Steady Signal Shining for First Solar Stock

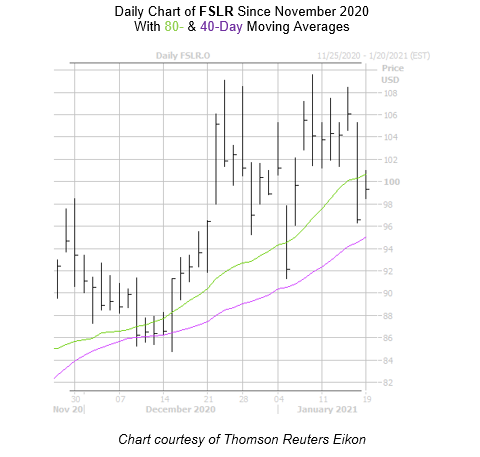

The shares of First Solar, Inc. (NASDAQ:FSLR) are up 2.6% at $99.10 at last check, bouncing back from a 9% loss on Friday. Nevertheless, the good news is that steep Friday pullback put the solar panel manufacturer in close contact with a historically bullish trendline.

More specifically, First Solar stock just came within one standard deviation of its 40-day moving average, after an extended period above the trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, eight similar signals have occurred during the past three years. One month later, FSLR enjoyed a positive return more than 85% of the time, averaging a gain of 8.2%.

From its current perch, a move of similar magnitude would put the security at $107.23 -- just below its Dec. 23, nine-year peak of $109.09. The last time this bullish alarm sounded to close out 2020, in that aforementioned record high just three weeks later. Longer term, FSLR is up 85.5% in the last 12 months.

Shorts, meanwhile, are already hitting the exits, yet there is plenty of pessimism left to be unwound, which could push the security higher. Short interest fell 4.8% in the last two reporting periods, and the 7.59 million shares sold short account for a healthy 8.2% of the stock's available float.

Now looks like the ideal opportunity to take advantage of FSLR's next move with options. The security's Schaeffer's Volatility Index (SVI) of 55% sits in the relatively low 18th percentile of its annual range. This means the stock currently sports attractively priced premiums.