"It Helped Me Cut Back Without Feeling Deprived": People Are Revealing The Money-Saving Tip They Swear By, And I Feel Richer Already

This year, Black Friday shoppers spent more than ever before, a record $9.12 billion. As one of those shoppers, I bought some holiday gifts plus my first-ever brand new couch. I don't regret my purchases; however, I'm feeling kinda stretched, and I'm definitely looking for ways to cut back.

NBC / Via giphy.com

Well, recently, u/trash2burn asked, "If you could share just one money saving/budgeting tip, what would it be?" And in the comments, people shared the tips and tricks that genuinely work for them — and I very much needed it. Here's what they had to say:

1."For me, it would be meal planning! Pre-COVID, my husband and I never planned meals. He would get lunch at the cafeteria at his work, and I would either eat snacks or walk to the nearest fast-food place by my office. One of us would call or text the other on the way home from work with the dreaded what’s for dinner question, which meant we would be hitting the store almost nightly. It also meant we ended up buying things we already had at home. When we moved two years ago, I found SIX jars of dried basil! We were also going out to eat a lot."

"When the lockdowns happened, going to the store every day wasn’t advised or safe, so I started planning out our meals and what we could reuse for multiple meals. We spend so much less on food when I check what we already have first and make a list. We also stopped needing to grab takeout as much. The habit stuck, and I’ll never go back to how it was before."

2."Wait a week to see if you actually want an item. Stops impulse buys."

3."There’s also something to be said for simply adding an item to your cart on an e-commerce platform and waiting, because sometimes, you will get discount offers in your email."

4."Pay myself first. Before any 'fun' money is spent, I'm throwing $$ into my savings fund. I haven't set it up for an automatic payment yet, but I will in the next few weeks."

5."I try to frame expenses, especially 'wants,' in terms of time. For example: This game/clothing item/electronic device is the equivalent of X hours/days of work — is it worth it to me? Especially when I think about it from a post-tax and deduction standpoint, it helps put things in more perspective for me."

"I do this, too, but in terms of McNuggets — do I want 500 nuggets, or do I want this sweater?"

6."Use a spam email account for any purchases you make so that the marketing emails go to that account instead of the account you use for everything else. No more impulse shopping when 'deals' come through in your email."

7."Budget realistically. If you give yourself unreasonable goals, you're setting yourself up to fail. Base your budget off of actual previous spending and try to improve slowly but surely. Yes, 'no spend November' can be a fun challenge, but it's not sustainable."

8."I'm by no means a minimalist, but I do like to think of my purchases through Marie Kondo's 'What gives you joy?' lens. If it's a purchase, however frivolous, that truly makes you happy — it is probably worth it (if you can afford it/make it worth saving for). I was able to cut so many things (and spend more on higher quality things) when I looked at things through the 'does it bring me joy' lens. Whatever those things are is going to be different from person to person, but this idea has really helped me cut back without feeling deprived."

9."I live in a small apartment that hasn't been updated since 1970, and I drive an old car. I don't make a ton of money, and I'm not particularly spendy in other areas, but I could be spending $700 or $800 more in fixed costs easily if I rented and drove 'what I could afford.' A few times a year, I get the bug to move into a nicer apartment, but instead, I spend a few hundred bucks on a new rug, jazzy wallpaper, or new sheets."

10."I generally check Marketplace and local groups before I buy things like clothes, toys, baby gear, and furniture (within reason; obviously, there are some things that shouldn’t be bought used). If I can find it in good condition used, I’ll get it instead of buying new. I’ve saved heaps this way, and it’s better for the environment."

"I started doing this but with Poshmark/eBay/Depop for clothes. More than likely, someone has already bought the item I want and is ready to get rid of it for way less!!"

11."Keep track of everything you spend. From pricy to cheap. Add it all up at the end of the month. It’s scary how much unnecessary spending goes on!"

"Agreed! My tip is to actually dedicate 30 minutes at the end of the month to look at Mint and look at your spending categories.

I use Mint to input data into my own personal spreadsheet of monthly spending, and I think about how it’ll feel to update it when I make an unnecessary purchase."

12."If you’re in a shopping mood, go to a thrift shop! Sometimes, I just want a new item, and that itch can be scratched with a $5 skirt or a $8 dish rather than $$$ at a regular shop. Bonus, there often aren’t that many items you want, so it stops you from buying up the whole shop, and secondly, items are often good quality and will last longer."

"This is such a great tip! When I feel like shopping, I go to the library; usually scratches the itch."

13."Leave the house less (aka make do with what you have). Literally, every time I leave the house, I spend at least $100. Groceries, fuel, toiletries, whatever. It’s relentless, and it sucks."

"I encourage myself to think of ways to leave the house without spending any money.

I bike, walk, run, go to the gym (where I'm paying a monthly membership fee), go to the park (where I have an annual pass), and carry a snack and a water bottle with me.

It's a great way to think about spending time outside. I enjoy it."

14."Use your credit cards like cash (that gives you cash back!). Don't spend money you don't have yet, and pay it off at least once a month."

