Stronger retail sales in July keep UK recession fears at bay

Retail sales in the UK unexpectedly climbed by 0.2% in July compared to the previous month, even after retail industry bodies had warned of a dire month for the sector.

The boost was mainly driven by growth in online and non-store retailing, which surged 6.9% compared to June, the strongest growth in three years.

There was also an unexpected turnaround for department stores. After six consecutive months of decline, sales at those retailers rose by 1.6% in July, according to the Office for National Statistics (ONS).

But other retailers suffered: Sales declined by 0.2% at textile, clothing, and shoe stores and by 5.4% at household goods stores.

There was only “modest growth,” said Rhian Murphy of the ONS, in the three months to the end of July, during which sales jumped 0.5%.

Sales had climbed by 0.7% in the three months to the end of June.

The data is still a surprising boost for the UK economy, in part because the British Retail Consortium had suggested that July was the worst month for retailers since records began.

Compared to the same month in 2018, growth in retail sales in July came in at 3.3% — well-above market expectations of 2.6%.

Internet sales increased by 12.7% compared to July 2018, with Murphy noting that “strong online sales growth on the month was driven by promotions.”

The figures come amid growing recession fears. Though analysts had been confident that the UK would be able to avert falling into negative growth, the ONS last week revealed that the economy shrunk by 0.2% in the second quarter of the year.

“The UK consumer continues to show impressive resilience to the slowing economy and political uncertainty, with retail sales figures for July topping estimates,” said David Cheetham, chief market analyst at XTB.

“This is the sixth time this year that monthly figures have been better than expected.”

READ MORE: This key investing metric is freaking out global markets

On Tuesday, stock markets around the world plunged after a key investing metric — the yield curve — turned negative for both the UK and US for the first time since before the 2008 financial crisis.

A negative yield curve is seen as a harbinger of recession, and weak economic data from across the world has only added to fears.

The pound had its worst month since October 2016 in July, mainly prompted by growing fears of a no-deal Brexit.

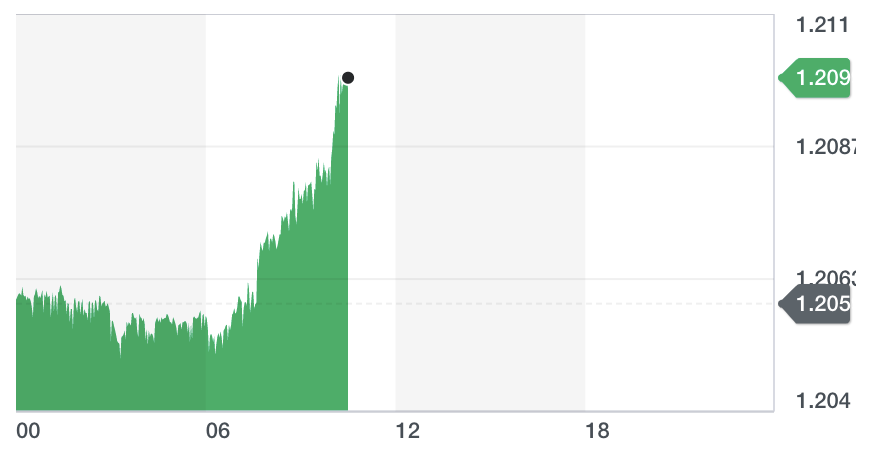

Earlier in August, the currency plunged below $1.21 (GBPUSD=X) for the first time since January 2017. The pound climbed 0.24% on Thursday, to $1.208, following the retail figures.