AT&T: Sell Puts to Generate More Income

- By Praveen Chawla

AT&T Inc. (NYSE:T) is the Rodney Dangerfield of U.S. large-cap stocks. In spite of a great dividend (7.2% currently), it gets "no respect" from investors. Maybe its because of the high debt load it carries and the perception of it being a stodgy "old tech" company. The stock has been rangebound for over a decade.

According to GuruFocus' Total Return Calculator, if you had invested in AT&T 10 years ago, your compound annualized growth rate would have been around 5% a year. Not bad, but not great either. The S&P 500 has returned 12.81%.

Over the last decade, AT&T has been transforming itself from being a network company to a network and media company. The big change has been the purchase of Time-Warner in 2018. However, the Time Warner acquisition resulted in the company taking on a lot of debt and investors have not warmed to the media and content strategy.

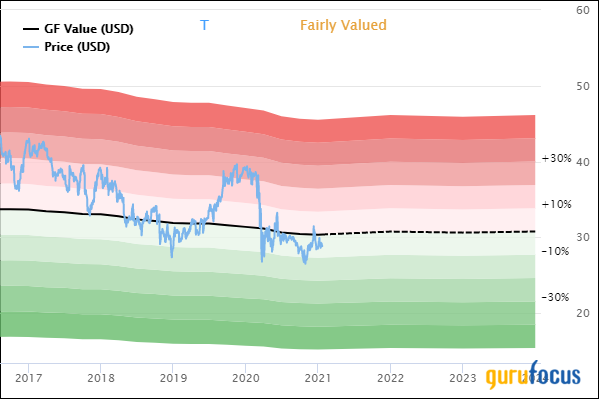

According to GuruFocus, the stock is fairly valued based on historical multiples, past performance as well as projections of future performance.

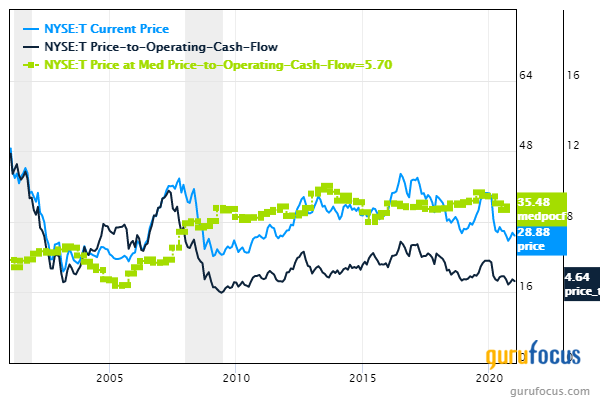

A metric I favor with AT&T is the price-to-median operating cash flow per share. According to this metric, which is illustrated in the chart below, AT&T is about 22% undervalued.

Selling put options on AT&T

Rather than buying and holding shares, I contend an arguably better way to invest is to sell and place the money in put options on AT&T shares. For example, with shares trading at $28.85 as I write, $28 strike put options expiring on June 18 are selling for $1.57. This works out to an 11.2% annualized payout (provided the options expire without being exercised), which is better than the 7.2% dividend.

Of course, it should be understood that if the stock falls below $28, you will be forced by your broker to buy the shares at $28. Therefore, it is important to put the cash aside in case this comes to pass. The cash can be invested in a money market account and you may be able to pick up 0.25% in interest. Even if you are assigned the shares, its not a big issue as they can easily be sold and another at-the-money put sold or held for its dividend. The main thing is the stock itself is undervalued.

There are few advantages with this model of generating income:

We get a higher income than is produced by dividends alone; in this case, more than 50% higher on an annualized basis.

Every six months or so, when the options expire, we are forced to evaluate if we want to continue to hold the assigned stock or sell another put. This forces us to re-evaluate the investment and come to a point of view on valuation. This appeals to me as this forces me to actively manage my positions rather than taking the lazy way out and let things ride.

The income generated is capital gains rather than dividend income. Depending on your circumstances, there might be some tax benefits. For example, if you have capital losses elsewhere, you can play off the gains to get tax-free income.

The disadvantages of this method include:

It is a lot more work in terms of trading, record-keeping and tax returns.

There are more trading fees involved, i.e., writing puts or dealing with assigned shares, but due to availability of discount brokers, this is not very much.

You give up any benefit of unexpected stock appreciation.

Conclusion

In terms of risk, as long as you keep aside enough cash (or equivalent) to cover an assigned put, there is no more risk than just holding the stock. When you sell puts, in essence what you are doing is monetizing the volatility associated with the underlying stock, plus you are getting the benefit of the dividend. The income produced in the form of capital gains (or losses) may also have tax benefits over dividends. The price you pay is a greater complexity in addition to giving up on unexpected stock appreciation. This is no free lunch, but you can customize your sandwich to your liking.

Disclosure: The author is short AT&T put options.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.