Options Traders Charging Toward Red-Hot Plug Power Stock

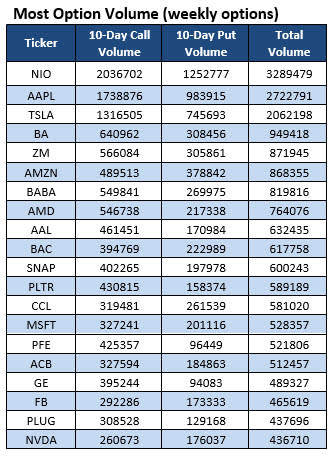

Below is a list of 20 stocks that have attracted the highest weekly options volume in the last 10 trading days, courtesy of Schaeffer's Senior Quantitative Analyst Rocky White, with highlighted names new to the list. One name that's been seen on the list recently is renewable energy name Plug Power Inc (NASDAQ:PLUG). Despite a brief pullback early last week, the security has enjoyed an impressive climb up the charts, following a secondary stock offering and impressive earnings results. In fact, PLUG is heading for its fourth-straight win, and earlier hit a record high of $26.15.

During the past two weeks, bulls have capitalized on this surge, with 308,528 calls exchanged during this time period, compared to 129,168 puts. The monthly November 25 call was the most popular during this time frame, followed by the weekly 11/13 23-strike call.

This bullish momentum is being maintained today, with 101,000 calls across the tape so far -- 1.6 times the intraday average -- compared to 24,000 puts. The weekly 11/27 26-strike call is seeing plenty of action, with contracts being opened here. Considering the security's current perch at $25.65, it looks like these traders are expecting even more upside for PLUG before these contracts expire this Friday, Nov 27.

While calls have been outnumbering puts on an overall basis, there has been an uptick in bearish trading during the past 10 days. This is per PLUG's 10-day put/call volume ratio of 0.44 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands higher than 89% of all other readings from the past year.

Short interest, meanwhile is in decline, down 8.8% in the last reporting period. Still, the 65.83 millions shares sold short make up 28.6% of PLUG's available float, or 2.3 days of trading at its average pace, leaving room for a short squeeze to potentially propel the security even higher.

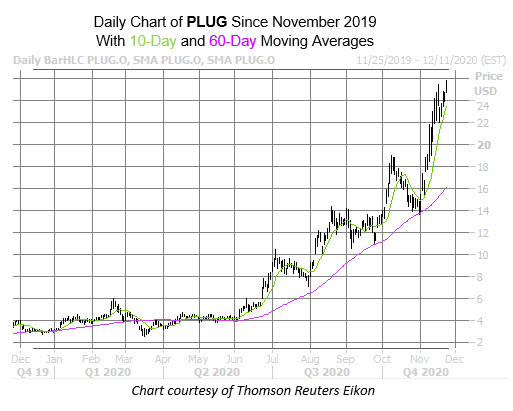

Circling back to PLUG's technical setup, the equity has managed to tack on over 711% this year alone, with the 60-day moving average capturing several pullbacks during the past six months, including a rejection at the $18 level in early October. Shorter term, the 10-day moving average has helped guide the security up the charts.