AT&T's Strong 4th Quarter Overshadowed by Low Guidance

- By Margaret Moran

American telecommunications major AT&T Inc. (NYSE:T) reported earnings results for the fourth quarter of 2020 before the markets opened on Jan. 27.

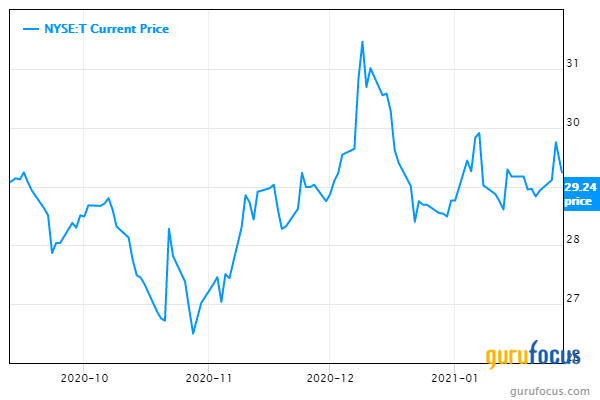

Despite reporting stronger-than-expected earnings and revenue, AT&T's guidance was weaker than the market had hoped on the back of cord-cutting, causing the stock to drop 1.7% to around $29.24 in midday trading.

Earnings results

In full-year 2020, the company saw adjusted earnings per share reach $3.18 compared to $3.57 in 2019, while revenue was $171.8 billion compared to the prior year's $181.1 billion.

For the fourth quarter, AT&T reported a diluted loss per share of $1.95 compared to diluted earnings per share of 33 cents in the prior-year quarter, attributing the majority of the discrepancy to non-cash charges. Adjusted earnings per share came in at 75 cents compared to last year's 89 cents, while consolidated revenue dropped 2% to $45.7 billion. Analysts had been expecting adjusted earnings of 73 cents on revenue of $44.5 billion.

By segment, the quarter saw continuing subscriber growth in wireless, fiber and HBO Max, though cord-cutting adversely affected domestic video, Warner Bros. television, theatrical products and legacy wireline services. Highlights included a 7.6% revenue increase in mobile phone revenues, driven by greater equipment revenues, as well as solid IP broadband average revenue per user growth of 4.6%.

Operating expenses were $56.4 billion versus $41.5 billion in the year-ago quarter, again due to non-cash charges. The non-cash charges were primarily due to the company recording asset impairments and abandonment charges, including a $15.5 billion write-off for the struggling domestic video business.

John Stankey had the following to say:

"We ended the year with strong momentum in our market focus areas of broadband connectivity and software-based entertainment. By investing in our high-quality wireless customer base, we had our best full-year of postpaid phone net adds in a decade and our second lowest postpaid phone churn ever. Our fiber broadband net adds passed the 1 million mark for the year. And the release of Wonder Woman 1984 helped drive our domestic HBO Max and HBO subscribers to more than 41 million, a full two years faster than our initial forecast."

Looking forward

For 2021, the company guides for consolidated revenue growth in the 1% range, disappointing investors who were expecting to see subscription services drive faster growth. Adjusted earnings per share is expected to remain flat compared to 2020.

AT&T also said it expects gross capital investment to be around $21 billion, with capital expenditures in the $18 billion range.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.