The TJX Companies' (TJX) Q3 Earnings Beat Estimates, Sales Up

The TJX Companies, Inc. TJX reported stellar third-quarter fiscal 2022 numbers, with the top and the bottom line beating the Zacks Consensus Estimate. Earnings and sales increased year over year. The company witnessed robust performance across all its divisions. Also, it saw encouraging open-only comp store sales in the apparel category.

Q3 in Details

TJX Companies’ third-quarter earnings came in at 84 cents per share, up from 71 cents reported in the year-ago quarter. In third-quarter fiscal 2020, the company’s earnings came in at 68 cents per share. The Zacks Consensus Estimate for third-quarter fiscal 2022 earnings was pegged at 81 cents per share.

Net sales came in at $12,532 million, 24% higher than $10,117 million reported in the year-ago quarter. Net sales in the quarter increased 20% from third-quarter fiscal 2020’s levels. The metric beat the Zacks Consensus Estimate of $12,312.7 million.

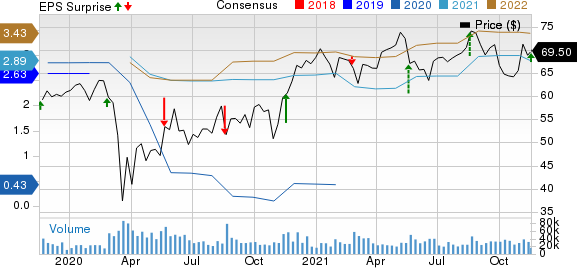

The TJX Companies, Inc. Price, Consensus and EPS Surprise

The TJX Companies, Inc. price-consensus-eps-surprise-chart | The TJX Companies, Inc. Quote

Management stated that due to temporary store closures amid the pandemic, the comp store sales definition was not applicable in the quarter under review. To offer a performance indicator for the stores as they reopen, The TJX Companies has come up with a temporary new sales measure — open-only comp store sales. This includes stores that were initially classified as comp stores (in the beginning of fiscal 2021). This metric reports rise or decline in sales of stores for the days they were operational in the third quarter of fiscal 2022 compared with the same days in fiscal 2020 before the pandemic.

Open-only comp store sales for the company rallied 14% compared with third-quarter fiscal 2020 levels. The metric increased 11%, 34%, 8% and 10% for Marmaxx (U.S.), HomeGoods (U.S.), TJX Canada and TJX International (Europe & Australia), respectively.

TJX Companies’ consolidated pretax profit margin came in at 11%, up 0.3 percentage point from the third quarter of fiscal 2020. The upside was driven by solid sales and increased merchandise margin. However, escalated freight expenses and significant investments to expand distribution capacity, increase incentive accruals as well as wage growth were a downside for the metric. In addition, net pandemic-induced expenses hurt the pretax margin by 0.5 percentage points.

Gross profit margin came in at 29.5%, up 0.7 percentage point from third-quarter fiscal 2020 levels. Selling, general and administrative (SG&A) costs, as a percent of sales, was 18.3%, higher by 0.3 percentage point related to fiscal 2020’s level.

Other Financial Updates

TJX Companies’ ended the quarter with cash and cash equivalents of $6,791.6 million, long-term debt of $3,353.9 million and shareholders’ equity of $6,444.8 million. For 39 weeks ended Oct 30, 2021, the company provided operating cash flow of $1,946.9 million.

The company expects to declare a quarterly dividend in the fourth quarter of fiscal 2022. During the quarter under review, the company returned $1.1 billion to shareholders. Management repurchased and retired 11.7 million shares for $800 million on a trade-date basis, while paying $313 million in shareholder dividends. It anticipates repurchasing nearly $1.75 billion to $2 billion company’s stocks in fiscal 2022.

Total inventories as of Oct 30, 2021, were $6.6 billion. Management is optimistic about its capabilities to provide fresh assortment of gifts in its stores and online websites during the holiday season.

Image Source: Zacks Investment Research

Store & More Updates

The company’s third-quarter fiscal 2022 performance was affected by pandemic-led temporary closure of few Australian stores, which were shut for almost 57% of the quarter. In total, its stores were closed for nearly 1% of the quarter. Management projects such closures to have caused $30-$40 million in lost sales during the third quarter of fiscal 2022. The company anticipates quarterly earnings per share to have been negatively impacted by a cent, thanks to such store closures. That being said, it has no pandemic-induced stores closures at present.

Outlook

At the beginning of fourth-quarter fiscal 2022, TJX Companies is witnessing overall open-only comp store sales growth in mid-teens compared with fourth-quarter fiscal 2020 levels.

Shares of the Zacks Rank #3 (Hold) company have inched up 1.7% so far this year compared with the industry’s growth of 24%.

Upcoming Earning Releases in the Industry

Dollar Tree, Inc. DLTR is slated to report earnings on Nov 23, 2021. The company is likely to register a decline in the bottom line when it reports third-quarter fiscal 2021 results. The Zacks Consensus Estimate for quarterly earnings has remained unchanged in the past 30 days at 95 cents per share, projecting a 31.7% slump from the year-ago quarter’s reported number.

Dollar Tree’s top line is expected to grow year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $6,423 million, which suggests growth of almost 4% from the figure reported in the prior-year quarter. DLTR presently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Burlington Stores, Inc. BURL is slated to report earnings on Nov 23, 2021. The company is likely to register an uptick in the bottom line when it reports third-quarter fiscal 2021 results. Although, the consensus mark for quarterly earnings has moved down by a penny in the last seven days to $1.26 per share, it projects a significant rise from 29 cents reported in the year-ago quarter.

Burlington Stores’ top line is also expected to grow year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2,292 million, which suggests a rally of 37.2% from the figure reported in the prior-year quarter. BURL presently carries a Zacks Rank #4 (Sell).

Dollar General Corporation DG is slated to report earnings on Dec 2, 2021. The company is likely to register a decline in the bottom line when it reports third-quarter fiscal 2021 earnings. The Zacks Consensus Estimate for quarterly earnings is unchanged in the past 30 days at $2.02 per share, projecting a 12.6% fall from the year-ago quarter’s reported number.

Dollar General’s top line is expected to rise year over year. The consensus mark for quarterly revenues is pegged at $8,488 million, which suggests an increase of 3.5% from the figure reported in the prior-year quarter. DG presently carries a Zacks Rank #4.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research