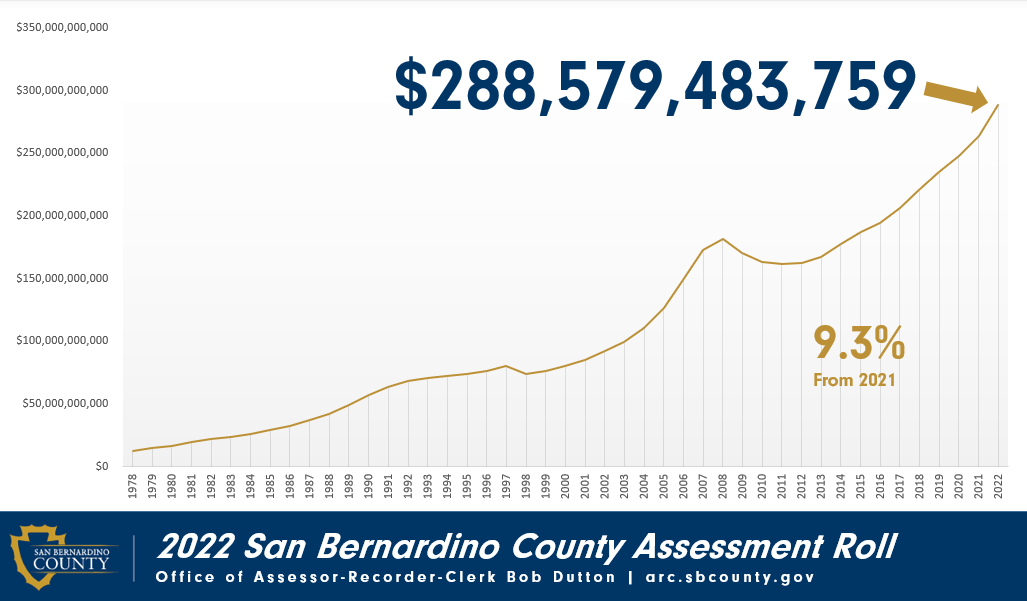

San Bernardino County’s property assessment roll jumps 9.3%, hits record high valuation

The total taxable value of real estate in San Bernardino County jumped 9.3% last year to $288 billion as home values rose and more residential and industrial properties were constructed, the county assessor-recorder said.

The roll reflects the total assessed value of real, business, and personal property subject to taxation in the county as of Jan. 1.

The $288 billion figure is about twice as large as what the county reported in 2008, just before the Great Recession.

Although it is not the most populous city in the county, Ontario was the jurisdiction with the highest assessed value, at $36 billion.

It was followed by the cities of Rancho Cucamonga at $32 billion and Fontana at $26 billion.

Ontario has about 175,000 residents, according to the 2020 Census, while Rancho Cucamonga has 174,000 and Fontana has 208,000. The City of San Bernardino is the county's most populous city, with 222,000 people.

The estimated total assessed valuation for High Desert municipalities includes:

Victorville, $11.8 billion

Hesperia, $8 billion

Apple Valley, $7.4 billion

Adelanto, $2.9 billion

Barstow, $1.7 billion

Incorporated cities as a total were valued at $245 billion, while unincorporated areas were valued at about $42 billion.

Dutton noted said in a statement that “despite the increase in home prices seen throughout our county, most property owners will not see an equal rise in their property value assessments for tax purposes as a result of Proposition 13’s requirements.

Prop. 13, passed by voters in 1978, requires county assessors to only reappraise a property to determine the fair market value for assessment purposes, also known as the “Base Year Value,” at the time of change of ownership, for new construction, or when a property’s current market value is below its base year value.

Prop. 13 limits the growth of a property’s annual base year value adjustment to no more than the California Consumer Price Index or 2%, whichever is lower.

The annual valuation is then listed on the assessment roll and is used by the county’s tax collector to determine the general county tax levy, which is 1% of the base year value, as mandated by Prop. 13.

Dutton noted many entities received exemptions and credits including:

227,901 county property owners were provided the Homeowners’ Exemption, saving them $15 million in property taxes.

4,628 county disabled veterans qualified for the Disabled Veterans’ Exemption, equaling over $6.6 million in property tax savings.

4,477 welfare institutions such as schools, churches, museums, and non-profits received over $97 million in property tax savings.

Property tax goes toward fundamental public services such as first responders, schools, libraries, and parks, as well as other city and county services.

Individuals wishing to see their assessed value may visit the assessor's website at arc.sbcounty.gov or call 877-885-7654.

This article originally appeared on Victorville Daily Press: San Bernardino County’s property assessment hits record high