People may not realize they're eligible for Earned Income Tax Credit on 2022 returns

Hard to imagine anyone walking away from a few hundred dollars or possibly even $5,000 or more, but plenty of working people lose out each year on a valuable tax credit simply because they don't file a tax return.

Many aren't required to file because their incomes are so low that they're not obligated to file a return. So they don't bother. But many would qualify for the Earned Income Tax Credit, which surely would make all the tax-time hassle very much worth it.

Many might not realize that they qualify for a key tax credit. If you're earning very little money, for example, you don't have to have children to qualify for some money through the earned income credit. And some first-time parents may not know they are eligible.

The average amount of Earned Income Tax Credit received nationwide in 2022 was about $2,043.

The tax refund could be used to pay high heating bills, pay down credit cards, cover a major home repair, buy a car or even save for the future.

The earned income credit is refundable — which means that even workers who did not earn enough money to have taxes withheld can receive hundreds or thousands of dollars in a tax refund for the earned income credit.

Detroit Mayor Mike Duggan once again tried to build awareness of the tax credit at an afternoon event Thursday, driving home the point that the extra tax money is valuable to struggling families and others. The event included groups that offer no-cost tax preparation services to many in Michigan.

Duggan said noted that many wealthy people have all sorts of tax breaks to consider, but "the Earned Income Tax Credit is the tax break for people of lower income. It's your tax break."

Many times, he said, he has talked with people who are shocked that they received $800 or $1,200 more as a tax refund. "They just don't believe a tax break is ... for low-income (people)," he said. "This is real."

He said the outreach efforts are designed to make sure "every Detroiter has the help they need to file their taxes, especially if they haven’t filed in the past.”

Priscilla Perkins, president and CEO of the Accounting Aid Society, said people may be reluctant file a tax return because of misinformation. Word of mouth on the street, she said, is wrong if they say that people risk losing other federal benefits, such as the Supplemental Nutrition Assistance Program, known as "SNAP," if they file a federal tax return, claim the Earned Income Tax Credit and receive a sizable refund.

While many who have very low incomes aren't required to file a tax return, she said, they should file one to claim important tax credits that can help pay bills.

The dollar amount that households receive will vary significantly and depend on your pay, filing status, and the size of your family. You need to have worked in 2022.

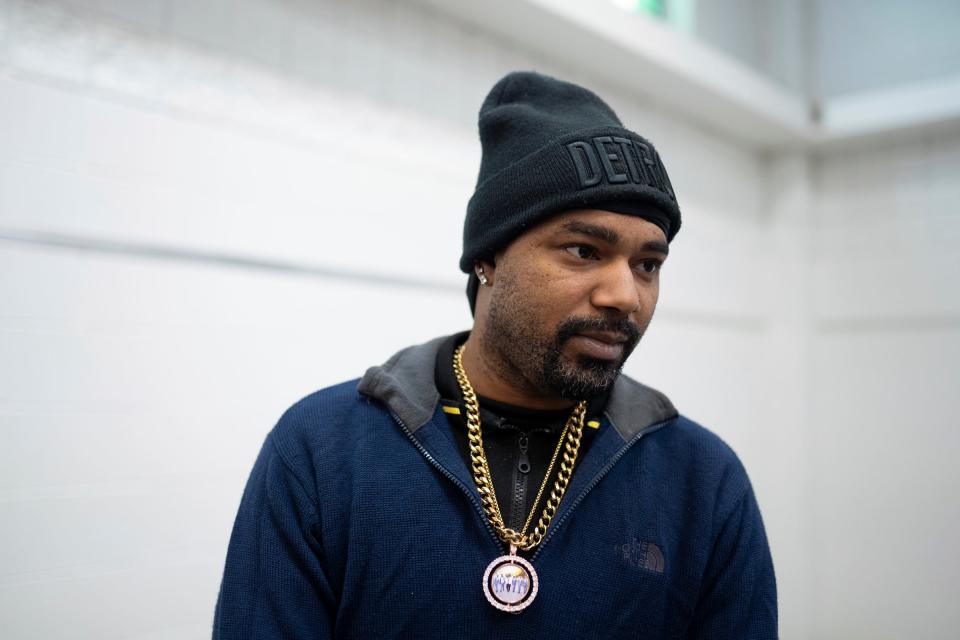

Lawrence Hargrave, who attended the news media event Thursday at the Ford Resource and Engagement Center on Detroit's east side, works as a security guard at the Amtrak station in Detroit and has five children, ages 12, 10, 6, 3 and 2.

