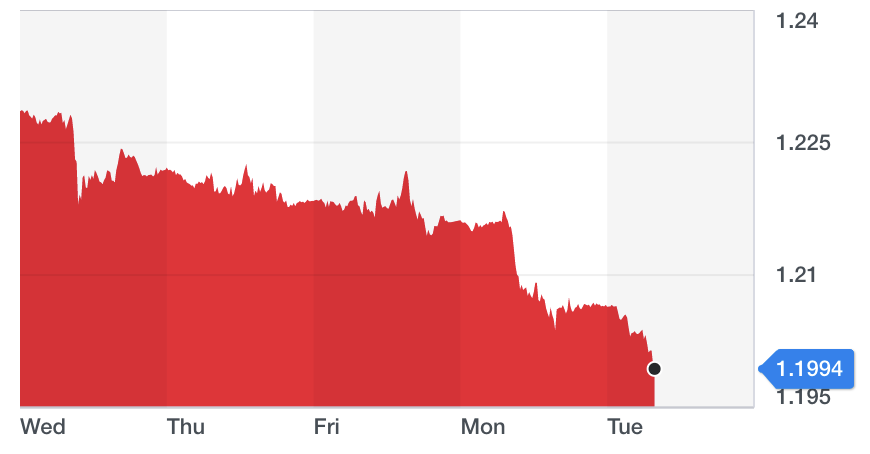

Pound hits 34-year low against US dollar after UK general election threats

The pound tumbled against the US dollar (GBPUSD=X) again on Tuesday after newly installed UK prime minister Boris Johnson threatened to call another snap general election on 14 October, if members of parliament blocked his ability to drag Britain out of the European Union without a deal.

Sterling against the dollar fell by 0.66% in early trading, pushing the pound near parity against USD to $1.19 — a 34-year-low, if you exclude the “flash crash” in 2016 when the pound fell to $1.1752 on 7 October 2016. An all-time low was on 29 March 1985 at $1.05520.

Marc-André Fongern, FX & macro strategist at MAF Global Forex said “the British Pound can hardly escape the downward spiral as the numerous political imponderables have completely poisoned the atmosphere around the currency.”

One of London’s most prominent currency and economy experts reiterated that if a snap general election was confirmed then it would continue to hammer the pound.

"Currencies, as a rule, do not like uncertainty.The idea is that there could of course be a no-deal Brexit, which investors do not like.They do not like the idea of the uncertainty or the potential chaos that that could bring,” said Jane Foley, of Rabobank on BBC’s Radio 4 Today programme.

"So the outlook for sterling is very much determined about the probabilities of a no-deal Brexit. If the members of parliament do manage to block a no-deal Brexit at the end of next month, then that is likely to push sterling up. That said, political uncertainty and a general election will likely push sterling down.

"Sterling will remain a very vulnerable currency."

READ MORE: Boris Johnson could push for general election in October if no-deal Brexit is blocked

Late on Monday, prime minister Johnson didn’t explicitly call for another election but didn’t rule it out too. In a speech he asked for unity among MPs to get a deal through and to back him, even if it means leaving the EU without a deal.

“I want everybody to know – there are no circumstances in which I will ask Brussels to delay. We are leaving on 31 October, no ifs or buts,” said Johnson.

“We will not accept any attempt to go back on our promises or scrub that referendum. Armed and fortified with that conviction I believe we will get a deal at that crucial summit in October.

“A deal that parliament will certainly be able to scrutinise. And in the meantime let our negotiators get on with their work. Without that sword of Damocles over their necks. And without an election, which I don’t want and you don’t want.”

Neil Wilson, chief market analyst for Markets.com said: “Sterling is under the cosh early doors and it could get worse before it gets better.

“It’s set to be a day of tumult in Westminster as rebel Tory MPs collude with the opposition to take control of parliamentary business and force the government to take no-deal off the table.

“The continued political uncertainty will do nothing to lift sterling from its torpor. There is more downside risk and very little to give bulls encouragement. A $1.18 handle is possible today as bears target the $1.19 round number.

“Ignoring the flash crash, we are very much in uncharted waters here. We could feasibly see $1.15 or even $1.10 in the coming weeks if traders decide to move against the pound.”

Meanwhile...