More Than 47% of Americans Aren’t Investing Their Money

It’s a good time to be an investor. All three of the major stock indexes, the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite, have hit record highs lately. That means you’ve likely seen your fortune rise along with the market — but only if you’ve invested in stocks.

Many Americans aren’t taking advantage of this way to build wealth or any sort of investment, according to a new survey. GOBankingRates polled more than 1,000 adults to find out if they’re investing or saving money, and the results aren’t encouraging.

Nearly Half of Americans Aren’t Investing

When asked where they are currently investing or saving their money, over 47% of respondents said they weren’t taking advantage of any of the following investments:

Stocks (not including retirement accounts)

Bonds (not including retirement accounts)

Mutual funds (not including retirement accounts)

Exchange-traded funds, aka ETFs (not including retirement accounts)

Cryptocurrency

Real estate

Individual retirement account (including Roth IRAs)

401(k)

Deposit accounts (savings, checking, etc.)

Many of those who are actually investing or saving seem to be playing it safe. The most common type of account among respondents was a deposit account, such as a savings or checking account. With these accounts, the risk of losing money is lower than it is with stocks and other investments — which makes them good short-term investments. But, compared to riskier investments, your money won’t grow nearly as much over the long run with deposit accounts because the interest rates are so low.

Survey Question: Where are you currently investing and/or saving your money?

Respondents | Most Popular Answer Choice | Least Popular Answer Choice |

Ages 18-24 | 44.76% selected “None of the above” | 0.95% selected “ETFs” |

Ages 25-34 | 48.51% selected “Deposit Accounts” | 0.99% selected “Real Estate” |

Ages 35-44 | 48.91% selected “None of the above” | 4.38% selected “Cryptocurrency” and “Bonds” (tied) |

Ages 45-54 | 46.37% selected “None of the above” | 2.23% selected “Cryptocurrency” |

Ages 55-64 | 59.88% selected “None of the above” | 0.62% selected “Cryptocurrency” |

Ages 65+ | 43.33% selected “None of the above” | 0% selected “Cryptocurrency” |

Female | 48.13% selected “None of the above” | 0.62% selected “Cryptocurrency” |

Male | 47.12% selected “None of the above” | 3.14% selected “ETFs” |

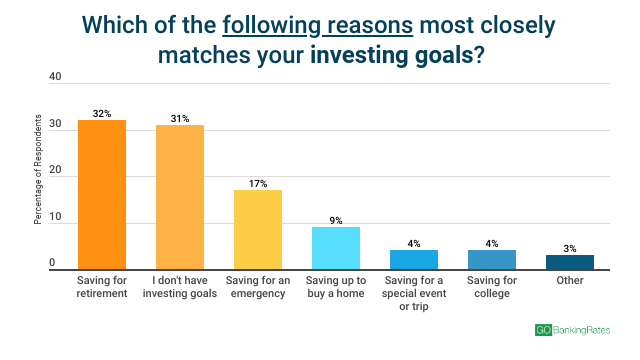

Although the survey found that the most common investing goal among respondents was saving for retirement, less than 20% said they are saving money in either a 401(k) or an IRA. The low percentage of Americans investing in retirement accounts is something to be concerned about, said Philip Weiss, a financial advisor and founder of Apprise Wealth Management. “If we don’t save and put some of our earnings to work to generate more income for us in retirement, our retirement life may be much less comfortable than we dreamed of,” he said.

Not only are most Americans not putting their money in retirement accounts, but they’re also not investing outside of retirement accounts. The survey found that just 10% of respondents are investing in stocks outside of retirement accounts. Only 7% said they are investing in mutual funds — which are essentially baskets of investments, such as stocks and bonds — outside of retirement accounts. Less than 4% have investment bonds or are taking advantage of ETF investing. Investing in cryptocurrency was the least popular, with just 2% of respondents saying they are currently invested in digital currencies such as bitcoin.

