Quidel: Looking Beyond the Recent Surge in the Share Price

- By Robert Abbott

For many companies, the Covid-19 pandemic has brought trouble and turmoil, with many wondering if they will survive. For other companies, though, it has been a bonanza. One of the latter is Quidel Corp. (NASDAQ:QDEL), which saw its share price spike after the pandemic hit:

The reason? Quidel is in the business of diagnostic testing.

The company

Based in San Diego, Quidel calls itself "a leading diagnostic healthcare manufacturer." On its website, it also lists the five product categories in which it operates:

Lateral flow, with diagnostics for infectious diseases and reproductive health.

Direct fluorescent antibodies (DFA), focused on infectious disease and virology.

Micro-titer production, which addresses bone and complement pathway markets.

Fluorescent immunoassay products (Sofia).

Molecular diagnostic products, "including the world's first FDA-cleared handheld molecular device, AmpliVue."

Since the pandemic first took hold in the U.S., there has been an exponential increase in the demand for diagnostic products. Douglas Bryant, Quidel's president and CEO wrote in the third-quarter earnings release:

"We were the first to develop and scale a rapid antigen test that democratized COVID-19 testing by providing affordable, highly accurate results in minutes at diverse points of care in tens of thousands of communities throughout the United States. As we enter both Q4 and flu season, Quidel is once again extending our innovation leadership with the first FDA-authorized 'ABC' rapid antigen test capable of detecting and distinguishing between Influenza A + B and COVID-19 from a single nasal swab in just 15 minutes. This real-time diagnostic tool will significantly enhance medical effectiveness in treating and containing the dangerous twin pandemic of COVID-19 and virulent flu."

Two of its products, QuickVue and Sofia Q will allow the company to go mass market with diagnostic tools that can be read by non-medical people on mobile devices:

Those are just two of the products that the company believes will keep it growing once pandemic demand fades away:

But do the fundamentals justify optimism about the company's fortunes over the next five to 10 years?

Financial strength

A 7out of 10 rating is considered strong by the GuruFocus system; personally, I would have thought it deserved a point or two more.

It carries some debt, but with an interest coverage ratio of 45.57, we know it is relatively light. The ratio tells us that Quidel earns enough operating income to pay its interest expenses 45.57 times over.

It has a Piotroski F-Score consistent with mature, well-performing companies and its Altman Z-Score is near the top of the range.

Most impressive is the WACC versus ROIC comparison. Just looking at the mini-chart tells us the company gets a much higher return on invested capital than it pays for its weighted average cost of capital.

Profitability

Lots of green on this screen, indicating it is doing better than its competitors and its own history at generating profits. Still, it receives only a 6 out of 10 rating.

Why? Let's review the criteria for the profitability ranking:

Operating Margin %.

Piotroski F-Score.

The trend of the Operating Margin % (five-year average).

Consistency of profitability.

Predictability Rank.

This 10-year chart shows why Quidel doesn't rank higher:

The company has had one year of spectacular earnings growth in the past 10 and there is no consistency or predictability to the returns.

Margins have a slightly longer history of increases, but still only a few years:

Summing up profitability, we see the company has a relatively short history of outperforming.

Competition

According to Quidel's10-K for 2019, competition is intense and affected by rapid changes in innovation, product development, regulatory clearances and commercial introduction of new in-vitro diagnostic technologies.

Key factors in the competition are convenience, speed to result, specimen flexibility, product menu, clinical needs, price, reimbursement levels, product performance and effective distribution and marketing.

Named competitors in the 10-K include Abbott Laboratories (NYSE:ABT), Beckman Coulter Primary Care Diagnostics, Thermo Fisher Scientific (NYSE:TMO), Becton Dickinson (NYSE:BDX), Meridian Bioscience (NASDAQ:VIVO) and Danaher Corp. (NYSE:DHR).

