UBS: The Fed is probably done cutting rates

The FOMC July press conference left many market participants confused about the future course of the Fed’s monetary policy. But while many Wall Street shops are still calling for more easing in the fall, economists at UBS believe that Fed chair Jay Powell and team are likely done with the rate cuts.

“If the [Fed] Chair could not pull the Committee to 50 basis points or even a strongly dovish tilt, we see it as unlikely that he can pull them to cuts in subsequent meetings,” UBS economists wrote in a note to clients following the FOMC press conference on July 31.

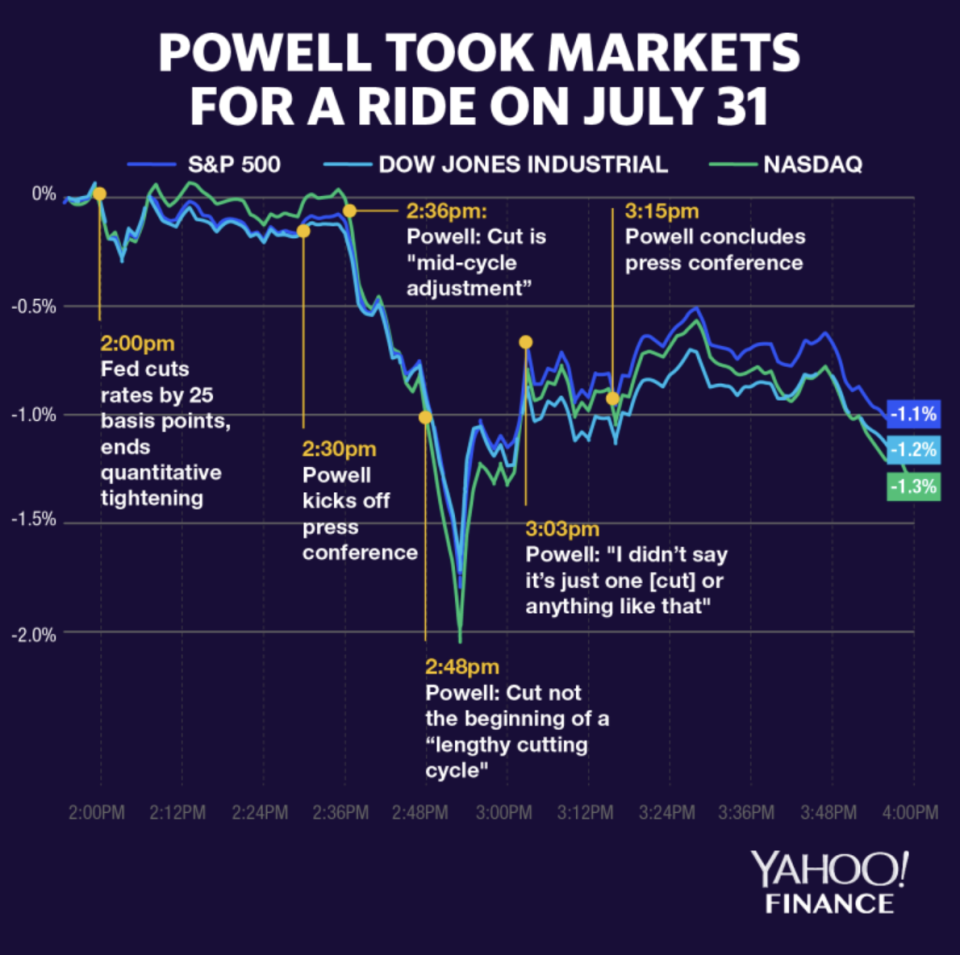

The Fed on Wednesday finally made its highly-anticipated move to cut interest rates by 25 basis points for the first time since the financial crisis. However, Powell made it clear during his press conference that the move was a “mid-cycle policy adjustment” and “not the beginning of a long series of rate cuts,” which sent both the Dow (^DJI) and S&P 500 (^GSPC) to their biggest one-day losses in two months.

But was it enough?

The quarter point cut disappointed the market participants who were either hoping for a bigger move on rates (50 basis points) or more clear guidance setting the stage for further easing in the future.

Rob Martin, who is part of the Americas Economics team at UBS, told Yahoo Finance’s The Final Round, that he believes the magnitude of the cut wasn’t enough to make a difference for the U.S. economy.

The 25 basis point cut is “better than a zero for stimulus, but it doesn’t do much,” he said. “You need insurance, but you didn't actually do enough. [Using] the prescription medicine analogy, you didn't actually do enough to make a difference if there's really a risk out there.”

Now what?

Looking at the rest of the year, Wall Street consensus seems to be divided over the path of monetary policy when it comes to further cuts. The UBS team, for example, remains optimistic about the U.S. economy and expects solid data for the rest of the year.

“Our forecast of 2.6% GDP growth and ongoing job creation suggests that another cut is unlikely,” UBS said in a note to clients.

Similarly the Economics team at Credit Suisse believes this was an isolated easing move by the Fed, saying in a note that they “continue to expect that this will be the only rate cut and policy will be on hold for the rest of 2019.”.

Other Wall Street banks still forecast more easing ahead for the FOMC. Goldman Sachs economists write that while they “expect a second cut at the September meeting, we continue to see little need for it.”

Others, like Morgan Stanley, believe October is a more likely time frame for the Fed to move on rates.

“We still expect a follow-up of (25 basis points) this year, but October now seems more likely than September, as the FOMC appears poised to wait for further evidence that downside risks are weighing on the economy,” the analysts wrote in a research note to clients.

Currently the Fed fund futures are pricing in a 68.1% chance of a rate cut in September and 83.8% chance of easing in October.

Iryna Kirby is a Producer for Yahoo Finance. Follow her on Twitter at @IrynaNesko.

Read more:

David Zervos: The Fed is ‘the greatest monetary policy experiment in history’

Why the Fed shouldn’t be afraid to make a rate cut ‘mistake’ right now

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.