Options Bulls Blast Rising Under Armour Stock

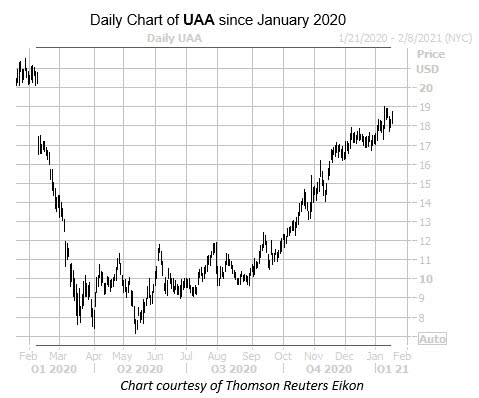

Under Armour Inc (NYSE:UAA) is up 2.2% at $18.53 at last check, and climbing back towards the $19 level, where it found resistance last week as it traded at its highest levels since February. It's also worth noting that UAA's pullback from those highs were saved by the 20-day moving average. Though still posting an 8.3% year-over-year deficit, the equity is up 32.6% in the last three months.

Amid this bounce, call traders are charging toward the equity with ample enthusiasm. The 32,000 calls across the tape so far today is 13 times what is typically seen at this point volume-wise, and pacing for the top percentile of its annual range. The March 20 call is the most popular by far, with new positions being opened there. This shows plenty of traders betting on more upside for Under Armour stock in the next couple months.

This penchant for calls is not unusual when looking at the recent activity in the options pits. UAA's 50-day call/put volume ratio of 4.99 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands higher than all but 2% of readings from the past year. This shows long calls being picked up at a much faster-than-usual rate during the past 10 weeks.

Despite the security's steady moves higher, there is ample room for upgrades amongst the brokerage bunch. More specifically, 15 of the 22 analysts in coverage carry a "hold" or worse rating on UAA. Plus, the 12-month consensus price target of $15.08 is an 18.6% discount to current levels.