His mother prepares taxes as part of the free program offered at the Ford Resource and Engagement Center and encouraged him to get his taxes done for free at the center, staffed by Accounting Aid Society volunteers.

After paying for years to get his taxes done, he got his taxes done for free last year at the center.

His tax refund, he said, ended up being about $5,000 last year, including the Earned Income Tax Credit. He was surprised at how quickly the money was deposited into a popular mobile app that he uses for banking. He's not sure what his refund will be this year — he's still waiting on his W-2 information — but he plans to get his taxes done for free again.

What kind of money can you get?

In Michigan, the maximum earned income credit for both the federal and state credit adds up to a maximum of $594 for a lower income worker who has no qualifying children but had an income that is less than $16,480 if single or head of household or an income of less than $22,610 if married and filing jointly.

The combined federal and state of Michigan earned income credits can climb up to a maximum of $7,351 for a family with three or more qualifying children. The family must have an income that is less than $53,057 if single or filing as head of household or an income of less than $59,187 if married and filing jointly.

The federal Earned Income Tax credit alone ranges from a maximum of $560 for a qualifying individual with no children to up to $6,935 for a qualifying family with three children or more.

The federal credit offers a maximum amount of $3,733 for one qualifying child in 2022 and a maximum of $6,164 for two qualifying children in 2022.

The federal credit, which dates to 1975, is designed to encourage work and recognizes that extra costs associated with holding down a job can discourage low-income wage earners from working. It is a key measure, according to advocates, for lifting children out of poverty. Substantial expansions to the federal program were adopted in 1986, 1990, and 1993.

How does the earned income credit work in Michigan?

Currently, the state of Michigan offers extra money through a state earned income credit that amounts to 6% of the federal credit.

The extra Michigan credit is $34 for a tax filers with no qualifying children, based on a maximum federal credit of $560.

With no qualifying children, the maximum federal credit is $560 so the maximum Michigan credit at 6% is $34.

The Michigan credit then can be a maximum of $224 with one child, $370 with two qualifying children or a maximum of $416 with three or more qualifying children.

It's important for those who qualify for the federal earned income credit to file a state return, as well, when a state, like Michigan, offers its own earned income credit.

More:Tax rollback? Sweetened EITC? Pension tax repeal? Michiganders could get it all.

More:Michigan Legislature approves expanding tax credit for low-income workers: What it means

Gov. Gretchen Whitmer wants an expanded earned income credit

Going forward, Gov. Gretchen Whitmer said she wants to significantly increase the state's earned income credit for an estimated 700,000 families. Whitmer calls the state's effort the Working Families Tax Credit.

On Thursday, the Michigan Senate passed a bill to create the Working Families Tax Credit, which would increase a state's match for the federal earned income credit to 30% — up from 6% currently — for qualifying taxpayers.

Duggan, who attended Whitmer's State of the State address Wednesday, noted that there was one time that both Democrats and Republicans stood up and cheered together during that speech "and it wasn't for the Detroit Lions." Instead, members of both parties applauded in agreement on expanding the state's earned income credit in some fashion.

Others elsewhere have pushed in the past few years to enhance the state earned income credits. At 6% of the federal credit, experts say, Michigan currently has one of the least generous programs in the country.

The New York City earned income credit — which was expanded in 2022 — ranges from 10% to 30% based on a taxpayer’s New York adjusted gross income. Under New York City’s expansion of the earned income credit, a single parent with one child with an income of $14,750 received $905 instead of $181. The credit had not been increased for almost 20 years.

In Wisconsin, for example, the state's earned income credit ranges from 4% of the federal credit allowed to an individual for a family with one child, going up to 11% for a family with two children and then reaching up to 34% for a family with three or more qualifying children.