The survey found that older adults are more likely to not have any investing goals than adults ages 44 and younger. Older adults ages 55-64 are also the least likely of any age group to be investing or saving. Nearly 60% of this age group said they weren’t investing their money in any of the common investments and accounts listed in the survey. And, more women than men claimed they didn’t have any investing goals — 34% vs. 27%, respectively.

Also See: 13 Questions About Investing That People Ask the Most

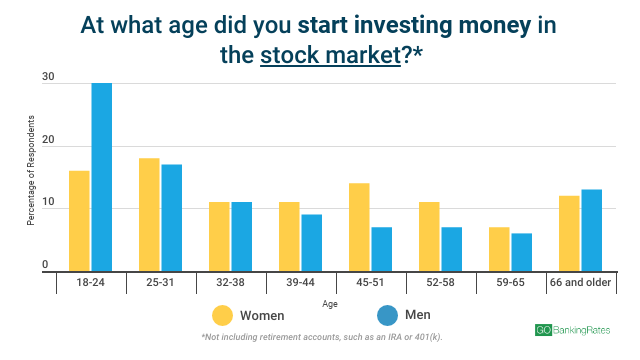

A Majority of Investors Started Investing Before Age 45

When asked at what age they started investing in the stock market, 60% of respondents said they started before the age of 45. Of those, nearly 22% said they started investing between ages 18-24.

However, nearly 40% of respondents said they didn’t start investing until ages 45 and older. Of those, 12% of respondents said they didn’t start investing until ages 66 and older.

Survey Question: At what age did you start investing your money in the stock market (not including retirement accounts like a 401(k) or an IRA)?

Ages | Percentage of Respondents |

18-24 | 21.95% |

25-31 | 17.21% |

32-38 | 11.11% |

39-44 | 9.89% |

45-51 | 11.25% |

52-58 | 9.62% |

59-65 | 6.78% |

66+ | 12.20% |

Men are much more likely to start investing at a young age, the survey found. Nearly 30% of men said they started investing between ages 18-24, while only 16% of women said they started investing in the stock market when they were in this age range. Instead, women revealed they were much more likely to wait until they were older to begin investing, with 45% saying they didn’t start until they were 45 and older, compared to 33% of men.

Perhaps even more shocking was the high percentage of older adults who waited until later in life to start investing. The survey found that half of respondents ages 65 and older didn’t invest in the stock market until they were at least 66 years old.

Nearly 1 in 4 Investors Have Less Than $500 Invested In Stocks

When asked to estimate how much they have invested in the stock market over a lifetime, the most common answer among respondents was “I don’t know.” The second-most common response after that was “less than $500,” with 24% of respondents choosing this amount.

However, nearly one-third of respondents said they have invested at least $1,000 in the stock market during their lifetime. Of those, 8% said they have invested more than $50,000.

Survey Question: To your best estimate, how much of your money have you invested over your lifetime in the stock market (not including retirement accounts)?

Answer Choice | Percentage of Respondents |

Less than $500 | 23.61% |

$500-$999 | 4.63% |

$1,000-$2,499 | 4.63% |

$2,500-$4,999 | 4.28% |

$5,000-$9,999 | 4.17% |

$10,000-$49,999 | 8.22% |

More than $50,000 | 8.22% |

I don’t know | 42.45% |

Not surprisingly, adults 65 and older are the most likely of any age group to have invested more than $50,000 in the stock market. About 16% of the 65-and-older age group said they have invested this much — likely because they’ve had the benefit of time to set more aside. Younger adults, on the other hand, are more likely to have invested less than $500.

Women and men were equally likely to say they have invested less than $500. However, men were more likely than women to say that they have invested $50,000 or more in the stock market — 10% vs. 6%, respectively.

Few Americans Seek Investing Help

The survey found that only 14% of respondents consult with a financial advisor when investing in the stock market. An almost equal percentage take a do-it-yourself approach. About 5% said they use a mobile investing app, and 4% said they use an online broker. Just 2% said they use a robo-advisor.

