Mortgage rates hit another record low as new refinance fee kicks in

Mortgage rates again sunk to a new low this week, according to Freddie Mac, marking the 14th time in 2020.

But the record comes just as a new refinance fee goes into effect, eroding some of the savings from historically low rates.

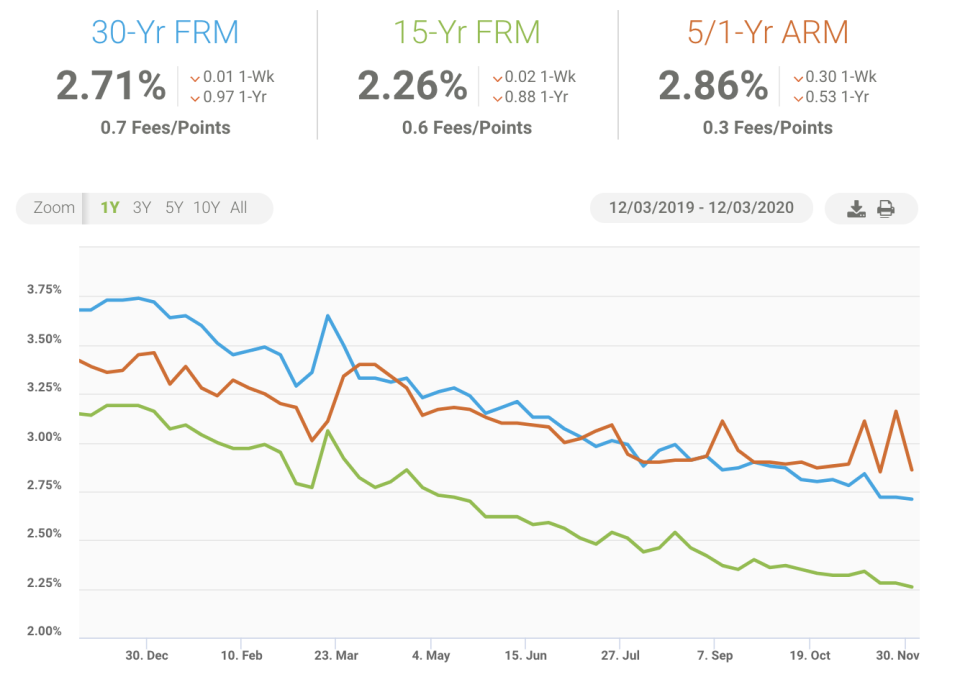

The rate on the 30-year-fixed mortgage fell to 2.71%, exceeding the previous low of 2.72% where it has been for the past two weeks. This is the lowest on records dating back to 1971 when the government agency that backs millions of mortgages started tracking rates.

Read more: Mortgage rates hit all-time low: Is it time to refinance?

A year ago this week, mortgage rates were nearly a full percentage point higher at 3.68%.

Whether record low rates stick around depends largely on where the economy goes, said Len Kiefer, Freddie Mac’s deputy chief economist.

“If the outlook improves — for example if we get more good news on a vaccine — then rates will likely increase. If the economic news is mixed, then rates may well decline,” Kiefer said. “Our baseline forecast has rates essentially flat for most of next year, but it’s not hard to imagine a scenario where rates could fall.”

‘Rates continue to entice homeowners to refinance’

There are 19.4 million homeowners who could save an average of $309 if they refinance, according to BlackKnight, but refinance candidates face a new refinancing fee that went into effect December 1.

“These rates continue to entice homeowners to refinance, although the 50 basis point higher refinance fee from Freddie and Fannie will increase closing costs and make the value proposition less attractive,” said George Ratiu, senior economist at Realtor.com.

Read more: Here's the history of the 30-year fixed mortgage rate

Fannie Mae and Freddie Mac are imposing a new 0.5% adverse market refinance fee on lenders who originate home loans backed by the agencies. It’s likely these lenders will pass some of this cost onto borrowers. Refinance loans below $125,000 are exempt from the fee altogether.

The fee is intended to help the government-sponsored enterprises to recoup losses from pandemic-related housing aid. Under the CARES Act, borrowers can request forbearance on their mortgage payments up to 360 days if they are experiencing a COVID-19 hardship.

‘Home sales have hit a wall’

While record low rates are good news for home buyers, too, rapidly accelerating home prices have chipped away at some of those benefits. Housing values have increased 6.95% in the past year, according to the S&P/Case-Shiller U.S. National Home Price NSA Index.

Read more: Record low mortgage rates: Should you cash out and refinance?

“For many Americans today, these low rates do not offer the same monthly savings that they did even six months ago,” Ratiu said in an emailed statement.

Additionally, a lack of housing inventory — especially for entry-level homes — has reduced the appeal factor of low mortgage rates.

“Despite persistently low mortgage rates, home sales have hit a wall,” said Sam Khater, Freddie Mac’s chief economist in a statement. “While homebuyer appetite remains robust, the scarce inventory has effectively put a limit on how much higher sales can increase.”

There are additional hurdles for those looking to lock in those low rates if they are refinancing an existing mortgage or purchasing a new home. Several lenders have created stricter lending requirements to guard against remaining economic uncertainties as the pandemic rages on.

“With lenders retaining tighter underwriting standards,” Ratiu said, “homebuyers will need larger down payments and higher credit scores.”

Dhara Singh is a reporter at Cashay and Yahoo Finance. Follow her on Twitter at @Dsinghx.

Read more:

Mortgage forbearances tick higher as homeowners reactivate payment deferral plans

Landlords can start the eviction process despite moratorium, government says

Housing expert: Eviction moratorium are ‘not enough’ during pandemic

‘Gone in 90 minutes:’ Rental Assistance is quickly running out for struggling renters

Read the latest financial and business news from Yahoo Finance and Yahoo Money

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.