German bank backed by Peter Thiel launches in US

BERLIN - German banking fintech N26 is making a big push for the U.S. market, announcing a nationwide rollout in the U.S. Thursday after a two-month beta program the company called successful.

The Peter Thiel-backed mobile-based bank is hoping to make the case that its user-friendliness and tech prowess give it a strong advantage in the U.S. market.

The bank currently has 3.5 million customers in 24 markets and targets the biggest banking market with $670 million in investment and guidance from U.S.-based VC firms Venture Partners and Valar Ventures, one of three venture funds co-founded by Thiel, who is also a co-founder of PayPal and Palantir Technologies. N26, which has no physical bank branches, has a $3.5 billion valuation. To put this into perspective, Chase had around 35 million active mobile customers and 5,000 branches in the U.S.

In an interview with Yahoo Finance, N26 US CEO Nicolas Kopp talked about how the company planned on disrupting the market and convincing American consumers to jump ship for N26 by providing a better user experience and innovative features, like getting paychecks early and instant money transfers.

The two other strongest European fintech “challenger banks” — Revolute and Monzo – have announced plans for the U.S., but so far only N26 has taken the plunge, leading the charge from the Continent. European banks view the U.S. as having great potential, mainly because of U.S. banks’ high fees and a big market of tech-savvy consumers.

“Usually, cool innovation comes from the States to other countries in Europe. This time it’s the other way around, which is really exciting,” said Kopp in July. “We’ll be the first mobile or challenger bank launching in the U.S.”

Kopp told Yahoo Finance that N26 had rolled 100,000 people off the waitlist, and that demand was expected to remain high. The U.S., like Europe, will get a freemium model eventually.

Like other companies that have looked to get an in with the U.S. banking market, N26 has chosen to partner with an established bank to get FDIC insurance, which is non-negotiable for U.S. banking customers.

“A fintech charter is not fully applicable if you’re a company with ambitions like ours,” Kopp said. Partnering with another bank, Axos (AX), proved to be an easier route than buying a bank or getting its own charter.

What N26 is offering and how it’s different than your bank

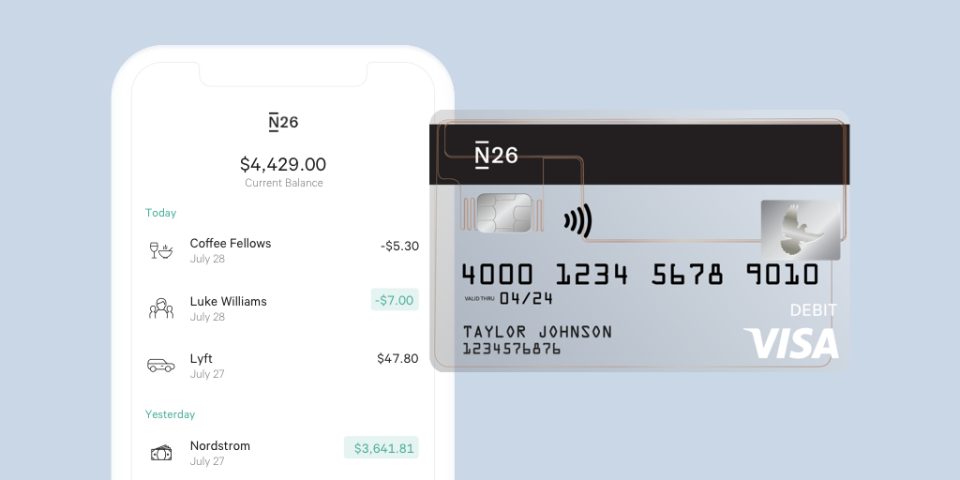

N26’s pitch is simplicity and offering the type of experience you expect from a Silicon Valley company rather than a bank that’s trying to figure out digital.

This has been a chief part of the play for the German market. "Banking. But without the bullshit,” has been a common tag line across the pond on billboards, as well as things like “Deine Bank verarscht dich,” which essentially means your bank is screwing you. (On the U.S. website, it says “banking without baggage.”)

Zielgruppenansprache! Und ihr so, Legacy-Banken? Immer noch im Tiefschlaf? #n26 #Sparkassen&Co #DigitalTransformation #Digitalisierung #digitalchange pic.twitter.com/aGYrjBYDYr

— Moritz Tillmann (@DerwahreMo) October 24, 2018

What Kopp, and company co-founders Valentin Stalf and Maximilian Tayenthal, global CEO and CFO, respectively, are trying to highlight through the cheeky advertising is a product that aims to give consumers simple organization.

Kopp said Americans are different from European bank customers in two main ways: in the U.S. people are focused on earning rewards when they spend, and they don’t save as much. The company sees this an opportunity.

