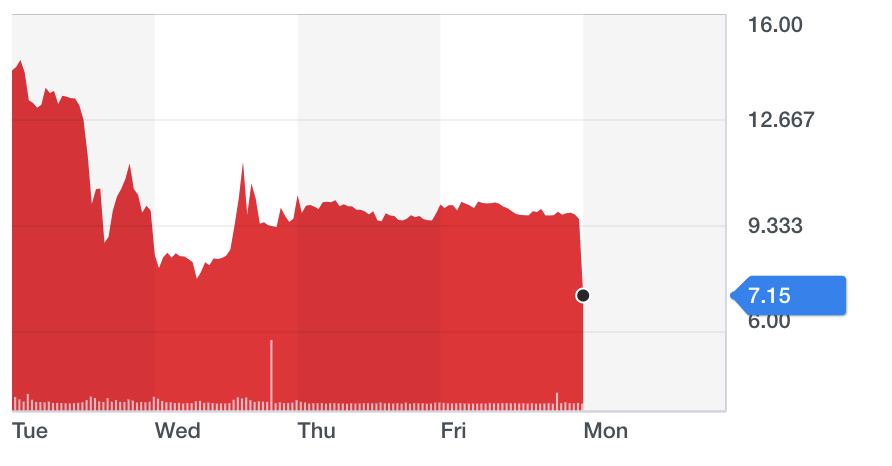

Thomas Cook shares plunge 25% as it seeks extra £150m cash injection

Thomas Cook (TCG.L) shares plunged 25% in early Monday morning trading after the troubled travel operator revealed it is seeking an additional £150m ($180.6m) worth of funding from creditors, on top of the £750m from Chinese firm Fosun and a range of banks.

The stock price fell to 7.15p. Last year, Thomas Cook shares were worth around £1.

The troubled travel operator confirmed in a statement that it has “made significant progress towards finalising the key transaction terms of the recapitalisation” with Fosun and that “this additional capital... will provide further liquidity headroom through the coming 2019/20 winter cash low period and ensure the business can continue to invest in its strategy.”

Thomas Cook, which has 21,000 employees and over 200 own-brand hotels, has encountered a range of issues over the last year, leading to job cuts and store closures. The travel group also put its airline business up for sale after a heat-wave in northern Europe last summer put holidaymakers off last-minute deals.

This led to a number of profit warnings. Thomas Cook warned earlier this year that the European travel market has become "progressively more challenging," which has led to a dent in its finances and has made it difficult to sell its tour business. This is why it has now entered talks with banks and Fosun.