However, the majority of respondents — 65% — said they don’t use any of these methods to invest.

The survey found that adults 65 and older are more likely to consult with a financial advisor about their investments, with nearly 27% of this age group saying they invest with help from an advisor. On the other hand, young adults ages 18-24 are more likely than any other age group to use a robo-advisor or mobile app to invest.

Men were more likely to consult with a financial advisor than women — or to use any method, for that matter. Seventy-one percent of women claimed they didn’t use any of the survey options when investing.

Many Americans Say They Don’t Have Enough Money To Invest

The survey asked respondents who aren’t investing in the stock market to share why they’re not doing it. The top reason — with 34% of respondents choosing it — was “I don’t have enough money to invest.”

If you don’t think there’s enough room in your budget to invest, review your spending for the past year and categorize your expenses, said Douglas Boneparth, president of Bone Fide Wealth. “Be honest with where you can change spending habits for the sake of additional savings,” he said. “If things are so tight there’s nothing to squeeze, or you’re just not willing to sacrifice your lifestyle, consider allocating any free time to things that can generate income.”

One way you can lower your risk is by investing in an exchange-traded fund rather than individual stocks. An ETF trades like a stock on the stock market. Unlike a stock, though, the performance of an ETF isn’t tied to the performance of an individual company. Instead, it’s a collection of many stocks, bonds or other securities.

Survey Question: If you’re not investing your money in the stock market (not including retirement accounts like a 401(k) or an IRA), why not?

Answer Choice | Percentage of Respondents |

I don’t have enough money to invest | 34.03% |

I have no interest in investing | 20.02% |

I’m afraid I’ll lose money | 18.52% |

I am investing in the stock market | 18.52% |

I don’t know how to invest | 14% |

I don’t need to invest — I have an IRA or 401(k) | 8.68% |

I don’t have enough time to invest | 7.87% |

Other | 1.85% |

Another common reason why respondents said they aren’t investing was that they’re afraid to lose money. However, avoiding stocks altogether can be even riskier.

“If the goal is to save for retirement and you’ve chosen to put savings for it away in something like a savings account, you’re missing out on the opportunity to grow your money at a much faster rate,” Boneparth said. “While there are no guarantees when it comes to investing, typically disciplined and diversified investors do a lot better than what risk-free rates can do in a savings account, especially over longer periods of time.”

You could consider investing in an index fund, which tracks the performance of a particular stock market index. The fees for index funds tend to be lower than for other mutual funds, but slightly higher than for ETFs.

If you’re too afraid to invest in the stock market, look for safe investments with higher returns. For example, you could grow your money faster with a certificate of deposit or money market account because their interest rates tend to be higher than the rates on traditional savings accounts.

Additionally, real estate investing can be an alternative to investing in stocks — or another avenue to diversify your investments beyond stocks and deposit accounts. If you’re trying to figure out how to invest in real estate with no money, consider a real estate investment trust. A REIT is like a portfolio of investment properties. You can buy shares of REITs through a broker for a fraction of the cost of buying or making a down payment on investment properties.

Start Investing Today

The best way to invest — regardless of the investment you choose — is to pay yourself first. That means having a certain amount from each paycheck automatically deposited into a savings or investment account.

“Paying yourself first helps remove the temptation to skip a contribution and spend funds on expenses other than savings,” Weiss said. “Contributing to your savings account on a consistent basis can play a significant role in helping you build a long-term nest egg.” It also can help you secure your future and create a cushion for financial emergencies.

The key to investing success is creating a plan and sticking to it. “Avoid trying to capitalize on the latest fad or trend,” Weiss said. And be careful about emotions that can cause you to sell a falling investment out of fear and buy a rising investment out of greed. Instead, focus on the long term and stay the course.

Click through to learn more about whether to invest during a recession.

