Twitter Options Explode After Musk Resurrects Buyout Bid

Shares of Twitter Inc (NYSE:TWTR) jumped 22.2% yesterday for their best daily gain in three months, after Tesla (TSLA) CEO Elon Musk revived his deal to buy the social media company for $44 billion, or $54.20 a share. It's been a bumpy ride to get to this point, with Twitter attempting to sue Musk after the billionaire attempted to pull out of the deal in July. With the plans set to move forward, options traders are taking in interest once again in TWTR.

Approaching the sessions end, more than 450,000 calls and 404,000 puts have been picked up so far, or seven times the volume that's typically seen at this point. Most popular is the weekly 10/7 52-strike call, followed by the 48-strike put in the same weekly series, with new positions opening at both contracts.

These traders look to have hit gold too, as Twitter stock boasts affordable premium at the moment. The security's Schaeffer's Volatility Index (SVI) of 38% stands higher than just 16% of readings from the past 12 months, suggesting that these players are pricing in low volatility expectations right now. What's more, the stock's Schaeffer's Volatility Scorecard (SVS) stands at slightly elevated 71 out of 100. This means TWTR has tended to outperform these volatility estimates.

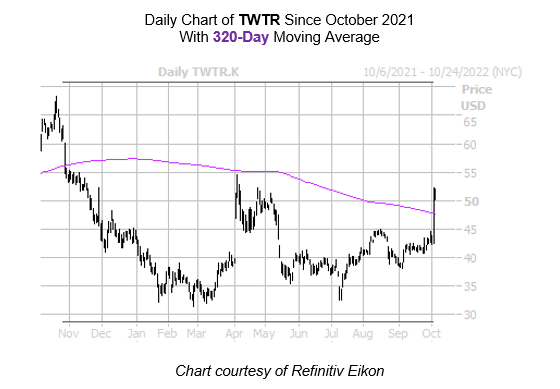

Today, Twitter stock was last seen down 0.6%, trading at $51.71, pulling back slightly from yesterday's gains but still trading at six-month highs. The equity still sports a 14% year-over-year deficit, but yesterday's pop has it up nearly 20% in 2022. What's more, TWTR is trading above its 320-day moving average for the first time in nearly 12 months.