More Upside in Store for Plug Power Stock, Signal Says

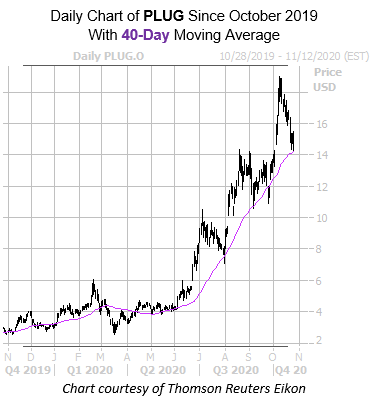

The shares of Plug Power Inc (NASDAQ:PLUG) are down 4.2% at $14.40 at last check. And while the electrical company has cooled off from its Oct. 8, 12-year-high of $19.02, the equity still sports a jaw-dropping 385% year-over-year lead. What's more, the stock's latest pullback has it near a historically bullish trendline, which could push PLUG even higher in the coming weeks.

More specifically, Plug Power stock just came within one standard deviation of its 40-day moving average, after spending a majority of the past several months above this trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, four similar signals have occurred during the past three years. Three-quarters of the time, PLUG enjoyed positive returns one month after each signal, averaging a 43.6% gain. From the stock's current perch, a move of similar magnitude would put PLUG just above the $20 mark -- at a fresh record peak.

A short squeeze could create even more tailwinds for the security. Short interest rose 14% during the past two reporting periods, and the 61.91 million shares now make up a whopping 26.9% of Plug Power stock's available float. In other words, it would take just over two days to buy back these bearish bets, at PLUG's average pace of daily trading.

An unwinding of pessimism in the options pits could also send the equity higher. This is per the security's 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 76th percentile of its annual range. In simpler terms, this suggests a healthier-than-usual appetite for bearish bets of late.