More:Many families could see drastically smaller tax refunds in 2023: Here’s why

More:IRS tax season to begin Jan. 23: What to know about smaller refunds

Billions of dollars going unclaimed

The Internal Revenue Service estimates that nationwide only four out of five of eligible workers claim and get their Earned Income Tax Credit. So roughly 20% who qualify don’t get their money, leaving billions of dollars going unclaimed.

Nationwide, more than 31 million workers and families received about $64 billion for the earned income credit as of December, according to the IRS.

In 2022, Detroiters claimed more than $260 million in earned income credit refunds alone. Many received even more money through other tax benefits, such as the Child Tax Credit.

A real push has been made in the past few years by community leaders and others to make sure people take advantage of free tax preparation services and claim valuable tax credits.

More:Tax rollback? Sweetened EITC? Pension tax repeal? Michiganders could get it all.

Before 2017, it was estimated that $80 million in potential tax refunds went unclaimed each year by Detroiters who were eligible for the earned income credit.

Get free help for a complex credit

The credit has several key rules, and frankly, is easier to handle if someone else does it for you, such as a trained volunteer at a free tax preparation site.

In Michigan, free tax preparation services are offered to those with lower incomes and others by the Accounting Aid Society, Wayne Metropolitan Community Action Agency and sites for the AARP Foundation Tax-Aide Program.

Those in metro Detroit can call the United Way for Southeastern Michigan at 211 or visit www.getthetaxfacts.org to learn more and schedule an appointment for free tax help.

Or see IRS.gov for information on a long list of free tax return preparation for qualifying taxpayers and events in your area, including free tax help at libraries, community centers, schools and shopping malls.

In general, volunteer income tax assistance sites offer free tax help to those who generally make $60,000 or less; persons with disabilities and limited English-speaking taxpayers. The sites are staffed by volunteers and run by IRS partners.

More:2023 tax season guide for new parents: What to know about the Child Tax Credit and more

Matt Hetherwick, director of individual tax programs for the nonprofit Accounting Aid Society in Detroit, said every dollar matters for clients served by the volunteers.

He stressed that the earned income credit is money that applies to qualifying working families and individuals but it can only be claimed by filing your tax return.

"It is your money, claim it," Hetherwick said.

The rules for the Earned Income Tax Credit can be complex and things can change over time. On 2022 returns, for example, the earned income credit rules will revert back to pre-2021 rules for age limits.

On 2022 returns, the minimum age for a taxpayer to qualify is 25 as of Dec. 31 on the 2022 federal income tax return; the maximum age is 64 as of Dec. 31 for those without qualifying children.

In 2021, a temporary break was given to expand the credit. For 2021 returns only, the minimum age limit was dropped to 24 years of age for a full-time student, 18 years of age for a qualified former foster youth or a qualified homeless youth, or 19 years of age for all others.

Currently, workers who are age 65 and older no longer qualify for the Earned Income Tax Credit if they do not have dependent children. The credit had applied to older workers for one year on 2021 returns. This year, they would not even qualify for the lower $560 credit for 2022. Last year, the credit was worth nearly $1,500 for those without children who qualified.

Hetherwick said earlier he doesn't have a number for how many clients could see a smaller refund because of the changes.

When it comes to the earned income credit, it's helpful to know:

The child or children you claim for the credit must be related to you, but grandparents who are raising children can qualify.

The child or children must live in the same home as you do for more than half of the tax year.

The tax filer needs to make sure that the Social Security number and name on the tax return are exactly how they appear on the Social Security card for everyone listed on that return.

How long will I wait for a tax refund?

Taxpayers may file their returns now. The deadline is April 18. But taxpayers need to realize that they will not receive a refund before mid-February if they claim the Earned Income Tax Credit or the additional Child Tax Credit. The IRS cannot issue refunds involving these credits any earlier. Extra time is given under the law for the IRS to review returns to prevent fraud.

The "Where's My Refund?" tool on IRS.gov should show an updated status by Feb. 18, according to the Internal Revenue Service, for most early filers who claim the earned income credit and the additional child credit. The IRS said most of these refunds should be available in taxpayer bank accounts or on debit cards by Feb. 28 if people file early, choose direct deposit and there are no other issues with their tax return.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.

This article originally appeared on Detroit Free Press: Earned Income Tax Credit: Who is eligible for 2022 returns