Toronto-Dominion: Good Finish to a Strong Year

Shares of Toronto-Dominion Bank (NYSE:TD) are up 36% over the last 12 months. Of the five largest banks in Canada, only the Bank of Montreal (NYSE:BMO) has a better performance over this period of time.

Much of this strength is due to the recovery that Toronto-Dominion has experienced since the economic crisis at the beginning of the Covid-19 pandemic. This has played a major role in the companys ability to top Wall Street analysts earnings and revenue estimates each quarter of the fiscal year.

Toronto-Dominions most recent quarterly report showed more of the same as the company finished a very strong year. Lets dig deeper into the company and the quarter to see why the stock is still undervalued even after recent gains.

Earnings highlights

Toronto-Dominion reported its fourth-quarter and fiscal year 2021 results on Dec. 2. All figures are in U.S. dollars unless otherwise noted and reflect the average U.S. dollar to Canadian dollar exchange rate for the period in question.

For fiscal year 2021, revenue grew nearly 8% to $32 billion while adjusted earnings per share increased 56% to $6.31.

For the quarter, revenue grew 5.5% to $8.1 billion, beating Wall Street analysts estimates by $321 million. Adjusted earnings per share of $1.63 compared to adjusted earnings per share of $1.24 in the prior year and was 10 cents better than expected.

Provisions for credit losses in the quarter saw a recovery of $98 million, up from a recovery of $29 million during the third quarter of the fiscal year. This also compares favorably to a PCL addition of $693 million in the same period of the prior year.

Total loans improved 6.1% to $575 billion year over year while total deposits grew 4.4% to $899 million.

Canadian Retail had net income growth of 19% while revenue was higher by 8%, largely due to the recovery of PCL during the quarter. Wealth assets, deposit volumes and loan volumes were up 24%, 11% and 8%. Driving loan growth was gains in commercial loans and mortgage originations. The net interest margin fell 4 basis points quarter over quarter to 2.57% due to lower mortgage prepayment revenue and 14 basis points year over year as a result of lower rates.

U.S. Retail saw net income more than double, and revenue was up 8% on much lower PCL. Deposit volumes were solid and higher fees were generated from customer activity. Loan volumes did decline 6% and personal loans were lower by 1%. On a sequential basis, higher investment income drove a 5 basis point improvement in the net interest margin to 2.21%.

Wholesale Banking net income fell 14%, mostly due to lower revenue and an increase in non-interest expense. Revenue was lower by 8% from the prior year, but up 6% from the prior quarter. Comparisons in the prior year were difficult as trading-related revenue was robust, but Toronto-Dominion saw higher advisory fees, equity underwriting and lending revenue.

Expenses were up in every segment as investment in the business and employee compensation rose. Adjusted return on common equity of 16.1% compared to 15.6% in the third quarter of the year and 13.3% in the fourth quarter of last year.

Takeaways

Like most of the big banks, Toronto-Dominion continues to reduce its financial allocations for emergency scenarios. In fact, PCLs reached a new cyclical low for the company, indicating the bank thinks the risk of loan defaults is continuing to decrease.

Loan growth remains in positive territory, as does the companys deposit base, showing that Toronto-Dominion has broad appeal to customers.

Part of this is on account of the companys digital presence. Between Canada and the U.S., Toronto-Dominion has 10.6 million active users, more than 10% above the same period of the prior year. Nearly 61% of Canadian customers and more than half of U.S. customers access their accounts digitally. The percentage of self-serve transactions completed digitally is 92% in Canada and 79.2% in the U.S.

Net interest income and margin results were mixed throughout the business, but leadership stated on the conference call that they expect the Federal Reserve to hike interest rates twice next year. This should provide some lift to the net interest income and margin. A continued strong housing market should provide additional tailwinds to the company, though loan year-over-year declines in the U.S. retail segment might reflect the rising home prices.

Regardless, those that follow the company expect fiscal year 2022 to be successful. According to analysts surveyed by Seeking Alpha, Toronto-Dominion is expected to earn $6.71 per share in the new fiscal year, which would be a 6.3% increase from the prior year. This is above the compound annual growth rate of 5.4% the company has produced since 2011, according to Value Line.

Valuation analysis

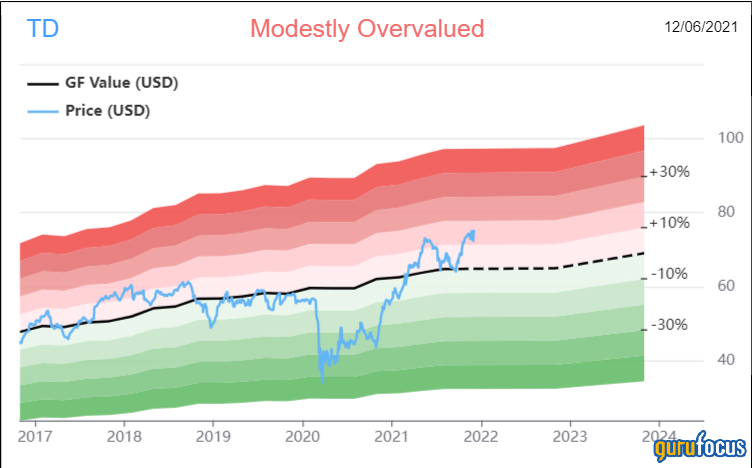

Toronto-Dominion is trading higher than its intrinsic value according to the GF Value chart.

Toronto-Dominion has a GF Value of $64.82. With the stock closing Friday at $74.43, the implied price-to-GF Value is 1.15. Shares would have to retreat 13% to reach its GF Value. Shares are rated as modestly overvalued by GuruFocus.

On the other hand, Toronto-Dominion is trading below its long-term average multiple. Currently, Toronto-Dominion is trading at just over 11 times earnings estimates for the new fiscal year. The stock has had an average price-earnings ratio of 12.2 since 2011, implying the stock is undervalued on a historical basis.

For dividend growth investors, Toronto-Dominion looks like an attractive opportunity. As with most of the other Canadian banks, the company raised its dividend by a double-digit percentage following the earnings release. U.S. shareholders will receive a quarterly dividend of 69.27 cents on Jan. 31, 2022, marking an 11.5% increase from the same period of last year. Toronto-Dominion has now raised its dividend for more than a decade.

Dividend payments for U.S. investors will always be subject to exchange rates, but the annualized dividend of $2.77 equates to a yield of 3.7% at the present time. This is just below the long-term average yield of 3.8%, but nearly three times the average yield of the S&P 500 Index.

Final thoughts

Toronto-Dominion finished of a year of growth and recovery. The company managed to beat analysts estimates for both revenue and earnings all four quarters. The surge in earnings per share growth for the year benefited from the recovery of PCLs. Growth in revenue was also solid as the company continues to see consumer demand in most areas of its business.

Shares are trading at a slight premium to the GF Value, but look inexpensive using Toronto-Dominions historical average. The dividend raise was the second largest amongst the Canadian banks and the yield remains robust.

A performing business combined with a reasonable valuation and generous yield could have shares of Toronto-Dominion poised to go even higher than it already has over the last year.

This article first appeared on GuruFocus.