The plan to put your employer on the hook for your retirement

Many Americans today are not on pace to have a comfortable retirement. A recent report by Stanford University’s Center for Longevity, found that only half of all households are offered work-based retirement plans in their current jobs.

“Half the people going to work today, clocking in at 9:00 AM this morning, are in a job that does nothing for the retirement beyond Social Security” Jim Kessler, the executive vice president for policy at Third Way, said on Yahoo Finance's “YFi PM.” “it's not their fault, most of them don't have the money to put into a retirement account.”

Kessler’s group has a plan to change this – especially for working-class families who currently have the least access. The idea is picking up some support on Capitol Hill and on the 2020 campaign trail.

The idea is called Universal Private (UP) Retirement Accounts. In many ways, they would work like a 401(k) account and are controlled by the employee with a variety of savings and disbursement options. The crucial distinction is that employers would be required to contribute, whether or not the worker does.

"We have a minimum wage in this country, we think there should be minimum pension contribution as well," says Kessler.

Under the plan, a worker who contributed nothing and relied only on employer contribution would "at the age of 67, in 2018 dollars, have $200,000 which is about $170,000 more than a typical person has now when they retire," says Kessler. Workers would be encouraged to contribute to their UP account but it would not be a requirement.

Employers would be required to chip in at least 50 cents per hour worked, adjusted for inflation. The savings would be separate from Social Security, which is funded by payroll taxes on both employers and employees.

Kessler appeared as part of Yahoo Finance’s ongoing partnership with the Funding our Future campaign, a group of organizations advocating for increased retirement security for Americans.

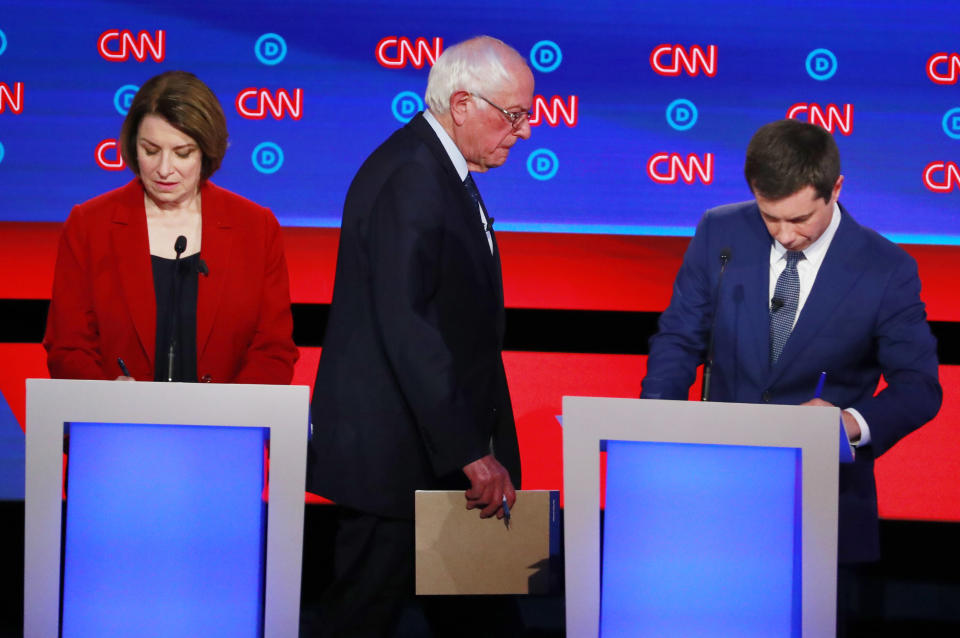

Third Way’s idea has gained support from different corners of the Democratic party. Presidential candidate Sen. Amy Klobuchar, along with Sen. Chris Coons, recently introduced a bill establishing the minimum employer contribution of 50 cents per hour. Klobuchar has vowed that, if elected, she would introduce legislation that includes “worker-owned UP Accounts for retirement savings” in her first 100 days.

Mayor Pete Buttigieg has mentioned a plan – still to be released – with a premise “that employers need to contribute to retirement for everybody and it needs to be pro-rated or portable.” Other candidates, like Sen. Bernie Sanders, have focused their plans on expanding the Social Security program.

Currently, a number of states have adopted plans to expand retirement access. Oregon has a program that automatically enrolls workers in an IRA if their employer doesn’t offer a plan. The contributions come from the employee’s paychecks, not the employer.

In Washington, there is little expectation that UP accounts will come to fruition anytime soon. A much more modest plan to expand retirement access has recently stalled in the Senate.

The issue is only likely to grow: eight in 10 working Americans expressed anxiety that their savings will provide enough for their retirement in a recent survey by the Alliance for Lifetime Income.

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

How the 2020 Democrats would fix Social Security

Why Social Security might be a loser of the recent budget deal

A new study looks deep at how to 'pensionize' your retirement plan

Former senator: 401(k) plans were 'never designed to be the retirement plan for America'

One senator with two different plans to save Social Security

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.