Pound set for worst week since early August amid Brexit woes

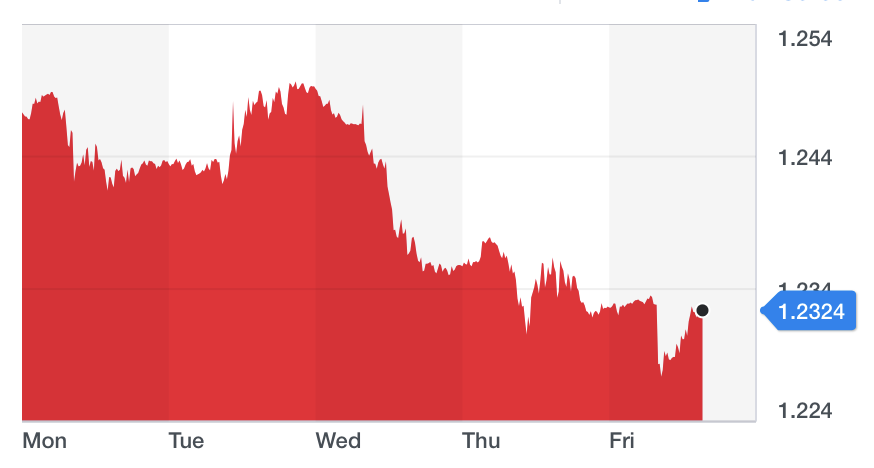

The pound is on track for its worst week since early August after one of the most tumultuous weeks in British political history and amid an interminable Brexit crisis.

Though the pound reversed the sharp losses it saw earlier on Friday, the currency still looks set to close out the week down by around 1.5%.

It fell by more than 0.4% against the dollar (GBPUSD=X), dropping below $1.23 for the first time since earlier this month, after a Bank of England policymaker said he thought it was possible interest rates would be cut even if the UK avoided a no-deal Brexit.

But the currency climbed on Friday afternoon, meaning it is now on the level for the day and well above $1.23.

The pound had surged in the wake of Tuesday’s UK Supreme Court ruling, which found that prime minister Boris Johnson’s five-week suspension of parliament was unlawful.

READ MORE: Pound plunges after Bank of England policymaker signals rate cut

It nevertheless erased most of its gains on Wednesday, when fiery scenes and profound discord in parliament demonstrated that the country was no closer to striking a Brexit deal with the EU.

The return of parliament also heightened concerns about a no-deal Brexit.

During a highly charged debate on Wednesday, Johnson told the House of Commons that he would not abide by the terms of the Benn Act, the law that requires him to seek a Brexit extension from the EU before 31 October.

“Proroguing parliament at least gave the pound a rest — as soon as MPs returned the noise was turned up to 11 and the pound suffered,” Neil Wilson, the chief market analyst of Markets.com, told Yahoo Finance UK.

“Sterling has had its worst week since August as the Brexit crisis shows no signs of resolution. Quite what MPs have achieved in getting parliament recalled is hard to say, but we are assured further noise and that tends to be bad for the pound,” he said.

“No deal risks are as high as ever, with the government showing no signs of backing down on the Benn bill.”

Sterling’s decline was good news for the FTSE 100 (^FTSE), which tends to climb when the currency weakens. The index, which tracks the UK’s top 100 listed companies, was up by almost 0.6% this week.

Yahoo Finance

Yahoo Finance