Trump's reelection could have a negative effect on these stock sectors

Every presidential election cycle has market watchers trying to forecast what particular candidates mean for stocks, particular sectors and companies. With the 2020 election just 15 months away, the prognosticating has already begun.

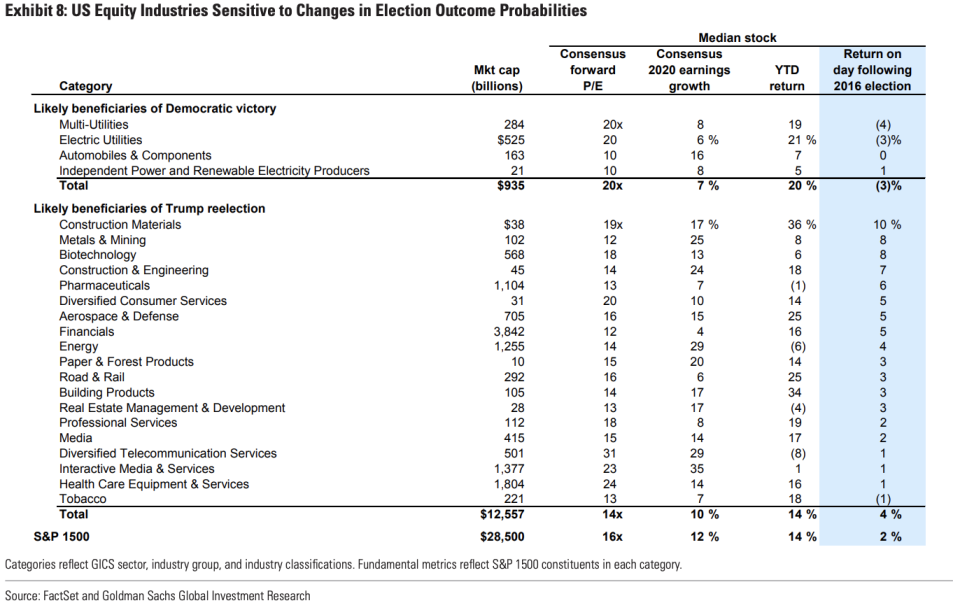

In a recent note, Goldman Sachs looked at the industries likely to be most affected from election outcome probabilities.

Republican win

Unsurprisingly, Goldman Sachs sees a positive response for financials, energy, aerospace and defense sectors if President Trump gets reelected. While Trump’s 2016 campaign promises to repeal the Affordable Care Act might have been a threat to parts of the health care sector, Congress’s failure to repeal it in 2017 suggests Republicans are unlikely to succeed in another attempt.

The consumer discretionary and retail sectors are expected to react strongly to an extension of Trump’s administration. As Goldman Sachs points out, stocks in consumer discretionary and retail with exposure to China, have reacted much more negatively to recent tariff announcements. (Apple lost $53 billion in market value on Monday after China let its currency weaken in response to Trump saying he will impose additional 10% tariffs on $300 billion in imports from China starting on Sept. 1.)

In a separate Goldman Sachs note, analysts said they no longer expect a trade deal before the 2020 election – which means prolonged uncertainty for U.S. companies already dealing with the consequences of a trade war. “We expect the newly announced 10% tariffs on the last $300 billion to remain in place on Election Day, and other forms of tit-for-tat retaliation are possible along the way,” the analysts wrote.

Whichever party wins next year, U.S.-China tensions are likely to continue, Goldman said, adding, “we expect that market participants would perceive tariff-related risks to be lower under a Democratic administration than under a second-term Trump White House.”

Democratic win

While health-care sector disruption seems less likely to come from Republicans should Trump get re-elected, a Democratic win has more downside risks to the sector given candidates like Sen. Elizabeth Warren and Sen. Bernie Sanders’ support for Medicare for All.

Senators Cory Booker, Kirsten Gillibrand, and Kamala Harris are advocating for a government-run program that also allows Americans to keep their private insurance. Goldman Sachs said it is skeptical that a Medicare for All-type plan would survive a Democrat-controlled House and Republican-controlled Senate and become law.

Given that a Democratic administration would not be immune from the challenges of a divided government, presidential attention could also veer toward executive orders, Goldman Sachs said. This would make it easier for a Democratic president to loosen immigration policy and enforcement or repeal tariffs without facing a Congressional showdown.

Raising taxes on the wealthy is a popular talking point on the campaign trail, but a divided government reduces the likelihood that Democrats such as Sanders and Warren will be able to make waves, according to Goldman Sachs. The investment bank points out that some tax provisions of Trump’s signature 2017 tax cut policy, which has been one of the major drivers of stock performance since the 2016 election, are set to expire in 2022 and 2023. (One that will expire unless Congress acts is the “bonus depreciation” benefit, which lets businesses write off capital expenditures right away instead of waiting for it to be amortized.) This would “incrementally increase the effective tax rate on business investment and R&D,” according to Goldman Sachs.

Pressure from both sides

Regardless of who wins in 2020, Big Tech companies such as Facebook, Alphabet, Apple, and Amazon will face antitrust and privacy challenges. These companies have been targeted by both Trump and Democratic candidates; Warren has proposed breaking up some of the country’s largest companies. Aside from a few fines – including Facebook’s $5 billion settlement and Google’s settlement with the FTC – short-term legislation action seems improbable. However, a new Democratic administration or a re-elected Trump could feel empowered to seek further action against Big Tech, according to Goldman Sachs.

Sector winners and losers

More market sectors would be beneficiaries of a Trump re-election because of differences between Republican and Democratic regulatory and tax policy positions, Goldman analysts wrote, as well as uncertainty surrounding Democratic policy given the large field of contenders.

As we head into another election, Goldman Sachs says it expects “the relationship between politics and stock performance to strengthen.”

More from Sibile:

Democratic debates: Fight over free college for rich kids

Trump adds $4.1 trillion to national debt. Here’s where the money went

Skills gap will cost US economy $1.2 trillion over the next decade

Washington playing ‘high stakes poker game’ with Big Tech: Analyst

Trump hopes for trade deal even though ‘China is letting us down’