South Shore experts: Skyrocketing interest rates cause real estate market uncertainty

Some of real estate agent's Beth McGrath's clients are now looking for less expensive houses than they originally wanted, thanks to rising mortgage rates.

It's one illustration of how higher interest rates are affecting the South Shore real estate market.

"One house that a client of mine could have afforded two weeks ago is now putting her $300 per month over where she wants to be budget-wise," said McGrath, of William Raveis Real Estate, Mortgage & Insurance in Hingham. "So it's really changing."

To avoid a sharp rise in mortgage payments, a buyer who was looking for a $600,000 home now needs to think about buying a $450,000 home, she said.

McGrath said the rising interest rates are affecting buyers more than sellers. She said she does not think the rising interest rates are affecting the number of houses going on the market, and that it is still peak homebuying season in New England.

Let's hear from a loan officer

Loan officer Jim Brown, of Guaranteed Rate, is bracing himself for what will be a tough few months ahead due to rising interest rates.

“Mortgage demand is the lowest it's been in 22 years. Refinance applications are down 75% from last year. Rates are over 6%. This is the largest rate increase I believe since the Jimmy Carter years,” wrote Brown in an email to Wicked Local.

A $500,000 mortgage now costs about $913 more monthly than it did six months ago because of rising interest rates, Brown said. Thirty-year fixed rates are a little more than 6% with zero points. Six months ago, they were 2.875% with zero points, he said.

From June 10-14, there were at least six rate increases in the mortgage market and rates went from about 5.375% to about 6.5%. Brown said in his 39-year career as a loan officer he has never seen rate increases like those.

More: Belmont home in desirable historic neighborhood on market for $4.25 million

“Consumer confidence will fall and the economy will have to slow down,” he said.

Guaranteed Rate’s economic advisers are telling loan officers the next three to six months are going to be painful, but they should come out of it within a year, Brown said.

He said he hopes it doesn’t last for years as it did following the 2008 crash.

Perspective of a seasoned realty agent

Jim Savas, broker/agent with Berkshire Hathaway Home Services Commonwealth Real Estate, has been representing buyers and sellers of residential properties since 1977. He said he noticed a shift in the market for the past two months.

“Houses will take longer to sell and there will be no appreciation, maybe some depreciation,” Savas said.

More: What do homes near The Country Club go for? Houses sold near this year's U.S. Open course

He said the number of people at open houses and the number of offers for homes have fallen significantly lately.

Inventory, on the other hand, is starting to increase, Savas said. For instance, in Belmont, as of June 16, 27 single-family homes were on the market, compared to fewer than half that one month ago, and he expects inventory to continue to rise.

The number of days homes are on the market is also increasing. The average is now two weeks, said Savas, whereas before homes would be under agreement within days.

The stock market is affecting buyers in the high-end market, Savas said. Because of the serious decline in stock values, he said, many people are unable to cash out stocks for down payments, which affects transactions.

“If inventory does start to level out with demand, we will see prices stabilize this year and possibly have a modest decrease in prices, especially in the high end of the market,” Savas said.

What this means for sellers

“Homes in our area will continue to sell, marketing time will be longer, prices may be slightly affected,” Savas said.

If you sell for less, you will also buy for less, so it evens out, he said.

“What does not even out is that your payments will be a lot higher in the new interest rate environment,” he said.

More: What to do when you inherit real estate: MA lawyer, realtor, estate company offer advice

Savas said eventually interest rates will go down and people will be able to refinance.

No need to panic

Colleen Barry, CEO of Gibson Sotheby’s International Realty in Boston, said the real estate market typically slows down in June. She does not see a major shift yet caused by rising interest rates.

The spring market started earlier than usual, Barry said. A lot more homes were under agreement in April compared to past years, which could indicate people were rushing to buy before interest rates went up.

More: Rents rise faster than incomes, expenses - housing shortage, real estate market to blame?

“It’s a supply-and-demand market and we have not had a major influx of supply. A lot of demand has not yet been satisfied,” Barry said.

She said she is confident the market will continue to be strong unless there is a giant change in supply or demand, or both.

During COVID, Barry said more people were moving because they needed more space to work from home and they wanted to take advantage of the low interest rates.

“Money was so cheap, almost free,” she said.

Will there be a repeat of the 2008 crisis?

Barry said she does not believe history will repeat itself.

In the early 2000s, lending practices were dangerous. A lot of people with zero equity were financing 100% of their purchase and using adjustable-rate mortgages.

“We don’t have those irresponsible practices anymore,” said Barry.

She said the current situation is not the same. She said there may be a market slowdown, but not necessarily a market shift.

More: 'Unicorn' of Arlington real estate, historic Victorian, listed for sale for $3.6 million

“People will have to rethink what they can afford if they need to borrow,” Barry said.

Sellers will also have to lower their expectations, she said. It may take more time to sell and they will have fewer offers.

Awaiting data

Tim Warren, CEO of The Warren Group, which has been collecting and analyzing real estate and financial data for 150 years, said it’s still too early to tell how rising rates will affect home sales.

For the last 2½ years, The Warren Group has reported double-digit increases in median sales prices across Massachusetts. At the same time, the number of homes sold has decreased.

More: Built circa 1686, Ipswich's Lummus House listed for sale changes hands after restoration

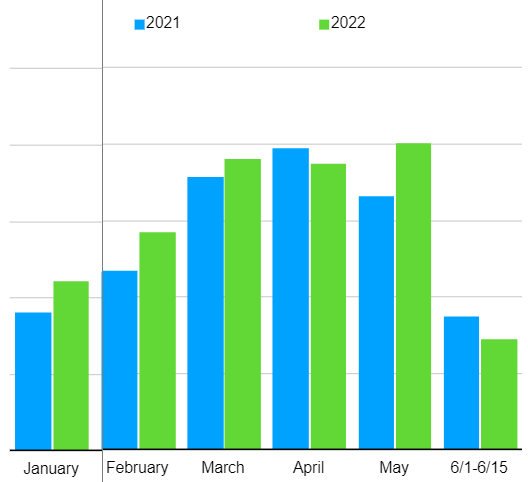

The number of houses sold went down 15% in April compared to April 2021. When comparing the first four months of 2022 to the same period in 2021, the number is down 11%.

However, data over the next few months may show a difference based on the higher interest rates.

“It’s a little early to see the effect of higher interest rates on sales data,” said Warren.

He said he expects to see a change the second half of the year but does not know how dramatic it will be.

Why is inventory so low

Warren said several factors could be affecting inventory. He thinks more people are aging in place. Baby boomers are deciding not to sell after their children move out. They are comfortable staying where they are.

Others may be nervous to move during COVID so they are staying put. Also, people may not be sure where they would go once they sell.

Warren’s predictions

Warren said he expects people will see the effects of higher mortgage rates and a cooling off of the real estate market by the second half of next year. The number of homes selling will continue to decline, possibly by 20% instead of 11%, he said.

He said he expects real estate prices will continue to rise, but modestly in the second half of the year, increasing 2% to 5% as compared to the 10% during the first four months of 2022.

This article originally appeared on wickedlocal.com: Interest rates highest in years, experts discuss real estate market