Pennant Investors Exits Johnson & Johnson, Cuts Amazon

- By Tiziano Frateschi

Alan Fournier (Trades, Portfolio)'s Pennant Investors, LP sold shares of the following stocks during the third quarter, which ended on Sept. 30.

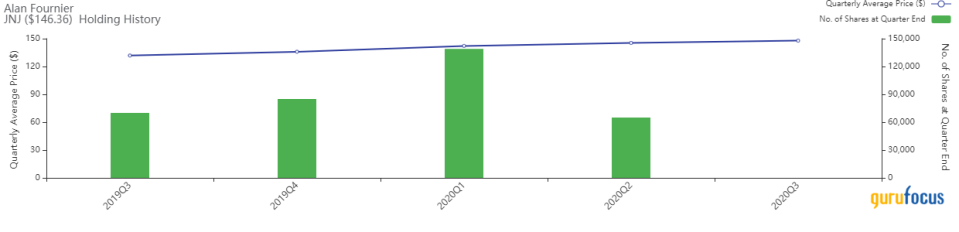

Johnson & Johnson

The firm closed its position Johnson & Johnson (JNJ). The trade had an impact of -3.86% on the portfolio.

The healthcare firm has a market cap of $385 billion and an enterprise value of $392 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 27.72% and return on assets of 10.65% are underperforming 86% of companies in its industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.82 is below the industry median of 0.91.

The company's largest guru shareholders are Pioneer Investments (Trades, Portfolio) with 0.23% and Jeremy Grantham (Trades, Portfolio) with 0.09% of outstanding shares.

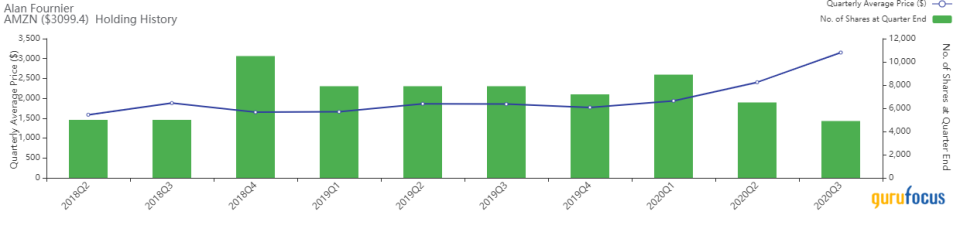

Amazon.com

The Amazon.com Inc. (AMZN) stake was trimmed by 24.62%, impacting the portfolio by -1.86%.

The world's largest online retailer by market cap has a market cap of $1.56 trillion and an enterprise value of $1.58 trillion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 25.53% and return on assets of 7.33% are outperforming 92% of companies in the retail, cyclical industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.84 is above the industry median of 0.51.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 0.34% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.21% and Spiros Segalas (Trades, Portfolio) with 0.20%.

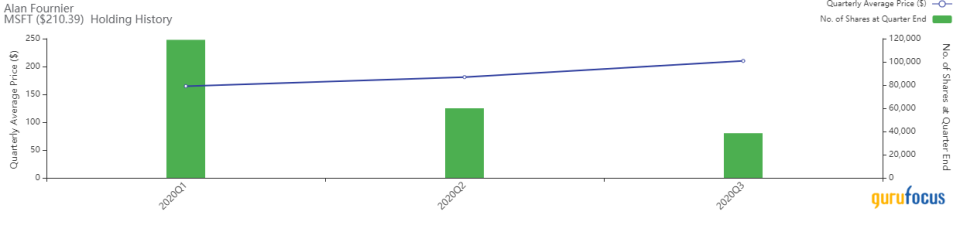

Microsoft

The firm trimmed its position in Microsoft Corp. (MSFT) by 35.83%. The portfolio was impacted by -1.85%.

The company, which develops and licenses consumer software, has a market cap of $1.59 trillion and an enterprise value of $1.52 trillion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 41.49% and return on assets of 16.38% are outperforming 93% of companies in the software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.94 is above the industry median of 2.33.

The largest guru shareholder of the company is Fisher with 0.30% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.29% and Pioneer Investments (Trades, Portfolio) with 0.27%.

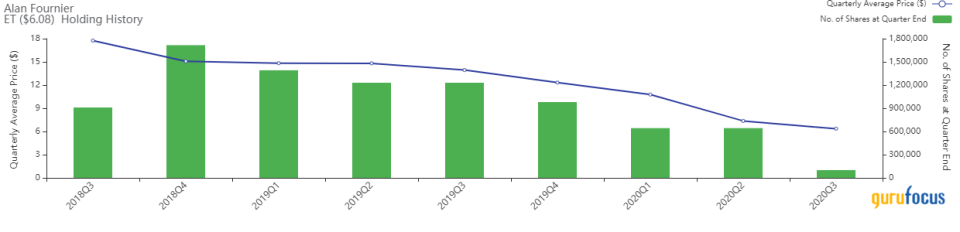

Energy Transfer

The firm curbed its Energy Transfer LP (ET) stake by 84.45%, impacting the portfolio by -1.63%.

The company has a market cap of $16.40 billion and an enterprise value of $81.53 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -1.18% and return on assets of -0.25% is outperforming 61% of companies in the oil and gas industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.01 is far below the industry median of 0.4.

The largest guru shareholder of the company is David Abrams (Trades, Portfolio) with 0.82% of outstanding shares, followed by David Tepper (Trades, Portfolio) with 0.70% and Louis Moore Bacon (Trades, Portfolio) with 0.37%.

Antero Midstream

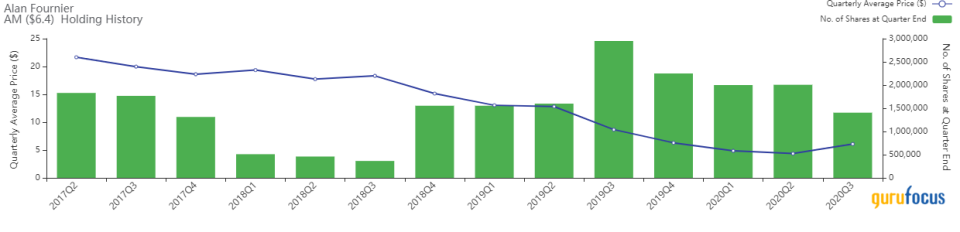

The investment firm reduced its Antero Midstream Corp. (AM) position by 29.96%. The trade had an impact of -1.29% on the portfolio.

The midstream company has a market cap of $3.05 billion and an enterprise value of $6.17 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -12.06% and return on assets of -5.75% are underperforming 55% of companies in the oil and gas industry. Its financial strength is rated 3 out of 10 with the cash-debt ratio of 0.44.

The largest guru shareholder of the company is Glenn Greenberg (Trades, Portfolio) with 1.78% of outstanding shares, followed by Fournier with 0.29% and Joel Greenblatt (Trades, Portfolio) with 0.09%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Maverick Capital Cuts Netflix, Facebook

Pioneer Investments Cuts Amazon, Apple

Tiger Global Management Exits New Relic, Athene Holding

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.