What This "Super Bowl Indicator" Says About Market Randomness

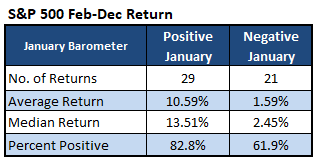

The Super Bowl teams are set, and based on the Super Bowl Indicator, investors should be rooting for the Tampa Bay Buccaneers. The table below shows the Dow Jones Industrial Average (DJIA) has outperformed in years that the National Football Conference (NFC) team defeated the American Football Conference (AFC) team. The difference was even more prominent before the last few years, but I doubt anyone takes the Super Bowl Indicator seriously. I will use it, however, to teach a valuable lesson in randomness and being skeptical toward more plausible-sounding theories.

More Randomness

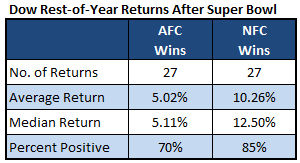

Here is another ridiculous example: I summarized 2020 stock returns based on the second letter of their ticker. Why the second letter, you ask? Because some time ago, I heard that when the market is bullish and investors are buying indiscriminately, stocks with a second letter early in alphabet may outperform, since investors often see lists of stocks in alphabetical order and buy the first good one that catches their eye.

My method does not even allow for that ridiculous theory. See the table below. In a year that the S&P 500 Index (SPX) was up 16%, stocks with “V” as the second letter averaged a gain of 89%, with 58% of the stocks positive. Stocks with “F” as the second letter, on the other hand, gained about 7% on the year, with less than half of the stocks positive. That gap seems significant, but it is obviously due to randomness.

The Lesson

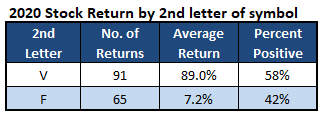

The example above shows how harmful randomness can be in stock market study results. If the results above can come about purely by randomness, then so can the results of more plausible-sounding theories. For example, the table below shows the Dow performs much better for the rest of the year when January is a positive month, rather than negative. This phenomenon is known as the January Barometer, and the theory goes that the early-year stock returns create momentum for investors, leading to the results you see below.

As someone who believes psychology plays a major role in market movements, at first this sounds like a reasonable-sounding theory. The fact remains, however, that these results are random. I am not saying studies like this have no credibility or are useless. What I am doing is making a point to be wary of stock market studies, because randomness plays a much bigger role than many seem to believe. This knowledge could save someone from putting too much faith (and money) into a trade, based on what is not necessarily a rock-solid study.