Solitron Devices: Large Margin of Safety as Earnings Growth Accelerates

Solitron Devices Inc. (SODI) continues to trade at a significant discount to its fair value. Indeed, at todays price, I believe the company presents one of the best bargains in the market today.

Since my last update, Solitron has provided shareholders with multiple positive updates. Despite the continued positive developments from the company, I have been quite surprised to see the stock continue to trade at its current price level. At around $10.38, I believe the stock remains significantly undervalued.

A brief background

Before delving into the companys recent positive developments, lets briefly review some background on Solitron for those who are unfamiliar with the company.

Solitron Devices manufactures semiconductor components that are used primarily for military and aerospace applications. This is a quality business. Its products are mission-critical to its customers a sthey are custom designed and integrated into hundreds of critical military programs. This is a low-risk, highly recurring, predictable and high-margin business. Solitron is run by well-respected hedge fund manager Tim Eriksen, who has successfully turned the company around after taking control back in 2015. Eriksen owns over 13% of the outstanding shares and is well aligned with minority shareholders.

A successful turnaround has set the stage for durable and sustained growth

Since my last update on the company, a great deal of positive news has emerged. Lets start with a summary of what management discussed at the annual shareholders meeting on Dec. 6. Eriksen and Chief Operating Officer Mark Matson updated shareholders on the state of the business and provided more clarity on Solitrons future growth initiatives.

Here are the most important takeaways from the 2021 meeting:

Management updated shareholders on Solitrons growth initiatives. The company recently introduced several new silicon carbide products. The reception from customers has been solid, and they have booked over $1.2 million in sales for these new products since fiscal 2020. Silicon carbide is a rapidly growing segment in the defense industry. Industry projections show the total addressable market for silicon carbide products growing to over $2.5 billion by 2025. Solitrons goal is to capture just a small slice of this large pie. This objective appears very doable given their initial success. Shortly after introducing these new products, the company signed several meaningfully-sized contracts with customers. Silicon carbide will provide a multidecade growth runway for Solitron. The companys growth prospects are immense capturing only a small fraction of this rapidly growing market will be a game changer for the company.

Management also provided an update on the current base of business. Solitrons head of sales, Jack Worthen, spoke confidently about the company's largest existing programs, which are all stable or growing. He has good visibility on the level of sales that will be generated from the companys existing programs over the next two to three years because of the multiyear planning and procurement processes conducted by Solitrons customers. When combining the positive outlook of the existing core programs and the silicon carbide growth initiatives, which are beginning to bear fruit, Solitron is likely to see meaningful sales growth in the coming years.

Finally, the company has continued to focus on optimizing its operations. Eriksen expects $1 million in annual expense savings going forward. This is a substantial figure for a company of Solitrons size and he expects all these cost efficiencies to fall directly to the bottom line.

Here is what Eriksen said in the companys recent 8-K filing, which was submitted just after the annual meeting:

"The Company anticipates that once it has completed its relocation to its new facility and headquarters it will realize annual, aggregate cost savings of approximately $1.0 million, consisting of the elimination of the $40,000 monthly rent, reduced costs for gases and utilities due to the smaller footprint of the new facility and headquarters, the Companys decision to not relocate and operate the Companys wafer fab at the new facility and headquarters, payroll savings and insurance cost savings."

A free cash flow cow

With its multiyear operational restructuring now complete, Solitron is demonstrating strong and consistent free cash flow. Over the past 12 months, the company has produced operating earnings of $3.01 million on $12.94 million in revenue. The company pays no taxes due to significant net operating loss carryforwards (NOLs). Furthermore, maintenance capital expenditure is equal to or less than depreciation in a typical year. Therefore, operating earnings are a good proxy for free cash flow.

As a result of better-than-expected sales growth and a higher level of cost efficiencies than previously anticipated, I am upgrading my financial projections from those in my last update on Solitron.

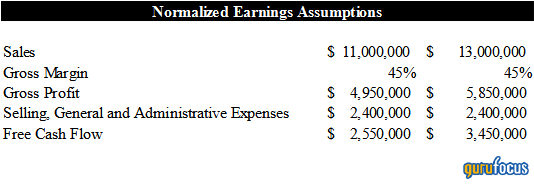

Incorporating the cost efficiencies, which were announced at the annual shareholders meeting, here are my expectations for Solitron's annual results going forward:

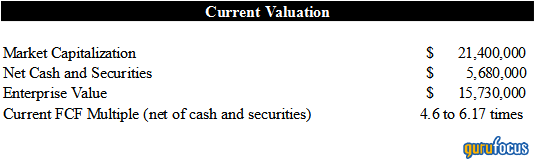

Here is what Solitron's valuation looks like currently, based on the recent $10.38 share price:

The stock is significantly undervalued

Solitron is currently trading for just 4.6 to 6.17 times my expectation of future FCF (net of balance sheet cash and securities). This strikes me as an absurdly low valuation for a high-quality, growing business with an outstanding management team. Therefore, I see significant upside from today's share price.

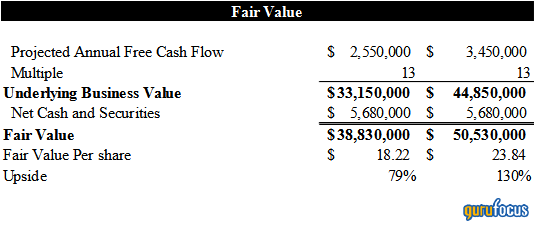

Below, I value the business at a more appropriate multiple of 13 times FCF and add net cash and securities, which results in a conservative valuation of $18.22 to $23.84 per share (76% to 130% upside from today's price):

Continued insider buying

In a further vote of confidence from the management team, on Nov. 10 and 11, 2021, Eriksen purchased a total of 7,000 shares on the open market at a price of $9.05. This is a meaningful data point because Eriksen knows the business better than anyone else due to his role as CEO, and he is also a very astute investor. According to his most recent public investor letter, his firm, Cedar Creek Partners, has produced a 772% return for its investors (after fees) since inception in January 2006. Seeing Eriksen buy more shares of Solitron is a promising signal.

Conclusion

Shares of Solitron Devices continue to present an excellent opportunity for patient investors.

Solitron is a high-quality business that supplies mission-critical and custom-designed components to a diversified group of some of the most important United States defense programs. Its largest programs are growing and provide a base of high-margin, non-cyclical recurring cash flow.

The company is run by an aligned and proven management team with significant skin in the game. Given their large share ownership, the management team is strongly incentivized to continue growing shareholder value. Eriksens recent share purchases serve as a further vote of confidence in the company.

Solitron is well-positioned to grow sales substantially in the years ahead as the new silicon carbide products continue to gain traction.

Substantial cost efficiencies are set to materialize in fiscal 2023 and drive FCF meaningfully higher in the short run.

The growing cash balance provides an opportunity for the management team to begin rewarding loyal shareholders with share repurchases or dividends, which will serve as a catalyst for the shares to trade more in line with fair value.

At the recent price of $10.38, Solitron is currently trading for just 4.6 to 6.17 times my expectation of future FCF (net of balance sheet cash and securities). A more appropriate multiple of 13 times FCF, when adding net cash and securities, results in a valuation of $18.22 to $23.84 per share (76% to 130% upside from today's price).

This article first appeared on GuruFocus.