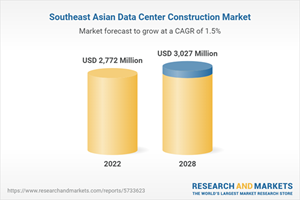

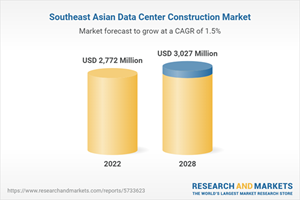

Southeast Asia Data Center Construction Market Outlook & Forecast Report 2023: A $3+ Billion Industry by 2028 - The Region is Witnessing Edge Data Center Investments Across Several Cities

Southeast Asian Data Center Construction Market

Dublin, Feb. 08, 2023 (GLOBE NEWSWIRE) -- The "Southeast Asia Data Center Construction Market - Industry Outlook & Forecast 2023-2028" report has been added to ResearchAndMarkets.com's offering.

The Southeast Asia data center construction market is forecast to be valued at $3,027 million by 2028 from $2,772 million in 2022, growing at a CAGR of 1.48% during 2022-2028

The market has grown significantly, with a major contribution from countries such as Indonesia, Malaysia, and Thailand. In 2022, the moratorium on data center construction in Singapore was lifted, with the pilot phase relating to sustainable data center development currently underway. Once this phase is deemed successful, it will result in strong growth in Singapore from 2024.

The Southeast Asia data center construction market also is witnessing several telecom operators' investments to establish edge data center facilities. For instance, DITO Telecommunity, a new entrant in the Philippines telecom space, deployed edge data centers in Iloilo, Roxas, Bulua, Baler, and Ibajay Aklan.

KEY HIGHLIGHTS

The Southeast Asia data center construction market is expected to witness a negative growth rate between 2022-2023, majorly impacted by the decline in investments in the Singapore market after the moratorium. However, lifting the moratorium and the expected increase in colocation demand across countries such as Malaysia, Thailand, Vietnam, Philippines, and Indonesia will slowly uplift the market's growth rate after 2024.

In terms of investment, the Southeast Asia data center construction market is driven by factors such as digitalization initiatives across the countries, subsea and inland connectivity growth, and the adoption of technologies such as 5G, big data, IoT, and artificial intelligence.

The region is also witnessing edge data center investments across several cities. For instance, in August 2022, Edge Centres announced the development of its EC61 (Chiang Mai) edge facility in Thailand. The company also has plans to deploy additional facilities, namely, EC63 (Khon Kaen) and EC62 (Phuket).

Southeast Asia has robust connectivity with the rest of the world via high numbers of existing submarine cables. The increasing demand for connectivity has led to the further deployment of new cables that will be ready for service in the coming years. The region's tropical climate, the adoption of advanced technologies such as artificial intelligence, and the need for efficiency drive the adoption of liquid-based cooling solutions in the market.

MARKET TRENDS & DRIVERS

Focus on Sustainability in the Region is Gaining Traction

In terms of power capacity, the Southeast Asia data center construction market has adopted several initiatives to make the market more sustainable in the coming years.

Governments across the region are taking up initiatives for making the market sustainable with the adoption of green energy, reduction of carbon emissions, the introduction of carbon laws, carbon credits, tax incentives for the adoption of renewable energy, and others.

For instance, the Government of Malaysia has aimed to generate around 31% of renewable energy out of the total power generation in Malaysia by 2025, with a major contribution expected from renewable energy sources.

Colocation operator ST Telemedia Global Data Centres has pledged to be carbon neutral by the year 2030, and it announced in November 2021 for purchase of carbon credits in Singapore.

Several operators are signing power purchase agreements to adopt green energy sources for their data center operations. For instance, in April 2022, YTL Data Center announced the development of its data center park powered by solar energy with a total capacity of around 500 MW located in Johor, Malaysia, out of which the first phase with a capacity of around 72 MW is expected to be operational by Q1 2024.

5G Deployments Will Drive Edge Data Center Investments

The deployment of 5G services across the region has grown significantly across countries such as Singapore, Indonesia, Thailand, Malaysia, Philippines, Vietnam, and others. Adopting advanced technologies such as 5G is further expected to launch in other regional countries.

These factors will increase demand for the deployment of edge data centers in tier 1 and tier 2 cities that have low connectivity or are in close proximity to any established mega data center facility. For instance, Edge Centres is involved in developing the pipeline of edge center facilities in Thailand, Malaysia, Vietnam, Indonesia, and the Philippines.

Report Insights

Data centers invest more in power infrastructure with a minimum of N+1 redundancy. Most facilities are installed with N+N or 2N redundancy for power infrastructure, with more redundancy for UPS and generator systems. The market is witnessing significant growth in the procurement of lithium-ion UPS systems.

Most edge facility deployment will include single-phase lithium-ion UPS and monitored and switched PDUs. Therefore, the emergence of edge facilities will majorly boost the Southeast Asia data center construction market growth.

The market has a presence of several local and global general construction service vendors such as Arup, Aurecon Group, Gammon Construction, CSF Group, First Balfour, NTT Facilities Group, AWP Architects, Corgan, DPR Construction, Kienta Engineering Construction, Obayashi Corporation, Nakano Corporation, Powerware Systems, RED Engineering, and others.