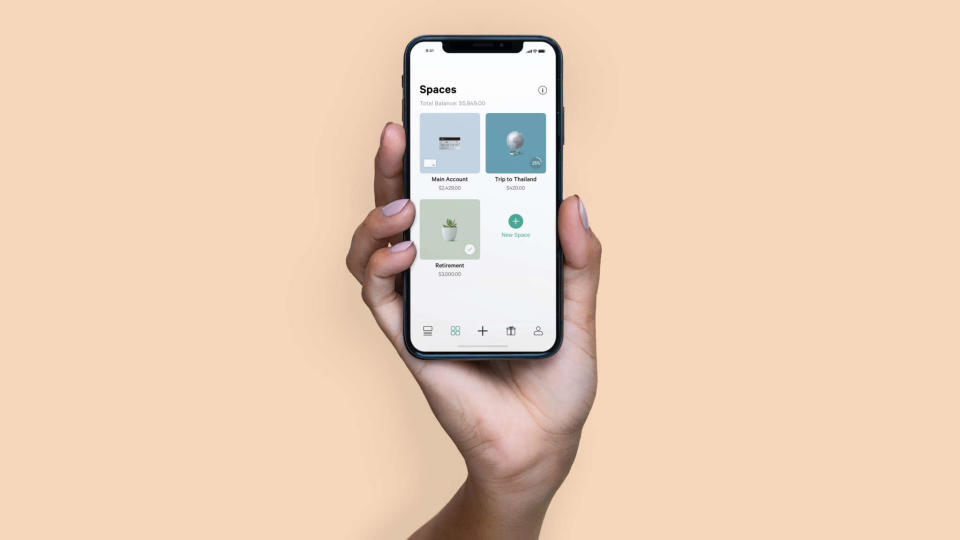

On the savings side, the pitch to U.S. users is “Spaces,” which is real time sub-accounts for vacation, down payment, emergency fund, whatever, and organize goals and show progress.

On the spending side, there’s detailed spending tracking, alerts, and expense breakdowns. There aren’t any points, but instead a feature called Perks, which offers 10% discounts to subscription services like Tidal, Luminary, and more.

No interest, no points, no problem?

American consumers might notice that N26 isn’t offering two big things they love: points and interest.

Kopp said that N26 is well aware that it can’t necessarily adopt the tactics used by many credit card companies to capture customers.

“We have to be innovative to not be thrown into that same bucket with Chase, which has a bunch of money to throw at this problem,” Kopp said. It likely won’t be a large factor, however. Most debit cards don’t provide much by way of rewards points because that’s the game of credit cards.

For some American banking customers, the idea of no interest may be tougher to swallow. N26’s top selling points, though, include no hidden fees, minimum balance, or foreign transaction fees. At other banks, all of those expenses could cancel out interest earnings for many customers.

However, many online-only banks like Ally offer features and usability similar to what N26 is pitching but with interest rates near 2%. But for customers at a major bank — the nationwide savings rate is 0.1%, according to Bankrate — ditching a tiny rate for a better experience might be worth it, and this is what N26 is hoping for.

“Yes, there are [high interest] offerings out there, but I truly believe people also make choices based on the features and the app usability that we offer,” said Kopp. “There are no hidden bad surprises in this product. We’re not going to sell your data. Whatever we do we will be transparent about, period. Everything relevant to consumers we disclose.”

For people who care about the speed their paycheck hits their account, N26 offers a feature that lets customers access their salary two days earlier when they’re set up with direct deposit. For people who really need that money, it could make a difference and provide N26 with a marked advantage.

Confidence in long-term despite a competitive climate

N26 has a very lofty goal in the U.S. – to become a major consumer brand in financial services. Already the bank has had significant success in Europe, but differences in how Americans and Europeans bank make for quite the challenge.

“We obviously don’t come to the U.S. and go through the developmental process if we didn’t have big plans,” said Kopp, who added that they are not focused on fellow start-up competitors like Monzo and Revolute, but rather the major incumbents (think: Chase, Wells Fargo, Bank of America.) “We wouldn’t be here if we didn’t think we could pull it off.”

The company has been around for six years, and had been eyeing the U.S. for a while. The main reason for the wait, CEO Valentin Stalf said in an interview with Business Insider Deutschland, was it was hard to find talent in the U.S. without already having a launched product.

N26 won’t give numbers as to what success would look like in the U.S. market, but the company’s long-term goal is to have its app be used more frequently than banking apps currently are. And N26 may have to build many more new features to accomplish this.

“I want to build a banking app people want to open multiple times every day,” Kopp said. “Based on that, it is really our vision to be that hub of financial services you run your life through that would include your daily spending. We’d like to be that platform where everything runs through.”

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

‘Flight shame’: A potential headwind for airlines in Europe

Apple Card might finally get people to use Apple Pay

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.