Is Molecular Data Inc. (MKD) A Good Stock To Buy?

A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31st, so let’s proceed with the discussion of the hedge fund sentiment on Molecular Data Inc. (NASDAQ:MKD).

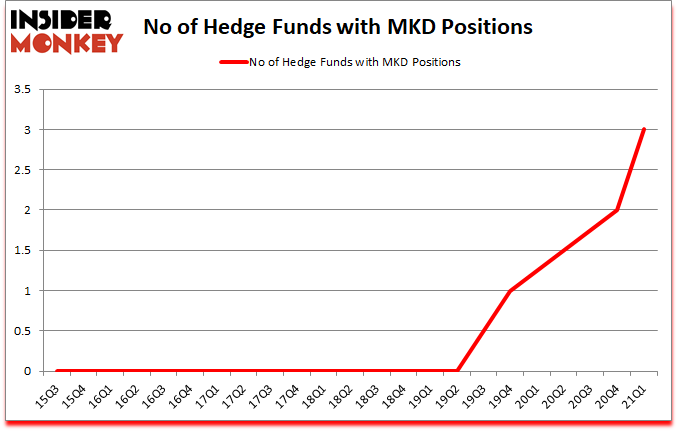

Is MKD a good stock to buy? Molecular Data Inc. (NASDAQ:MKD) shareholders have witnessed an increase in enthusiasm from smart money of late. Molecular Data Inc. (NASDAQ:MKD) was in 3 hedge funds' portfolios at the end of March. The all time high for this statistic was previously 2. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that MKD isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's monthly stock picks returned 206.8% since March 2017 and outperformed the S&P 500 ETFs by more than 115 percentage points (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ken Griffin of Citadel Investment Group

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, an activist hedge fund wants to buy this $28 biotech stock for $50. So, we recommended a long position to our monthly premium newsletter subscribers. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we're going to view the key hedge fund action encompassing Molecular Data Inc. (NASDAQ:MKD).

Do Hedge Funds Think MKD Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in MKD a year ago. So, let's see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Molecular Data Inc. (NASDAQ:MKD) was held by Renaissance Technologies, which reported holding $0.5 million worth of stock at the end of December. It was followed by Citadel Investment Group with a $0.3 million position. The only other hedge fund that is bullish on the company was Two Sigma Advisors.

As aggregate interest increased, key money managers were leading the bulls' herd. Renaissance Technologies, established the most outsized position in Molecular Data Inc. (NASDAQ:MKD). Renaissance Technologies had $0.5 million invested in the company at the end of the quarter.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as Molecular Data Inc. (NASDAQ:MKD) but similarly valued. These stocks are California BanCorp (NASDAQ:CALB), Oconee Federal Financial (NASDAQ:OFED), China Automotive Systems, Inc. (NASDAQ:CAAS), Dynagas LNG Partners LP (NYSE:DLNG), Western Copper and Gold Corporation (NYSE:WRN), Computer Task Group, Inc. (NASDAQ:CTG), and Superior Industries International Inc. (NYSE:SUP). This group of stocks' market valuations resemble MKD's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CALB,4,6061,1 OFED,1,299,-1 CAAS,1,2401,-4 DLNG,1,60,1 WRN,2,852,-1 CTG,6,30525,1 SUP,12,22250,0 Average,3.9,8921,-0.4 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.9 hedge funds with bullish positions and the average amount invested in these stocks was $9 million. That figure was $1 million in MKD's case. Superior Industries International Inc. (NYSE:SUP) is the most popular stock in this table. On the other hand Oconee Federal Financial (NASDAQ:OFED) is the least popular one with only 1 bullish hedge fund positions. Molecular Data Inc. (NASDAQ:MKD) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for MKD is 45.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th and surpassed the market again by 3.3 percentage points. Unfortunately MKD wasn't nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); MKD investors were disappointed as the stock returned -22.6% since the end of March (through 6/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Get real-time email alerts: Follow Molecular Data Inc. (NASDAQ:MKD)

Disclosure: None. This article was originally published at Insider Monkey.

Follow Insider Monkey on Twitter

Related Content