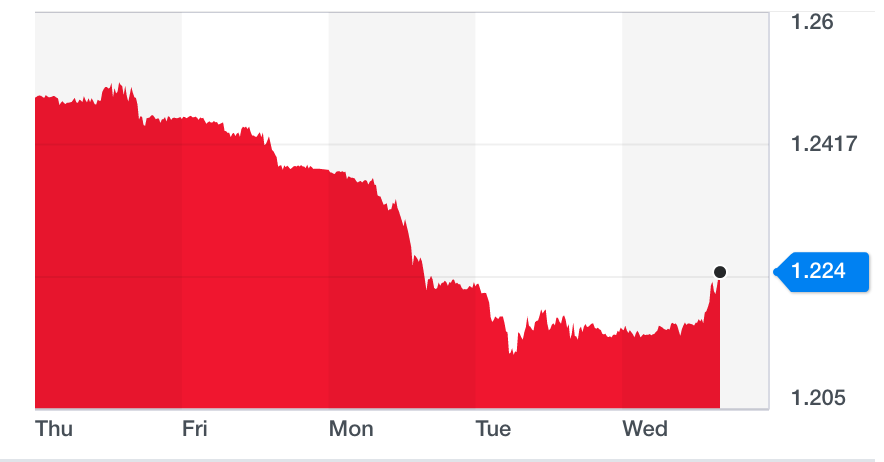

Pound has finally stopped its slide since Boris Johnson took office

Sterling finally ticked upwards against the dollar on Wednesday after days of decline, as markets anticipated the US Federal Reserve would slash interest rates.

The pound had sunk to 28-month lows in recent days, falling for four days in a row after new UK prime minister Boris Johnson won his party’s leadership contest and pledged to leave the EU by 31 October, “no ifs, no buts.”

His new government has ratcheted up planning for a no-deal Brexit and shown few signs of willingness to strike a compromise with the EU, dashing business hopes of a deal to maintain Britain’s close ties with the EU.

Better-than-expected UK consumer survey data may have also eased markets’ fears about wider signs of a slowdown in the British economy, while major retailer Next brushed off Brexit with positive results.

READ MORE: Pound at two-year lows as UK ramps up no-deal planning under Johnson

The pound bounced back 0.7% against the dollar in mid-afternoon trading to around $1.22 ahead of a Federal Reserve interest rate decision later on Wednesday, with US policymakers widely expected to make money cheaper for the first time in more than a decade.

Sterling was also up 0.8% against the euro at around 5pm in London.

But several analysts warn sterling could fall far further if hopes of a deal continue to recede over the summer, pushing up import costs and making Brits’ summer holidays more expensive.

“We are just seeing stabilisation after four very bad days,” said Lee Hardman, FX strategist at MUFG.

He said the recovery “doesn’t change the bigger picture and the pound will continue to weaken but clearly it won’t be a one-way street.”

Neil Jones, head of European hedge fund sales at Mizuho, said the sterling plunge had been in response to investors increasing their predictions of a hard Brexit to up to 40%, but said it could be even higher.

The past week has seen a significant escalation of hard Brexit rhetoric from the UK government, with Michael Gove, the minister in charge of no-deal planning, saying it was a “very real prospect” on Sunday.

READ MORE: Travel money tips for Brits abroad as pound makes summer holidays more expensive

Britain’s budget watchdog warned earlier in July a no-deal Brexit would send Britain into recession, with unemployment, import prices, government borrowing and trade barriers soaring while real incomes, foreign investment, and house prices crash.

Markets are also focused on a Bank of England meeting on Thursday, hoping for clues from policymakers over whether it will soften its stated hopes of a gradual rise in rates.

Reuters reports that money markets currently see the odds at 60% of a December cut to the key UK rate.

Yahoo Finance

Yahoo Finance