OKX’s February Proof-of-Reserves Report Shows $8.6B in ‘Clean Assets’

Join the most important conversation in crypto and web3! Secure your seat today

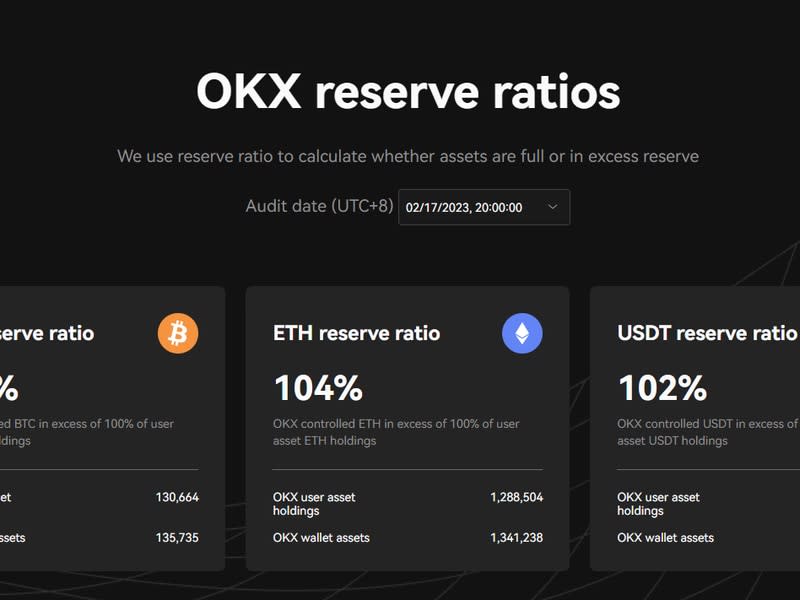

OKX is overcollateralized with a reserve ratio of 104% for bitcoin (BTC), 104% for ether (ETH), and 102% for USDT according to a recently published Proof-of-Reserves report.

The exchange says that over 175,000 unique users have visited its Proof-of-Reserves page since it launched the initiative late last year.

“Proof of Reserves is far from a niche topic - it is of vital importance to building user trust and we are dedicated to ensuring OKX shows continued leadership in this area," OKX Managing Director of Financial Markets Lennix Lai said in a release.

In January, the exchange released a report stating it had $7.5 billion in clean assets. The cleanliness of assets refers to a metric developed by CryptoQuant which measures how reliant an exchange is on its native token.

OKX continues to have an entirely clean reserve, according to CryptoQuant data, while Binance’s ‘cleanliness’ comes in at 94% while Huobi has 61%.

In an interview with CoinDesk in January Haider Rafique, OKX’s chief marketing officer, said that OKX has “never used a native token to finance the company.”

“The native token was never a big part of our business or treasury. Our native token was always designed to engage our most active customers and give them a way to seek discounts through activity on the platform,” he said at the time.

OKX’s token, OKB, is currently trading at $52.35, according to CoinGecko data, up 28.4% on-week.