered the economy.

The average transaction prices in November are up 6.5% year-on-year, and up 0.9% month-on-month to an average of £229,721 ($307,408).

READ MORE: UK house price growth hits five-year high but could slow ‘sharply’

“Coming off the back of a 13-year high in mortgage approvals yesterday [Monday] it is clear that demand for housing remains resilient, providing a decent boost to banks as well, as higher asset prices reduce the pressure on any impairment provisions,” said Michael Hewson, chief market analyst at CMC Markets UK.

Despite GDP being set for its biggest fall in 300 years this year, annual house price growth accelerated to its highest rate since January 2015 in November.

Yet some analyst say the surge in prices this year will be reversed in 2021.

“The divergence has only been possible due to extraordinary policy support that has protected and boosted house prices,” said Andrew Wishart, property economist at Capital Economics. “When that is withdrawn in 2021, we expect the pandemic to take its toll.”

READ MORE: Debenhams to be wound down with 12,000 jobs likely to go

If mortgage approvals remain at their current high level they will be higher in 2020 than 2019, said Wishart, which means the pent-up demand from the first lockdown will soon be expended.

“Coinciding with the end of the furlough scheme, the stamp duty holiday will finish as we expect the unemployment rate to be nearing a peak of 7%,” he added.

Despite these fears, Goldman Sachs forecasts a sunnier outlook for the UK economy in an analyst note published on Tuesday.

It predicted that a last minute “skinny” Brexit deal will be achieved that will bring about a strong rebound in the UK economy next year, making a bullish case to buy UK stocks. UK homebuilders and real estate firms are among the top three stocks to be sensitive to FX moves and “would benefit from a growth improvement next year,” said Deutsche analysts.

WATCH: Why are house prices rising during a recession?