In 2022, in Southeast Asia, the colocation market was dominated by companies such as Digital Realty, Equinix, FPT Telecom, Iron Mountain, ST Telemedia Global Data Centres, and Big Data Exchange (BDx). Several telecommunication operators have also invested in developing colocation data center facilities in the region in 2022.

In terms of investments, the market is witnessing data center investments by several new entrants, such as OneAsia Network, Pure Data Centres Group, Nautilus Data Technologies, EdgeConneX, and Edge Centres.

GEOGRAPHICAL ANALYSIS

Singapore has been a major shareholder in the overall investments in the Southeast Asia data center construction market. However, the market faced challenges led by the moratorium in the country in 2020 and 2021, which was lifted in June 2022, with the authorities announcing invitations for facilities development plans in July 2022.

In 2022, the investments across countries such as Indonesia, Malaysia, and Thailand grew significantly from existing operators along with the entry of new entrants. Other countries, such as the Philippines and Vietnam, have also emerged as new locations that have witnessed an increase in investments for mega and edge data centers.

Several new entrants have been identified in the Southeast Asia data center construction market, including recently established brands and the expansion of China-based operators like GDS Services and OneAsia Network into the Southeast Asian region.

VENDOR LANDSCAPE

The Southeast Asia data center construction market has the presence of several global and local construction contractor vendors. These prominent vendors include Arup, Aurecon Group, AWP Architects, CSF Group, Corgan, DSCO Group, First Balfour, Gammon Construction, ISG, Kienta Engineering Construction, NTT Facilities Group, PM Group, Powerware Systems, Red Engineering, others offering their services in the region. For instance, Philippines-based construction contractor First Balfour has provided general construction services to ePLDT's VITRO Data Center for its facility in Makati, Philippines.

The Southeast Asia data center construction market, in terms of support infrastructure vendors, has the presence of several global vendors such as ABB, Airedale, Caterpillar, Cummins, Delta Electronics, Eaton, HITEC Power Protection, KOHLER Power, Legrand, Piller Power Systems, Rolls-Royce, Rittal, STULZ, Schneider Electric, Vertiv, and others. These players are offering traditional and innovative data center solutions in the market.

Key Metrics

Report Attribute | Details |

No. of Pages | 337 |

Forecast Period | 2022 - 2028 |

Estimated Market Value (USD) in 2022 | $2772 Million |

Forecasted Market Value (USD) by 2028 | $3027 Million |

Compound Annual Growth Rate | 1.4% |

Regions Covered | Asia Pacific |

Introduction

Data Center Construction Market Overview

Southeast Asia Data Center Construction Market Overview

Data Center Design Certifications

Uptime Institute Tier Standards

Leed Certification

Tia 942 Certification

Market Opportunities & Trends

Growing Sustainability Initiatives

Rise in 5G & Edge Data Center Deployments

Growing Adoption of Artificial Intelligence

Data Localization Laws in the Region

Market Growth Enablers

Increasing Adoption of Cloud-Based Services

Growing Digitalization Initiatives

Increasing Adoption of Big Data & IoT and Smart City Developments

Rise in Submarine Cable Connectivity

Market Restraints

Dearth of Skilled Workforce

Security Challenges in Data Centers

Location Constraints on Data Center Construction

Major Vendors

Support Infrastructure Vendors

ABB

Airedale

Caterpillar

Cummins

Cyber Power Systems

Delta Electronics

Eaton

Fuji Electric

HITEC Power Protection

KOHLER Power

Legrand

Mitsubishi Electric

Narada

Piller Power Systems

Rittal

Rolls-Royce

Schneider Electric

Siemens

STULZ

Trane

Vertiv

Data Center Construction Contractors

Arup

Aurecon Group

AWP Architects

CSF Group

Corgan

DSCO Group

DPR Construction

Faithful+Gould

First Balfour

Fortis Construction

Gammon Construction

ISG

Kienta Engineering Construction

Linesight

LSK Engineering

M+W Group

Nakano Corporation

NTT Facilities Group

Obayashi Corporation

PM Group

Powerware Systems (PWS)

Red Engineering

Sato Kogyo

Data Center Investors

AirTrunk

Amazon Web Services (AWS)

Big Data Exchange (BDx)

Bee Information Technology

Chindata

CMC Telecom

Converge ICT Solutions

DCI Indonesia

Digital Edge DC

DITO Telecommunity

DTP

ePLDT

Equinix

Facebook (Meta)

FPT Telecom

Google

HTC International Telecommunication JSC (HTC-ITC)

Huawei Technologies

Iron Mountain

Keppel Data Centres

Microsoft

NTT Global Data Centers

Open DC

PP Telecommunication (PPTEL)

Princeton Digital Group

SpaceDC

ST Telemedia Global Data Centres

Telehouse

Telkom Indonesia

True IDC

Vantage Data Centers

Viettel IDC

New Entrants

Data Center First

Edge Centres

EdgeConneX

Evolution Data Centres

MettaDC

Nautilus Data Technologies

OneAsia Network

Pure Data Centres Group

YCO Cloud Centers

Yondr

YTL Data Center

For more information about this report visit https://www.researchandmarkets.com/r/o30di8-asia?w=12

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900