Superdry stock crashes as poor Christmas could wipe out profit

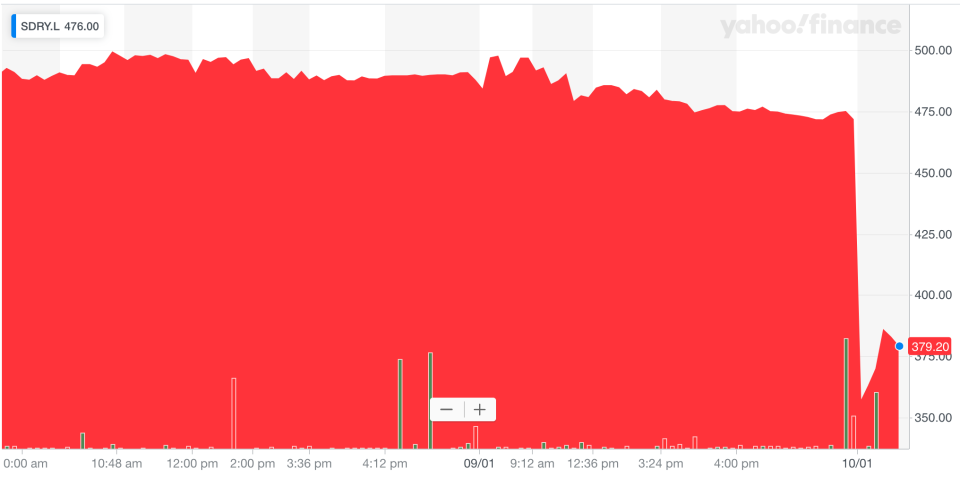

Superdry (SDRY.L) shares crashed over 20% on Friday after the fashion brand warned investors a difficult Christmas means it could make no profit this year.

In an unplanned update to shareholder, Superdry said sales at its stores crashed by 15.8% over Christmas.

As a result, Superdry said underlying profit for the year was expected to be between nothing and £10m ($13m). Analysts had previously been forecasting profit of £20m.

It marks the company’s fourth profit warning in the last 18 months and shares in the retailer and fashion brand dropped 23% at the open in London. The stock had already been under pressure on Thursday, falling over 3%.

Superdry said a strategic push to end widespread discounting and get people paying full price had contributed to the lower than expected sales over Christmas. Poor consumer spending and discounting elsewhere on the High Street also hit performance.

A shortage of better selling items also hit the company. New CEO Julian Dunkerton made the decision to reduce the level of inventory held by Superdry in warehouses when he came in last April. That led to lower levels of advanced orders and items like the Ella bomber jacket sold out as a result. The company believes it could have sold more but wanted to tackle the inventory issues.

Superdry sold £23m less than it was expecting in stores over the festive period. Its wholesale business also missed targets by £5m. Group revenue fell 15.8% over Christmas, with retail sales down 18.5%.

“Everyone at Superdry continues to work intensively to deliver the turnaround of the business,” chief executive Julian Dunkerton said. “While we have always said it will take time, we continue to make progress in implementing our strategy.”

Superdry founder Dunkerton returned to run the business in April 2019 after a boardroom coup. Dunkerton was unhappy with the work of successor Euan Sutherland and set about putting in place a turnaround plan for the company, which is known for its loudly branded t-shirts and coats.

However, sales and profits have suffered since Dunkerton regained control. Profits crashed 98% in the first half of Superdry’s financial year.

Dunkerton stood by his plan on Friday, although admitted his hard-line approach was damaging sales for now.

“A key element of this is to focus on and return to full price sales and reduce promotional activity, and we halved the proportion of discounted sales over our peak trading period, benefitting both our margins and the Superdry brand,” he said in a statement.

Just 39% of Superdry sales were full price last year but that number has now risen to 73%.

“However this adversely affected our sales during the peak trading period given the level of promotional activity in the market,” Dunkerton said.

“Despite this, our disciplined plan to reinvigorate the brand and return Superdry to sustainable long-term growth is on track.”

Last year was a difficult one for retailers. The British Retail Consortium (BRC) said this week that 2019 was the first year ever retail sales fell compared to the prior 12 months. Retailers and supermarkets have warned trading was particular difficult over Christmas, which is when many retail companies make the bulk of their money for the year. Separately on Friday, Joules also put out a profit warning on Friday after poor festive trading.