More on Investing

Methodology: GOBankingRates surveyed 1,026 Americans from across the country between June 26 and July 9, 2019, asking six questions: 1) Where are you currently investing and/or saving your money? Select all that apply; 2) At what age did you start investing your money in the stock market (not including retirement accounts like an IRA or 401(k))?; 3) Which of the following reasons most closely matches your investing goals?; 4) To your best estimate, how much of your money have you invested over your lifetime in the stock market (not including retirement accounts)?; 5) If you’re not investing your money in the stock market (not including retirement accounts like a 401(k) or IRA), why not? Select all that apply; 6) Do you use any of the following when investing in the stock market? Select all that apply. GOBankingRates used Survata’s survey platform to conduct the poll.

Americans had a lot of money regrets last year. In a separate GOBankingRates survey, a sizable portion of respondents — 11 percent — claimed that not investing in the stock market was their biggest financial regret of 2017. And, if the results of a new GOBankingRates survey hold true, it doesn’t appear that habit is changing.

GOBankingRates surveyed 5,000 Americans about their investing behaviors and habits. Survey takers were asked if they’ve ever invested in the past, if they’re currently investing, where they’re investing their money and more.

Click through to see the results and find out how Americans are investing their money.

Well Over Two-Fifths of Americans Aren't Currently Investing

The good news from the survey is that the majority of Americans are currently investing. Fifty-six percent of respondents said “yes” to the question: Are you currently investing your money? The bad news is, of course, that leaves a significant 44 percent of Americans who said, “no.” Unfortunately, there’s a common misconception that’s keeping more people from investing.

But remember: This survey only asked respondents, “Are you currently investing your money?” This doesn’t necessarily mean that 44 percent of Americans don’t have their money invested or saved in retirement accounts either, such as 401ks. In fact, a 2018 survey found that many Americans are building their wealth through 401ks.

So, there’s a possibility that some respondents were considering their retirement savings when answering this question — and some were not.

New to Investing? Check Out the Best Brokers for Beginners

More Men Are Investing Than Women (but Not by Much)

When breaking down the question by gender, a higher proportion of male respondents said they were currently investing than female respondents: 57 percent compared with 50 percent. Explanations for this discrepancy vary widely and can only be conjecture. However, past surveys have revealed possible reasons, such as lacking sufficient money to invest.

Investing Is Most Common Among Gen X

The overall results by age group show some noticeable variations. People ages 35 to 44 had the highest proportion of investors, with 64 percent that said they’re currently investing. That group is followed by 45- to 54-year-olds, 60 percent of whom said they have their money invested. Combined, these groups approximately make up Generation X.

Millennial investing is split between younger millennials (18 to 24) and older millennials (25 to 34). The groups with the lowest rate of investors are people ages 18 to 24 (49 percent) and Generation Z, 13- to 17-year-olds (39 percent).

If you’re wondering where to invest your money, check out these smart investments everyone should try.

Americans Mostly Put Their Money in the 'Big Three' Investments

Question 2 asked respondents where they are investing their money. Respondents were allowed to select multiple responses from the following answer choices: (1) banking products, such as savings, checking and money market accounts; (2) stocks and/or bonds; (3) investment funds, such as mutual funds and ETFs; (4) cryptocurrency; (5) real estate; and (6) other.

Overall results showed a preference for safer, more traditional investment vehicles. The most popular investment types are called “the big three,” which include “stocks and/or bonds,” with 46 percent of survey respondents selecting this; “investment funds,” with 44 percent of respondents; and “banking products,” with 43 percent.

“Real estate,” though less popular, still garnered one-fifth of respondents (20 percent), while “cryptocurrency” grabbed 7 percent. Seven percent of respondents chose “other.”

Americans and 401ks: Wells Fargo Crunched the Numbers: The Best 401k Plans Have These Key Features

Men and Women Have Similar Investment Preferences

Comparing results by gender gives a similar picture to overall responses. The “big three” investment products — banking products, stocks and/or bonds and investment funds — each captured 42 percent or more of both sexes.

