Ranks of the 'super-wealthy' swell by 31,000

The population of “ultra-wealthy” people around the world grew by over 31,000 last year, according to a new report.

The number of people with a net worth of $30m (£23.5m) or more — known as ultra-high net worth individuals (UHNWIs) — rose by 6.4% to 513,244 in 2019, according to The Wealth Report 2020 compiled by property consultants Knight Frank.

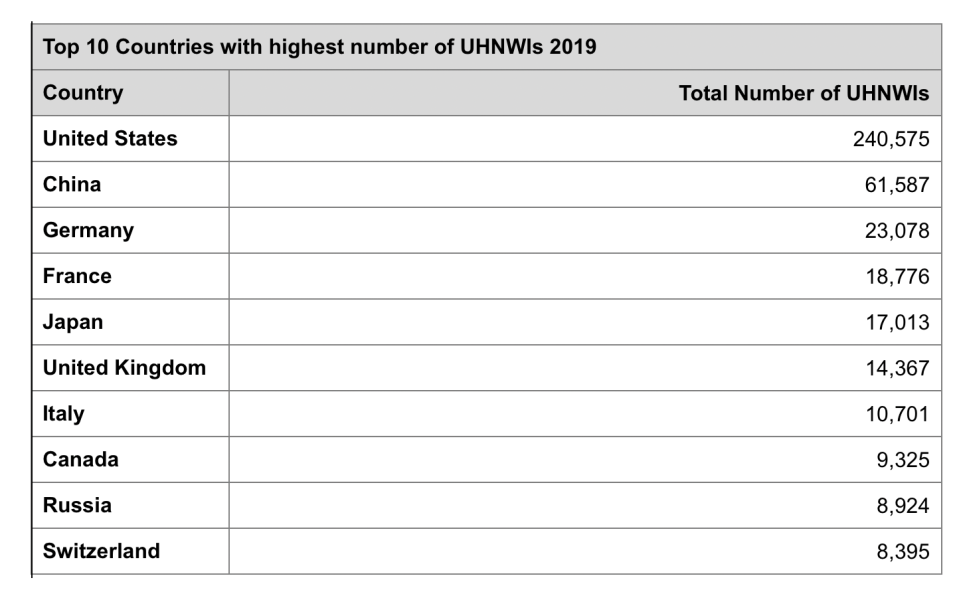

The US comes top of the ranking, with 240,575 UHNWIs, — more than Europe and Asia together, constituting almost half the global total.

China ranks second with 61,587, followed by Germany (23,078), France (18,776), and Japan (17,013).

The UK is in sixth place with 14,367 super-rich individuals.

Asia added 11,788 to the ranks of the super-rich, markedly outpacing Europe which created 4,682 new UHNWIs in 2019.

The number of ultra wealthy people is predicted to grow by 27% over the next five years to 650,000 by 2024.

Asia is fast catching up on Europe as by 2024 it is estimated to become the world’s second largest wealth hub, with India, currently 12th in the ranking, leading the way with 73% growth forecast.

The report said: “Economically, 2019 was outwardly a tumultuous year, with the International Monetary Fund reducing its forecast for global GDP growth from 3.5% in January 2019 to just 2.9% in January 2020 – a 10-year low”.

Despite this, 63% of wealth managers said their clients’ wealth had grown in the last year, with only 11% seeing a decrease.

Read more: World’s richest gain $1.2 trillion in 2019

The overall numbers of the ultra-wealthy elite included in the report increased significantly compared with 2018, after Knight Frank changed its methodology to include the value of individuals’ homes. Property makes up almost a third (27%) of the total wealth owned by the ultra-rich.

Liam Bailey, global head of research at Knight Frank, said: “It’s exciting to see how wealth is developing across Asia and, with the number of ultra-wealthy in India, Vietnam, China and Malaysia outpacing many other markets over the next five years, it will be interesting to see how this impacts the global property market.”