Options Bulls Bet on Apple Stock Amidst Pullback

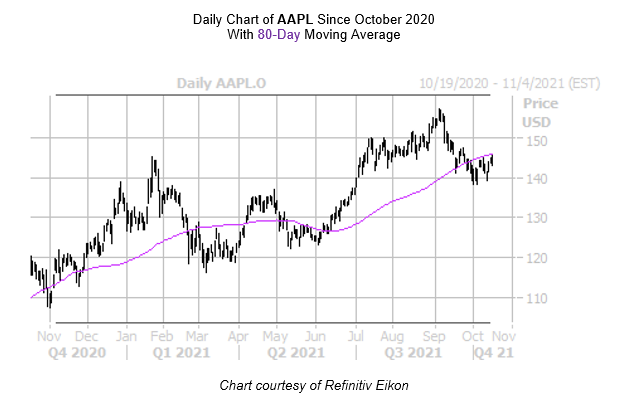

The shares of FAANG name Apple Inc (NASDAQ:AAPL) are inching higher today, last seen up 0.4% at $145.45. Boasting a 22% year-over-year lead, AAPL's Sept. 7 all-time of $157.26 so far marks the pinnacle of the stock's stellar year. However, in the month and a half following that peak, the equity has shed 7.5%, and now faces pressure from the previously supportive 80-day moving average.

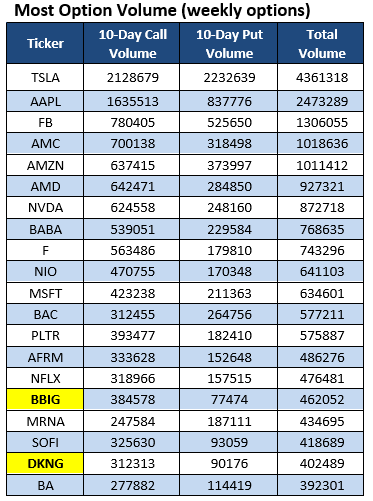

This pullback has done little to deter option bulls. In fact, the security landed in second place on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the last two weeks, with new names to the list highlighted in yellow. According to White, 1,635,513 calls and 837,776 puts were exchanged over this two week time period. The most popular position was the October 145 call, followed by the 144 call in the same series.

This preference for bullish bets is being echoed in today's trading. So far, 376,000 calls have crossed the tape, compared to 174,000 puts. The weekly 10/22 145-, 146-, and 144-strike calls take up the top three spots for most popular contracts today, with new positions being bought to open at each. This suggests traders are expecting more upside for AAPL by the time these positions expire this Friday.

Despite this preference for calls, puts have been unusually popular. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), AAPL's 50-day put/call volume ratio stands higher than 84% of readings from the past year. This means long puts have been picked up a much quicker clip during the past two weeks.

Now could be a good opportunity to take advantage of Apple stock's next move with options. The security's Schaeffer's Volatility Index (SVI) of 22% sits in the 14th percentile of its annual range, indicating that options traders are pricing in relatively low volatility expectations at the moment. Plus, the stock's Schaeffer's Volatility Scorecard (SVS) comes in at a relatively high 71 (out of 100). In other words, the security has exceeded options traders' volatility expectations in the last year.