Even on the choice of “real estate,” both sexes converge, with 18 percent of women and 20 percent of men that said they’re investing in real estate.

Take a Closer Look: How Women Stack Up in America’s Economy

Real Estate Investing Grows With Age

Across most age groups, the answer to this question was again the “big three.” Generally, more than 40 percent of respondents ages 25 and older chose these three investment vehicles. Investing in stocks peaked at 54 percent of 45- to 54-year-olds. Investing in mutual funds, ETFs and similar funds also grabbed 54 percent of that age group.

An interesting pattern emerged with those who said they invest in real estate. As the age of respondents approaches middle age (35- to 44 year-olds), the percentage of those who chose “real estate” increases and then settles around 20 to 25 percent of respondents ages 45 and up.

Americans Invest for Retirement, Leaving Little Money for Other Purposes

Question 3 asked survey takers: Which of the following reasons most closely matches your investing goals? Despite the quantity and variety of survey respondents, answers largely clustered around “saving for retirement.”

In fact, “saving for retirement” captured 57 percent of total responses, leaving “saving for an emergency” in a distant second with 19 percent, though that is notably high in itself. The third-most popular response was “saving for college” with 10 percent, while “saving to make a large purchase” and “saving for a special event or trip” each garnered less than one-tenth of respondents.

Retirement Savings Tips: Consider One of the Best IRAs

Both Males and Females Invest for Retirement and Emergencies

Again, when asked about their main reason for investing, the majority of both sexes said “saving for retirement,” with 61 percent of males choosing this and 57 percent of females. The second-most popular response was “saving for an emergency,” though women had a higher rate of this than men.

The Young Invest for Education, Everyone Else for Retirement

On the question of investment goals, only two answers captured a majority of responses: “saving for college” and “saving for retirement.” Nearly 60 percent of people ages 13 to 17 chose “saving for college.” Meanwhile, more than 50 percent of all respondents ages 25 and older said “saving for retirement,” peaking at 83 percent of respondents aged 55 to 64.

Discover: The Best College in Every State That Costs Less Than $20,000 a Year

More Than One-Fifth of Americans Check Their Investments Weekly

The fourth survey question asked how often respondents check their investments’ performance. Here, responses displayed a bell-shaped curve, with 35 percent of respondents saying “monthly,” followed by “a couple times a year” (22 percent), “weekly” (21 percent), “daily” (16 percent) and finally “I never check my investments’ performance” (7 percent).

For those that would rather “set it and forget it,” there are plenty of low-risk options for your money.

Women Check Their Investments Less Frequently

Based on survey responses, it would seem female investors are less antsy than their male counterparts. Male respondents showed a higher tendency to check their investments’ performance “weekly” and “daily” compared to female respondents. A higher proportion of women also said they checked “monthly” compared to men, reflecting this tendency.

Perhaps the men’s anxiety stems from not having built a strong enough investment portfolio.

Millennials Check Their Investments Most Frequently

When broken down by age, response rates to question 4 still largely matched the bell-shaped curve of overall results. However, there is a noticeable deviation among Americans ages 25 to 34, who have a high rate of checking performance “weekly” (24 percent) and even “daily” (18 percent). It seems that with age, investors tend to settle down to checking performance “monthly,” peaking with 65-year-olds and older at 42 percent.

Consider a Robo-Advisor: Here Are the Best Robo-Advisors

Americans Either Invest a Lot or Very Little Over Their Lives

Question 5 asked respondents to give their best estimate as to how much money they have invested over their lifetime. Responses tended to polarize, with nearly one-fifth of respondents saying “less than $500,” whereas nearly 30 percent said “more than $50,000.”

If you find yourself in the pool of respondents that said they’ve invested “less than $500,” know that there are a number of good investments out there even if you don’t have a lot of money to spend.

