Is Sea (NYSE:SE) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Sea Limited (NYSE:SE) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Sea

What Is Sea's Net Debt?

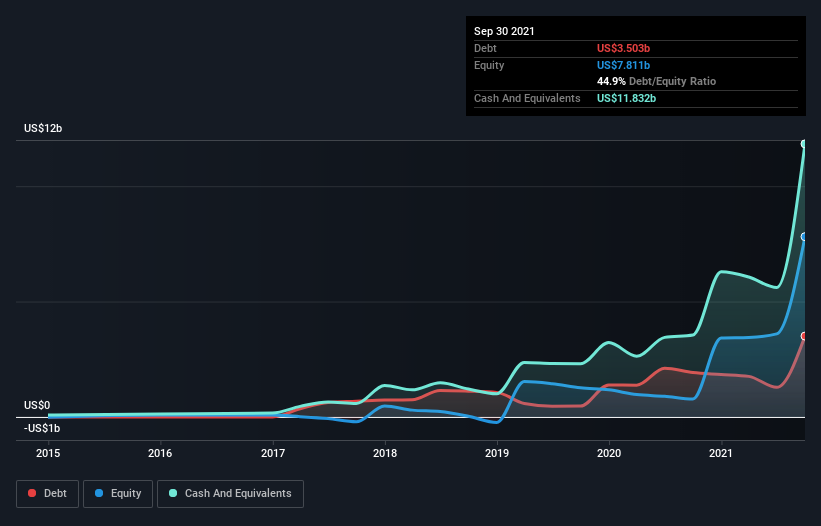

As you can see below, at the end of September 2021, Sea had US$3.50b of debt, up from US$1.92b a year ago. Click the image for more detail. However, its balance sheet shows it holds US$11.8b in cash, so it actually has US$8.33b net cash.

A Look At Sea's Liabilities

According to the last reported balance sheet, Sea had liabilities of US$6.42b due within 12 months, and liabilities of US$4.32b due beyond 12 months. Offsetting this, it had US$11.8b in cash and US$1.43b in receivables that were due within 12 months. So it can boast US$2.53b more liquid assets than total liabilities.

Having regard to Sea's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$126.4b company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that Sea has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Sea can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Sea wasn't profitable at an EBIT level, but managed to grow its revenue by 131%, to US$8.3b. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Sea?

While Sea lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow US$342m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Keeping in mind its 131% revenue growth over the last year, we think there's a decent chance the company is on track. There's no doubt fast top line growth can cure all manner of ills, for a stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Sea is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.