Policymaker: Smooth Brexit deal will mean higher interest rates

A top policymaker at the Bank of England believes that the central bank should still consider increasing interest rates if prime minister Boris Johnson manages to take the UK out of the European Union with a deal.

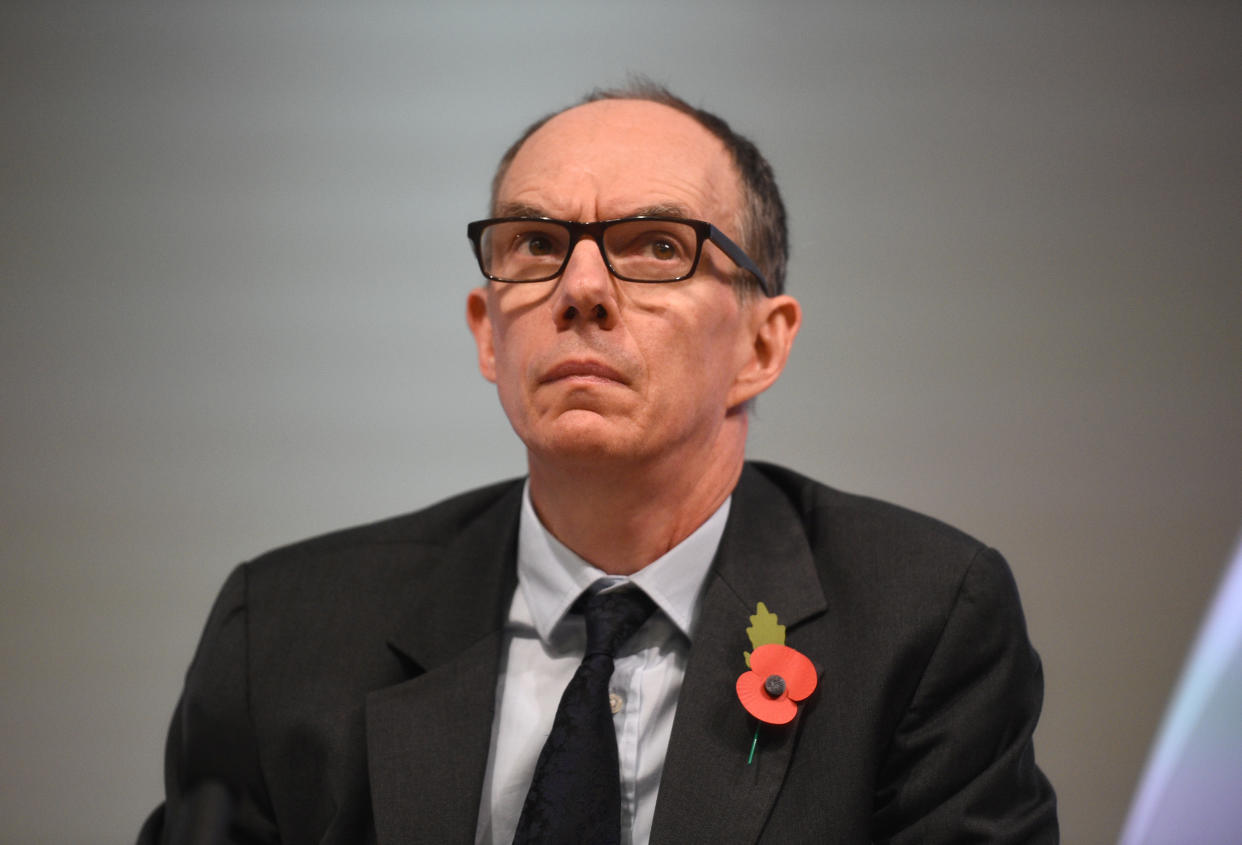

Dave Ramsden, the deputy governor, said on Friday that the central bank’s guidance held. While the Bank of England has long signalled that an orderly or smooth Brexit would see a “limited and gradual” increase in interest rates, several of his peers on the rate-setting committee have suggested that rates might need to be lowered no matter what happens on 31 October.

Focusing on the possibility of “prolonged Brexit uncertainty” even if the UK avoided a no-deal Brexit, Michael Saunders, an external member of the Bank’s rate-setting committee, said last month that he thought it possible that the Bank of England would cut rates.

But in an interview with Bloomberg, Ramsden said that “in the world of a deal [the Bank’s guidance] still applies.”

READ MORE: Pound hovers at five-month highs ahead of crunch Brexit deal vote

Uncertainty about the shape of the UK’s post-Brexit relationship with the EU has weakened the pound and dented economic confidence.

Some policymakers and economists have raised the prospect of sustained economic uncertainty. This is primarily because, even if Johnson manages to get his deal through the House of Commons, it is not clear what the UK’s future trading relationship with the bloc will look like after the year-long transition period.

Ramsden said that a deal with the EU would result in “some pickup in investment” and potentially lead to an increase in demand and productivity.

He did not suggest that the Bank would immediately hike rates, but rather that he believed increases should be on the table.

“We’re not saying over what timeframe, but limited and gradual is a reasonable qualitative framing,” he said.

READ MORE: Mysterious Dutchman pens finance spoof of 'Where's Wally?'

The Bank would be expected to ease its policy stance in the event of a no-deal Brexit — something that would likely involve a slashing of interest rates and stimulus measures designed to boost the economy.

But the stark fall in the value of the pound since the referendum, at various points, prompted a surge in inflation, mainly because it made it more expensive to import goods.

Above-target inflation would normally prompt the Bank to increase interest rates. While it has been reticent to make any policy changes ahead of the 31 October Brexit deadline, a slight drop-off in price growth has eased pressure on the Bank.

At 1.7%, UK inflation last month came in slightly below expectations and remained at its lowest level since December 2016.