One in Three Women Have Invested Less Than $500 in Their Lifetime

On the question of how much people have invested over their lifetime, sharp differences emerge between genders. Male respondents clearly have invested more money over time, with 28 percent that said “$10,000 to $49,999” and 26 percent that said “more than $50,000,” for a total of 54 percent who have invested $10,000 or more. This could be partially attributed to the significant gender pay gaps across the country.

Female respondents, on the other hand, clustered around the poles: “Less than $500” grabbed 35 percent whereas “more than $50,000” had the second-most at 32 percent.

Ages Split Between Investing Less Than $500 and More Than $50,000

Question 5 polarized respondents overall, and the discrepancies were even more extreme when broken down by age. A majority of respondents ages 13 to 17 said they’ve invested “less than $500.” Close to two-fifths of young millennials, aka 18- to 24-year-olds, also said “less than $500.” And slightly more than one-fifth of 25- to 34-year-olds have only invested “less than $500” in their lifetime.

Related: What We Can All Learn From Millennials and Their Saving Habits

Overall, Americans Are Mediocre Investors

The sixth and final question of the survey asked respondents how successful their investments have been. Respondents gave their answers on a scale from 1 to 5, with “1” being “very unsuccessful” and “5” equal to “very successful.” Perhaps not surprisingly, the most popular answer was “3,” which equates to “average” or breaking even, with 34 percent of responses.

On the positive side, 23 percent of respondents chose “4,” meaning their investments have been “successful.” On the negative side, 22 percent chose “1.”

Not finding success in investing? You might be making these other financial mistakes, too.

Men and Women Have Similar Success With Their Investments

There’s essentially no correlation between gender and success of investments. More than 30 percent of both sexes gave their investments a “3” in terms of success. And a little over 20 percent of both men and women rated their investments a “4.”

When you calculate the average success rating for each gender, both male and female investors leaned toward the less successful side. Taking account for all responses, men had an average success score of 2.9 and women averaged 2.5.

Learn: How to Set Career and Financial Goals You’ll Actually Achieve

Middle-Aged Americans Have the Most Successful Investments

A correlation between age and investment success is fairly elusive. For instance, the percentage of “successful” investors (i.e., respondents that chose “4”) increases from a low of 18 percent among 18- to 24-year-olds to a high of 29 percent among 45- to 54-year-olds before falling off.

Meanwhile, the rate of respondents who chose “very unsuccessful,” or “1,” increases from 20 percent of 45- to 54-year-olds to 30 percent of people aged 65 and older. It could be that older Americans are harsher judges or have had more time to see their investments go south.

It’s important to note that Americans ages 55 to 64 as well as 65 and older were the age groups most severely impacted by the housing bubble of the 2000s, which could be shaping their views of success.

More Americans Should Be Investing -- and With Greater Diversity

Even though it’s great to see that a majority of Americans are currently investing, it still leaves a massive 44 percent out of the game. As any expert will tell you, you don’t earn your way to true wealth through paychecks — you do it through investing. That’s because investing opens your money up to much higher rates of return and the ability to earn compound interest.

There is little diversity in the main reasons for investing. The overriding reason Americans invest is for retirement. However, this predominance can often prevent more opportunistic investments — ones not made solely for necessity, but for profit and social development.

Click through to learn about the best brokers for investing.

More on Investing

Methodology: The GOBankingRates survey posed six questions to 5,000 respondents: 1) Are you currently investing your money? 2) Where are you investing your money? 3) Which of the following reasons most closely matches your investing goals? 4) How often do you check your investments’ performance? 5) To your best estimate, how much of your money have you invested over your lifetime? 6) How successful have your investments been?

Responses were collected by a survey conducted July 2 to 6, 2018, using Survata. Survata categorizes the ages of their respondents in the following groups: 1) 13 to 17, 2) 18 to 24, 3) 25 to 34, 4) 35 to 44, 5) 45 to 54, 6) 55 to 64, 7) 65 and over.

This article originally appeared on GOBankingRates.com: More Than 47% of Americans Aren’t Investing Their Money