Pound loses all its gains since UK election on hard Brexit fears

The pound’s gains since the UK election on Thursday have been wiped out within a week, after government plans to stop the Brexit transition period being extended sparked fresh fears of a hard exit.

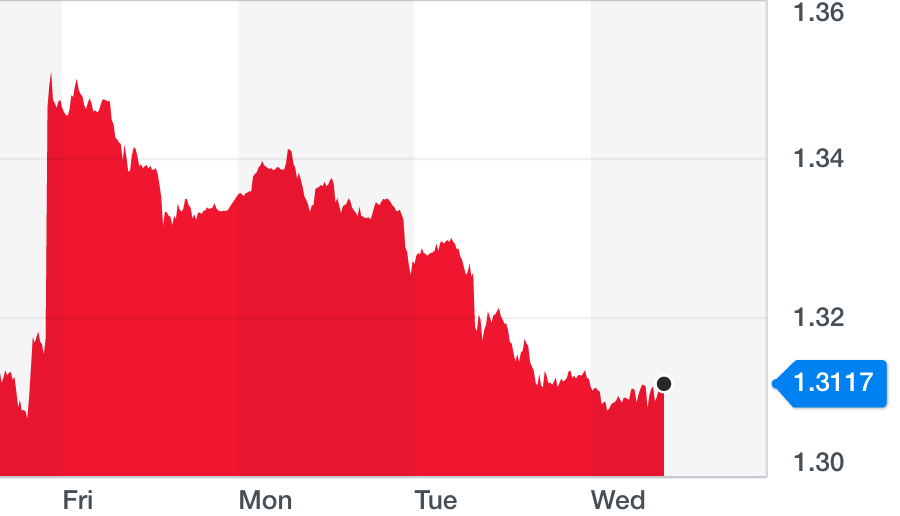

Sterling was hovering (GBPUSD=X) at around $1.31 on Wednesday morning, just under its exchange rate last Thursday night shortly before the election exit poll signalled a decisive Conservative victory.

The pound was also treading water against the euro (GBPEUR=X) on Wednesday at a lower rate than immediately before the election.

It remained below the €1.18 mark it had fallen to on Tuesday, also dipping lower than it had been trading shortly before the 10pm exit poll last Thursday.

READ MORE: Why a Johnson victory does not take a no-deal Brexit off the table

Prime minister Boris Johnson’s landslide victory had sparked a surge on the markets, with the value of sterling and Britain’s leading companies rocketing.

The gains had reflected not only relief at avoiding a radical Labour government under opposition leader Jeremy Corbyn, but also hopes a strong Conservative majority would lead to a smoother Brexit.

Britain looks set to be spared both the deadlock of a hung parliament and the risk of crashing out of the EU without a withdrawal deal on 31 January.

But while MPs are expected to approve Johnson’s withdrawal agreement with Brussels, formal negotiations have not even begun on a future trade deal.

The future relationship between Britain and its biggest trading partner remains up in the air, with the withdrawal deal only committing to a one-year transition period under EU rules after Britain’s departure.

Some analysts and investors had expected Johnson to be willing to extend the transition period to ensure a more comprehensive trade deal can be struck in time.

The scale of his majority was thought to insulate him from a backlash from more hardline Conservative MPs or the electorate, who he may not need to face for another five years.

READ MORE: Sterling falls as Johnson says he’ll stop the Brexit transition being extended

But it emerged on Monday Johnson is planning to legislate to prevent any extension, sparking dismay among businesses and investors.

If a trade agreement cannot be reached by the end of the transition, the UK could face enormous disruption to trade and other ties with the EU from new trade barriers.

“Sterling continues to slide, surrendering its post-election gains,” said Russ Mould, investment director at AJ Bell, highlighting the legislative plans.

But several analysts cautioned not to read too much into Johnson’s words, and noted the pound remained much higher than the lows it sunk to below $1.20 in September.

“Legislation can be reversed and time will tell if this is a negotiating tactic, political ploy or a genuine commitment to going over an apparent cliff edge if a deal can’t be concluded by the end of next year,” added Mould.

Michael Hewson, chief market analyst at CMC Markets UK, noted Britain had not still not left the EU and a possible no-deal exit remained “well over a year away.”

“It seems a little early to start fretting about that,” he said.

Marc-Andre Fongern, an FX analyst at MAF Global Forex, said the pound’s decline was “disproportionately exaggerated,” saying the trade talks were not “necessarily doomed to failure.”