Despite the competition, the Jan. 13 presentation shows Quidel is optimistic about this year:

In particular, take note of the last line on the slide: "We expect to double 2020 revenue in 2021 with a similar drop-through to the bottom line." That's a prediction of serious growth.

What happened in the first nine months of 2020? Here are a few details from the third-quarter earnings release:

Total revenue grew by 123% to $852.5 million.

Gross profit increased to $647.4 million.

Gross margin improved.

Net income grew from $1.02 per diluted share in the first nine months of 2019 to $7.82 per diluted share in 2020.

If Quidel can deliver on the promise of the last line of the slide, it will become something of a powerhouse in its field. And two years of heavy growth in net income would produce a lot of free cash flow for investments in both organic growth and corporate acquisitions.

Dividends and share buybacks

None of that free cash flow will be needed for dividends or share repurchases. It does not pay a dividend and its share buyback ratio over the past three years has been negative; that means it is issuing more new shares than it is buying back.

Valuation

Quidel stock was on quite a roller coaster ride last year, peaking in August, plunging in September, recovering in October, only to plunge again in November:

The GuruFocus Value chart claims the company is significantly overvalued.

The price-earnings ratio of 24 shows Quidel to be undervalued in comparison to its competitors and peers in the Medical Diagnostics and Research industry. The latter has a 10-year price-earnings median of 39.3. Quidel is also undervalued in comparison with its own history, with a 10-year median of 58.16.

Undervalued is also the verdict when Ebitda growth is factored into the measures. The PEG ratio is 0.49, which is well below the fair valuation mark of 1.

Because Quidel has a predictability rating of just one out of five stars, the discounted cash flow calculator will not produce a reliable result.

Since this is a growth stock, I would cautiously call it modestly undervalued, on the basis of the PEG ratio and the price-earnings ratio comparisons.

Gurus

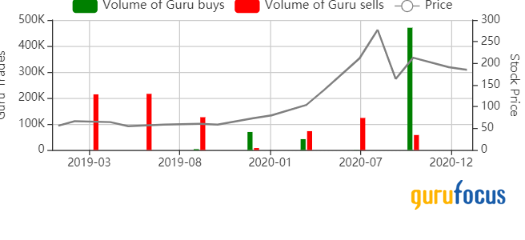

Last year's share price attracted the interest of guru investors, and then exploded in the third quarter:

As of Sept. 30, eight gurus held positions in Quidel. The three largest holdings belonged to:

Mario Gabelli (Trades, Portfolio) of GAMCO Investors with 294,500 shares, good for a 0.70% stake and representing 0.72% of his portfolio. That followed a reduction of 15.64% from the end of the second quarter.

Vanguard Health Care Fund (Trades, Portfolio) took on Quidel as a new holding in the quarter, buying 286,797 shares.

Steven Cohen (Trades, Portfolio) of Point72 Asset Management also took a new position, with 141,841 shares.

Conclusion

The word "quidel" originates with an indigenous group in Chile and Argentina; in the Mapuche language, it means "burning torch." The company named Quidel delivered a burning torch to shareholders in 2020 with exceptional returns thanks mainly to its diagnostic tools that can detect the Covid-19 virus.

As for the next five to 10 years, the odds are reasonably good that shareholders will receive above-average capital gains. The company's outlook for next year is very bullish and if it has another successful year, it should have lots of cash flow to dedicate to new growth.

While its valuation is uncertain, the odds seem to be on the side of undervaluation. If 2021 is as good as the company expects, the current price will likely be considered a pullback a year from now.

Aggressive value investors prepared to live with a modest amount of debt may want to go on to assess the valuation in more detail. Growth investors may want to keep an eye on this stock, looking for a return to capital gains. For income investors, there is nothing here.

Disclosure: I do not own shares in any of the companies named in this article and do expect to buy any in the next 72 hours.

Read more here:

What Could a VMware Spinoff Mean?

An Undervalued Predictable Mid Cap

Jim Simons, Chuck Royce and Winmark

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.