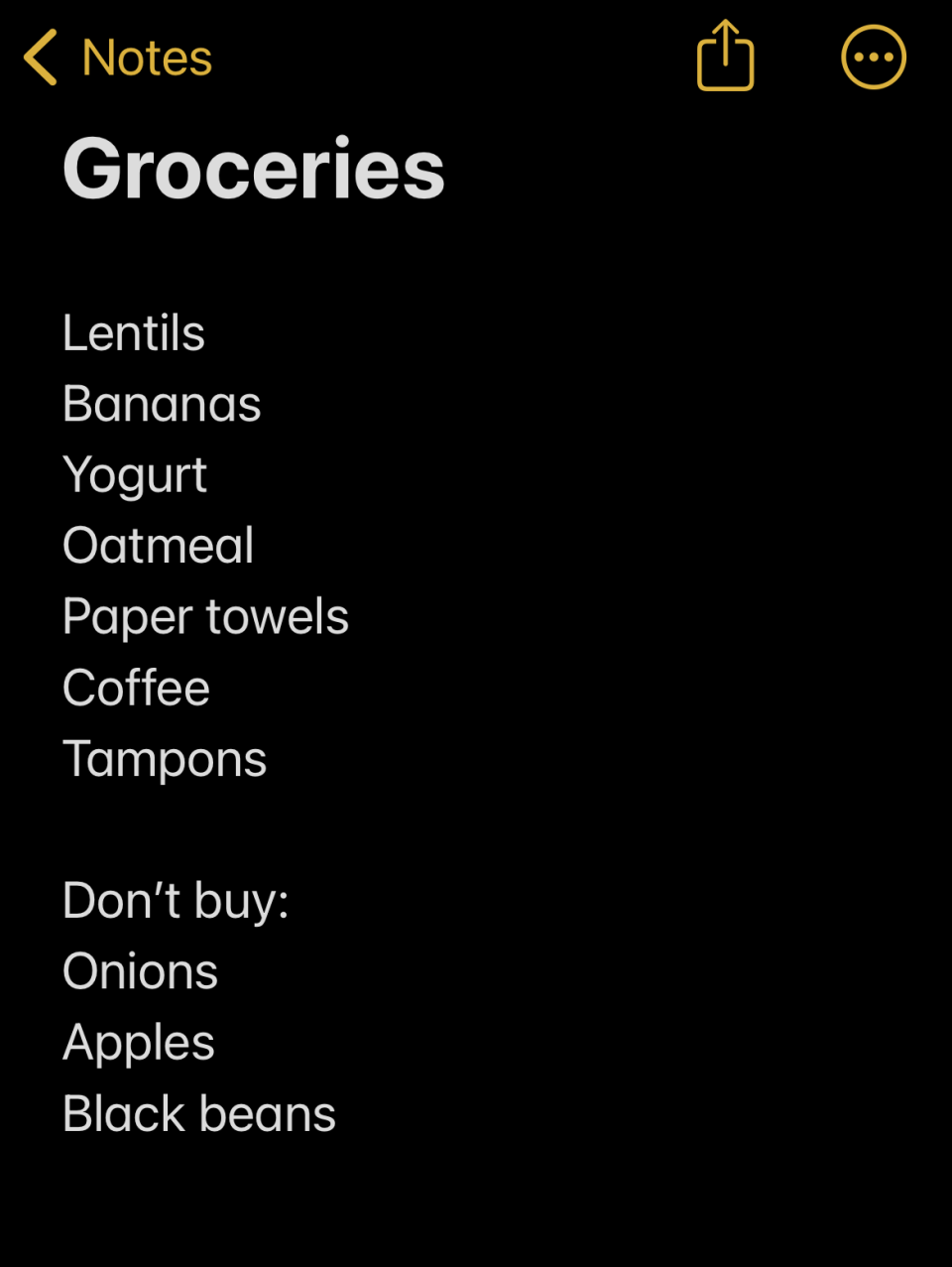

15."On my grocery list, I include a 'not' section, too, to remind me of things I commonly buy but don't need this week (generally butter, cheese, carrots, onions, potatoes, beans, pulses, herbs, and spices). It helps stop some 'just in case' purchases."

16."Shop your fridge, freezer, and pantry BEFORE you even contemplate grocery shopping. The meme is true: 'We have food at home.'"

17."Always, always, always save something! Even $10, $20, $50. I've saved $50 out of my paychecks since I started working because something is always going to come up or is coming up. Holidays, birthdays, car repairs, etc."

18."Reporting my annual mileage to my car insurance company since my annual mileage is less than half of the generic estimate they use. Savings from that add up over time!"

19."Plan once a year to call all your services and negotiate for better deals, and, if necessary, be prepared to leave a service and try another for a better deal. I have had my internet 'first year' 50% off deal extended for going on three years now. My cellphone plan is excellent and frugal, and in October, I lowered my auto insurance by $53 a month for the same coverage (and actually a little better in a few areas). It does take a little time and effort, but when you consider how much it saves over the course of a year, it's completely worth it."

"I am also a big believer in rotating streaming services and/or sharing them with friends and family. I have Prime, Netflix, and Crave, but they only cost me $11 a month total because I share them all."

20."I leave my purse/phone in the car at certain stores (Michaels, Menards) so that I have to go out and get it before checking out. That two minutes and leaving empty-handed breaks the spell, and I can go back in and really edit my overflowing cart before I get in line. Weird, but it works!"

21."For emergency savings, have a high yield savings account at a different bank from your checking account so your savings is direct deposited and that money doesn't even hit your checking account. Once a year (I do it when I've received a raise), recalibrate that amount. It's amazing how quickly it grows when you set it and forget it for a while, and you get used to living without it since you never see it in your checking account in the first place."

22."If you are planning on taking on new debt by financing a large purchase (car, house, etc.), calculate what the monthly payment would be, then practice making that payment by putting that amount in a savings account each month. It gets you used to having that expense in your budget and helps you save up for a down payment."

23."I don't save credit cards in my shopping profiles. It stops impulse buying since I have to GET UP and get my credit card."