'An important step forward': New Chase research reveals true weight of student debt

Student loan borrowers — particularly those who are younger and from lower-income families — are spending up to 17% of their annual income on repayments, sometimes putting off basic needs to meet them, according to a comprehensive new report from JPMorgan Chase Institute.

The research — which used data from 4.9 million Chase checking accounts from 2012 and 2018 that made at least one student loan payment — presented a more nuanced picture about just how much debt borrowers have as well as how exactly borrowers are repaying their loans.

In some cases, families that were actively repaying their loans sometimes spent more on the payments than on fuel, leading the study to note that “families are spending more on student loans than key categories of basic necessities.”

D.C.-based Center for American Progress Director of Postsecondary Education Colleen Campbell told Yahoo Finance that the report’s findings were “an important step forward in looking at student debt as part of a person’s whole financial situation, rather than just looking at debt in isolation.”

In a press release, JPMorgan Chase Institute President and CEO Diana Farrell stated: “By understanding the relationship between these student loan payments and other financial outcomes, we hope to provide policymakers, lenders and other stakeholders with valuable information that can help shape policies to ease this burden for America’s families.”

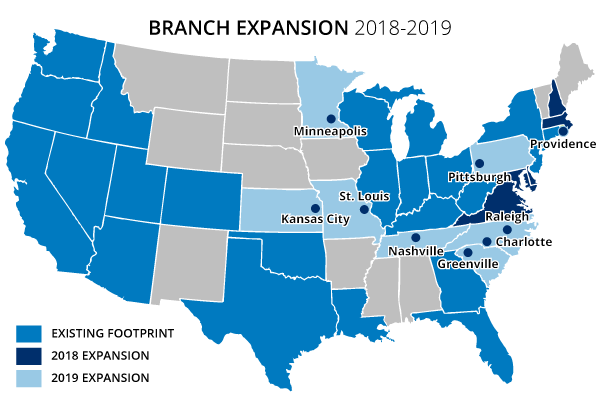

While the scale of the study is massive, it’s also important to note that Chase does not operate in all U.S. states:

Student loans are hampering lives of young people

The median age of the student loan borrowers analyzed was 34, and the average gross income was $76,557. Their average student loan payment was $394 or 6.1% of their take-home income.

And that percentage rose among younger and low-income borrowers. Looking at Chase account holders aged between 25 to 34, one in 4 spent 11.8% of their income on student loan repayments, and a quarter of account holders below 25 spend 16.8% of their income on repayments.

Broken down by income level, families that earn less than $50,000, they’re making student loan repayments that comprise of roughly 7% of their take-home income. And for 1 in 4 of those families, that number goes up to 14.7%.

Overall, the report found that families making student loan payments “spend a higher share of their take-home income on student loans… than on out-of-pocket health expenses” in particular over 2017.

That pain is compounded as many millennials also struggle with their auto loans as well as credit card debt. Serious delinquencies rose for both components in the first quarter of this year, according to data from the New York Fed.

And when borrowers face an income shock — such as if a borrower gets laid off, or was in an adverse situation where they couldn’t earn an income — the report indicated they’d scale back their student loan payments first by putting them into forbearance rather than the other components like auto loans and credit card debt.

But since interest racks up on those in forbearance, that debt pile continues to grow while they attempt to fan the flames on the rest of their overall debt.

Private loan market may be able to do a better job

Amid repayment troubles — many student loans are going into delinquency status or are in default — the report also suggested that applying the private sector’s approach to federally held student loans could be a solution.

“The federal government does not apply risk-based underwriting, which could lead to borrowers taking on too much debt and being overly burdened by repayment costs,” it stated. “In contrast, the private loan market does apply actuarial pricing and, as a result, targets more creditworthy borrowers to whom they can offer competitive interest rates compared to the federal pool… [hence] putting upwards pressure on interest rates in the federal direct loan program.”

On top of that, “private [student] loans have a 98% repayment rate. So this is really a problem with federal student loans,” Consumer Bankers Association VP of Congressional Affairs and Director of Policy Kris Fallon recently told Yahoo Finance’s On The Move. “There’s a federal student loan crisis… the system is rigged in favor of the federal government.”

Making student debt benefits like a 401(k)

Another option — this time from Silicon Valley — proposes that firms embrace student debt as part of their employees’ life.

Goodly Co-Founder and CEO Greg Poulin — who had personally struggled with a student loans — thinks that employers should pay off their employees’ student debt as a benefit, just like how they offer 401(k)s.

“When I was in school, my father passed away very unexpectedly,” Poulin told Yahoo Finance. “So to pay for school at Dartmouth — had to borrow about $80,000 in student loans — I then moved out here to San Francisco to start working for a [human resources] startup. And it's really difficult to do things like save for retirement, let alone think about saving for a house, start a family because my monthly payment’s over $900 a month.”

Poulin’s idea — which birthed his startup, Goodly — is that just like how 401(k)s are offered to employees as a benefit, companies could use his startup’s software to also offer to help pay off employees’ student debt, which he believes is a perk that many would appreciate.

“We could see that payoff in terms of recruiting and retention is a lot of companies,” he explained. “You will get benefits in companies, particularly other companies here in Silicon Valley, … [like] some pretty ridiculous things like ping pong tables, cold brew or dry cleaning for their employees. But at the end of the day, a lot of employees are struggling with student loans.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Presidential candidate Pete Buttigieg: ‘I have six-figure student debt’

Bernie Sanders unveils sweeping student debt cancellation plan

Household debt hits $13.6 trillion as student loan and credit card delinquencies rise

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.